Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. How would you adjust the closing price according to the dividend rate in Excel? b. How would you adjust the return expectations? Do you

a. How would you adjust the closing price according to the dividend rate in Excel?

b. How would you adjust the return expectations? Do you add 5.5% for ANZ or subtract 5.5% for FMG for each daily returns?

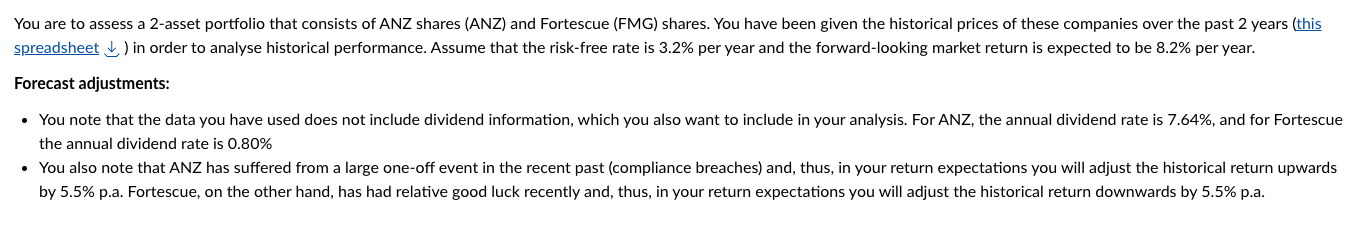

You are to assess a 2-asset portfolio that consists of ANZ shares (ANZ) and Fortescue (FMG) shares. You have been given the historical prices of these companies over the past 2 years (this .) in order to analyse historical performance. Assume that the risk-free rate is 3.2% per year and the forward-looking market return is expected to be 8.2% per year. Forecast adjustments: - You note that the data you have used does not include dividend information, which you also want to include in your analysis. For ANZ, the annual dividend rate is 7.64%, and for Fortescue the annual dividend rate is 0.80% - You also note that ANZ has suffered from a large one-off event in the recent past (compliance breaches) and, thus, in your return expectations you will adjust the historical return upwards by 5.5% p.a. Fortescue, on the other hand, has had relative good luck recently and, thus, in your return expectations you will adjust the historical return downwards by 5.5% p.a. You are to assess a 2-asset portfolio that consists of ANZ shares (ANZ) and Fortescue (FMG) shares. You have been given the historical prices of these companies over the past 2 years (this .) in order to analyse historical performance. Assume that the risk-free rate is 3.2% per year and the forward-looking market return is expected to be 8.2% per year. Forecast adjustments: - You note that the data you have used does not include dividend information, which you also want to include in your analysis. For ANZ, the annual dividend rate is 7.64%, and for Fortescue the annual dividend rate is 0.80% - You also note that ANZ has suffered from a large one-off event in the recent past (compliance breaches) and, thus, in your return expectations you will adjust the historical return upwards by 5.5% p.a. Fortescue, on the other hand, has had relative good luck recently and, thus, in your return expectations you will adjust the historical return downwards by 5.5% p.aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started