Question

a. IBX's stock dividend at the end of this year is expected to be $2.15, and it is expected to grow at 11.2% per

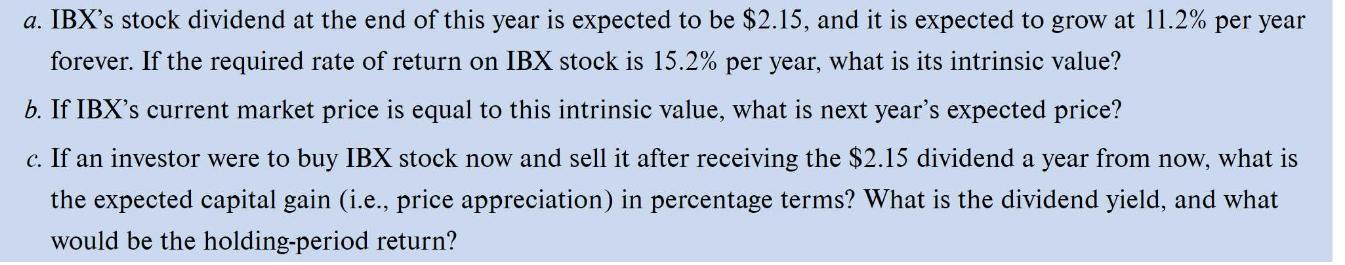

a. IBX's stock dividend at the end of this year is expected to be $2.15, and it is expected to grow at 11.2% per year forever. If the required rate of return on IBX stock is 15.2% per year, what is its intrinsic value? b. If IBX's current market price is equal to this intrinsic value, what is next year's expected price? c. If an investor were to buy IBX stock now and sell it after receiving the $2.15 dividend a year from now, what is the expected capital gain (i.e., price appreciation) in percentage terms? What is the dividend yield, and what would be the holding-period return?

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Dividend year 1 215 g112 Required Rate 152 Intr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Financial Management

Authors: James R Mcguigan, R Charles Moyer, William J Kretlow

10th Edition

978-0324289114, 0324289111

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App