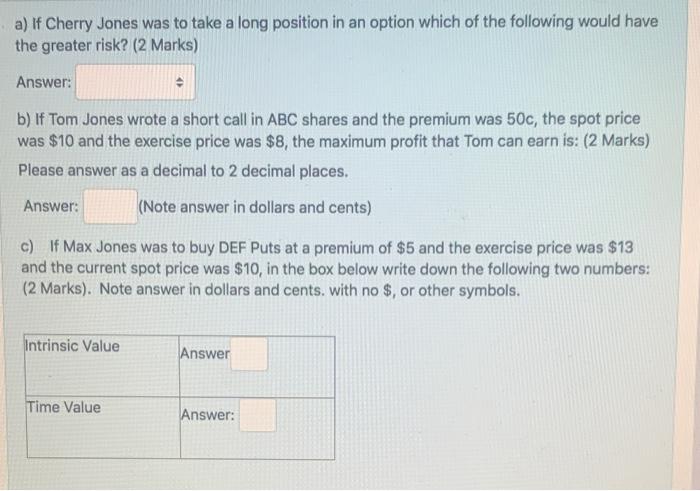

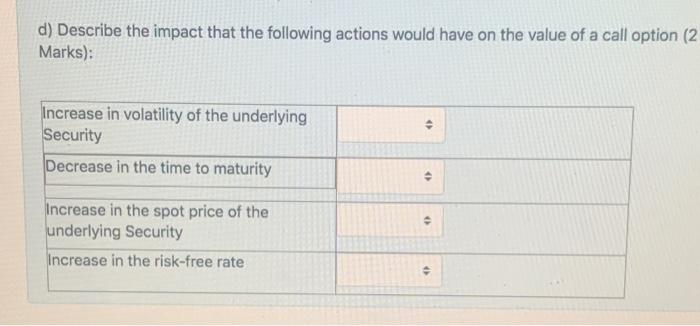

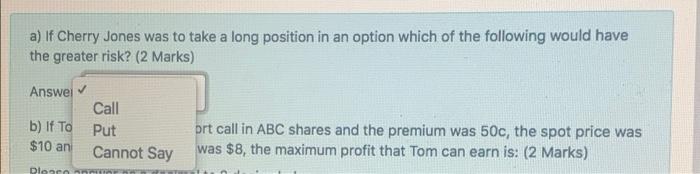

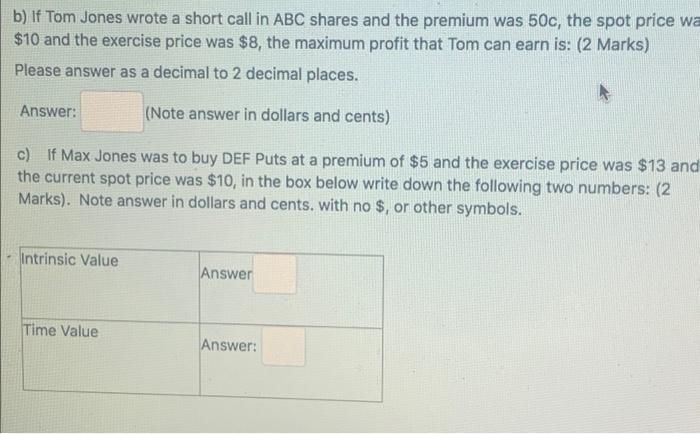

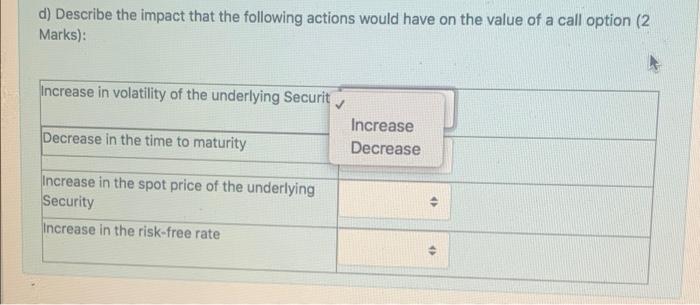

a) If Cherry Jones was to take a long position in an option which of the following would have the greater risk? (2 Marks) Answer: b) If Tom Jones wrote a short call in ABC shares and the premium was 50c, the spot price was $10 and the exercise price was $8, the maximum profit that Tom can earn is: (2 Marks) Please answer as a decimal to 2 decimal places. Answer: (Note answer in dollars and cents) c) If Max Jones was to buy DEF Puts at a premium of $5 and the exercise price was $13 and the current spot price was $10, in the box below write down the following two numbers: (2 Marks). Note answer in dollars and cents. with no $, or other symbols. Intrinsic Value Answer Time Value Answer: d) Describe the impact that the following actions would have on the value of a call option (2 Marks): . Increase in volatility of the underlying Security Decrease in the time to maturity . Increase in the spot price of the underlying Security Increase in the risk-free rate . a) If Cherry Jones was to take a long position in an option which of the following would have the greater risk? (2 Marks) Answej b) If To $10 an Call Put Cannot Say prt call in ABC shares and the premium was 50c, the spot price was was $8, the maximum profit that Tom can earn is: (2 Marks) Dler b) If Tom Jones wrote a short call in ABC shares and the premium was 50c, the spot price wa $10 and the exercise price was $8, the maximum profit that Tom can earn is: (2 Marks) Please answer as a decimal to 2 decimal places. Answer: (Note answer in dollars and cents) c) If Max Jones was to buy DEF Puts at a premium of $5 and the exercise price was $13 and the current spot price was $10, in the box below write down the following two numbers: (2 Marks). Note answer in dollars and cents. with no $, or other symbols. Intrinsic Value Answer Time Value Answer: d) Describe the impact that the following actions would have on the value of a call option (2 Marks): Increase in volatility of the underlying Securit Decrease in the time to maturity Increase Decrease Increase in the spot price of the underlying Security Increase in the risk-free rate (