Answered step by step

Verified Expert Solution

Question

1 Approved Answer

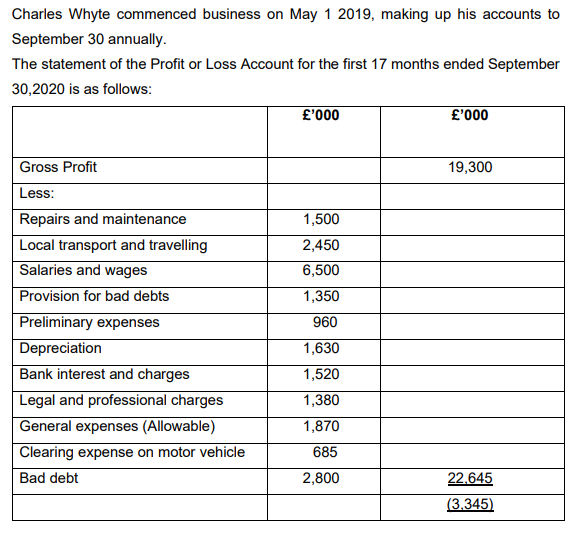

a. Identify FIVE deduction not allowable for the purpose of ascertaining the income of an individual for tax purposes. b. Compute the Adjusted Profit of

a. Identify FIVE deduction not allowable for the purpose of ascertaining the income of an individual for tax purposes.

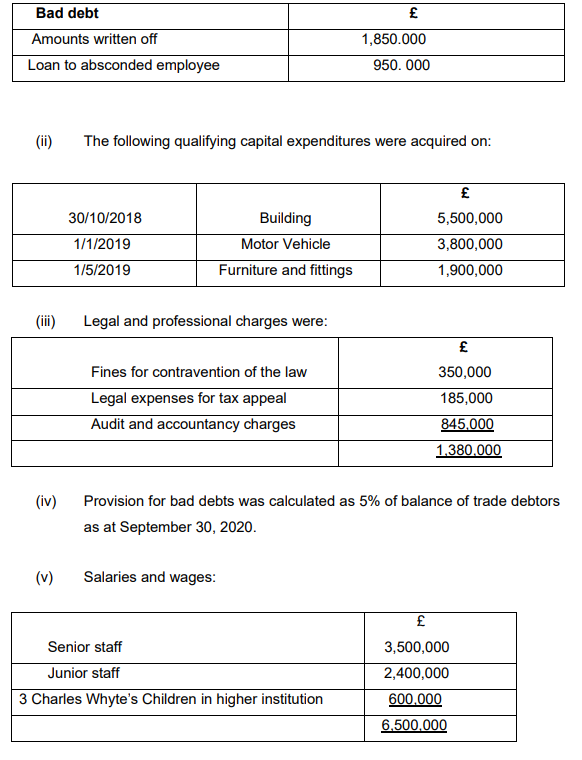

b. Compute the Adjusted Profit of Charles Whyte for the period ended. September 30 ,2020

c. Identify and explain types of loss relief and their treatment.

d. Any good tax system must be based on certain principle.

Illustrate with examples, SIX principles as laid down by Adam Smith.

Charles Whyte commenced business on May 12019 , making up his accounts to September 30 annually. The statement of the Profit or Loss Account for the first 17 months ended September 30,2020 is as follows: (ii) The following qualifying capital expenditures were acquired on: (iii) Legal and professional charges were: (iv) Provision for bad debts was calculated as 5% of balance of trade debtors as at September 30, 2020. (v) Salaries and wagesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started