Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. If I give you $30,000 today, and you invest it, how much money will you have in 25 years - assuming an interest

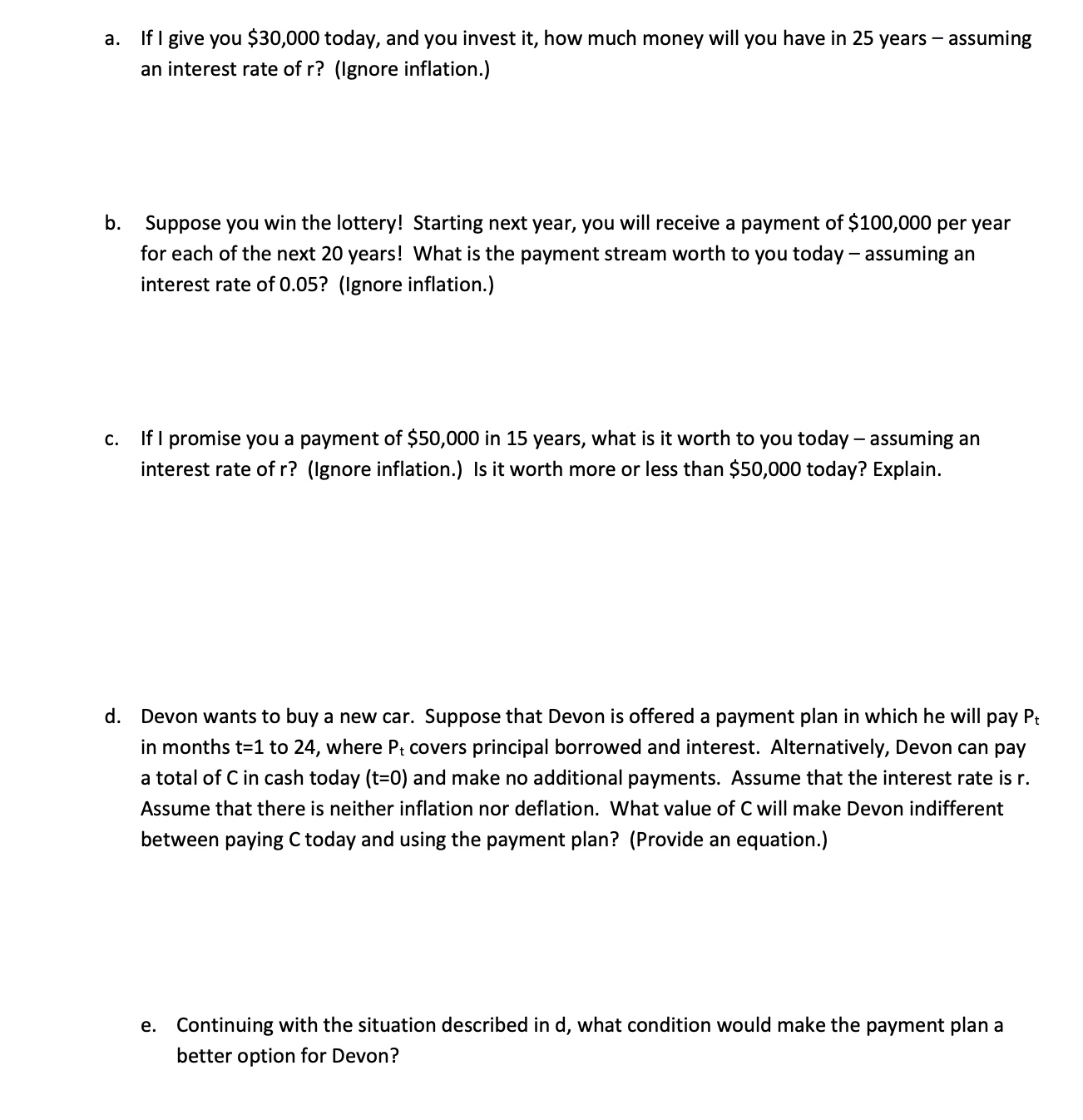

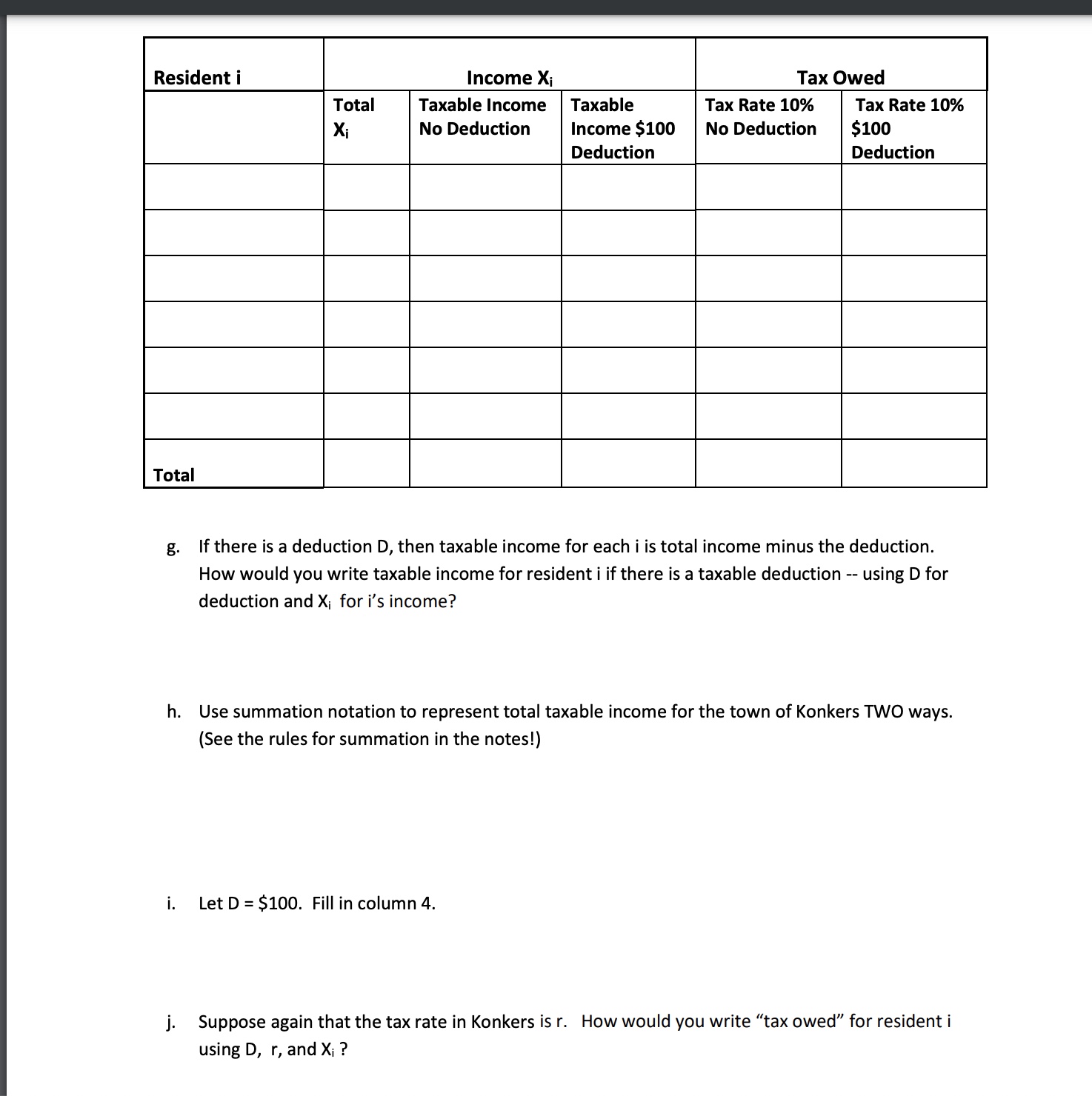

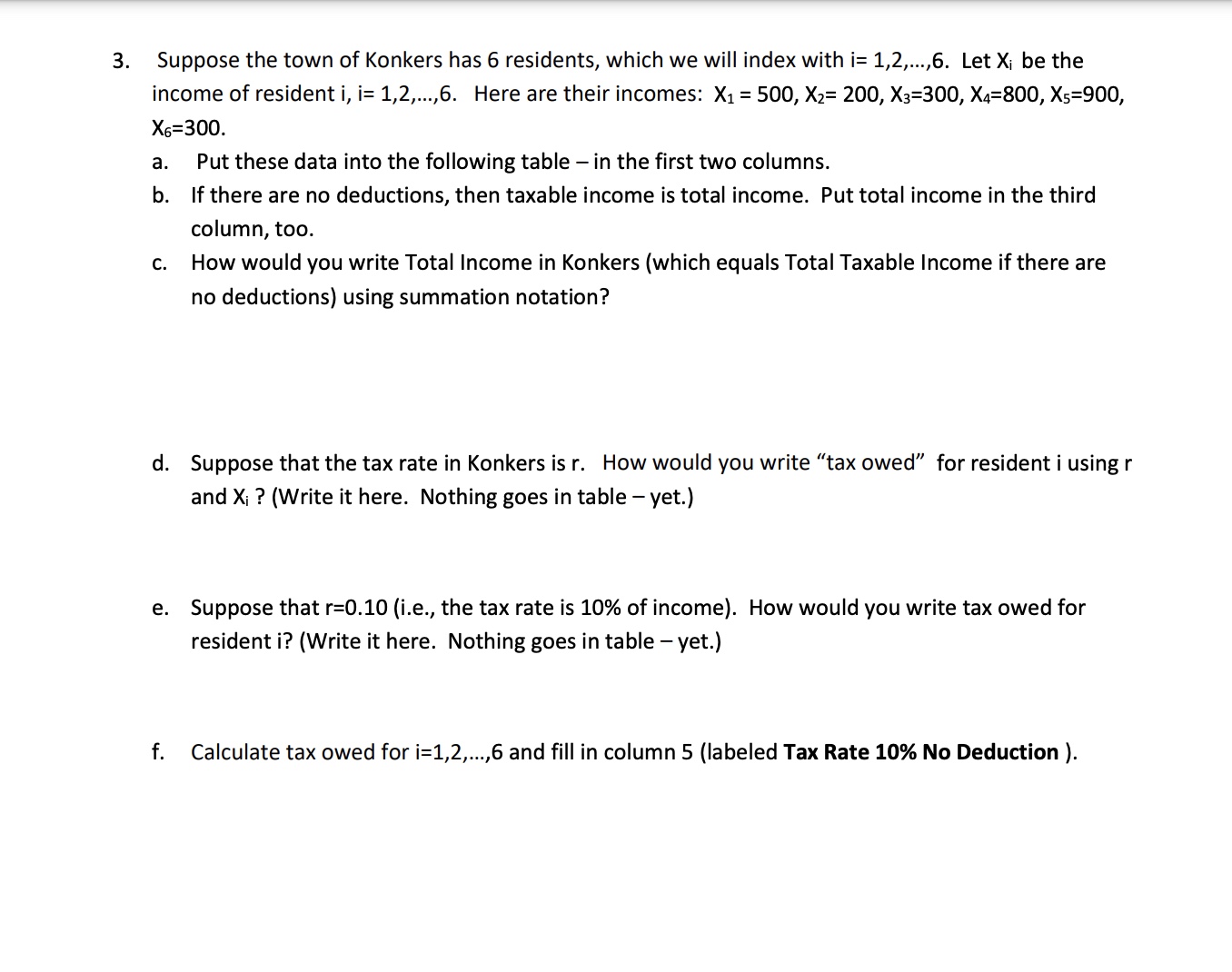

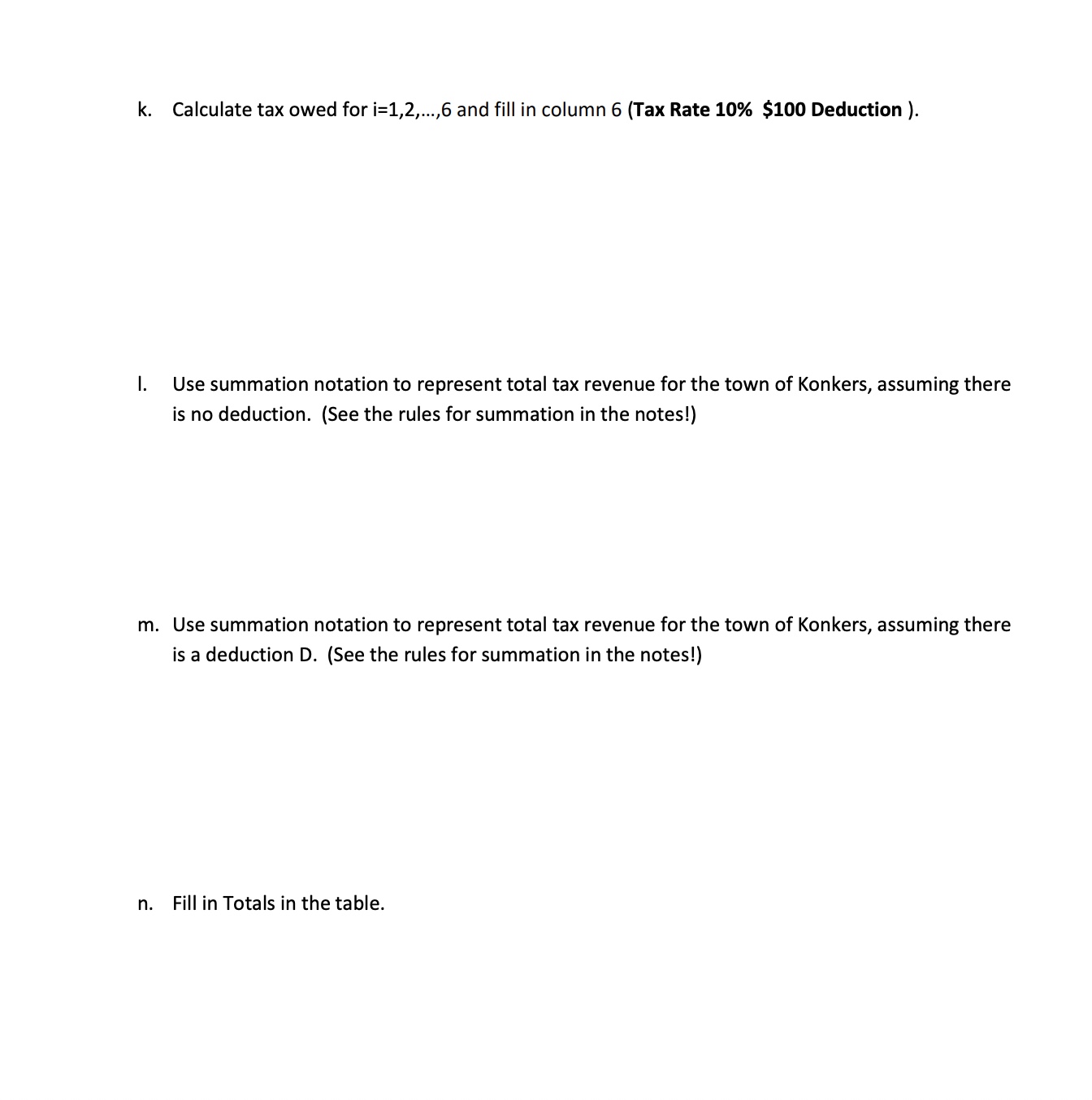

a. If I give you $30,000 today, and you invest it, how much money will you have in 25 years - assuming an interest rate of r? (Ignore inflation.) b. Suppose you win the lottery! Starting next year, you will receive a payment of $100,000 per year for each of the next 20 years! What is the payment stream worth to you today - assuming an interest rate of 0.05? (Ignore inflation.) C. If I promise you a payment of $50,000 in 15 years, what is it worth to you today - assuming an interest rate of r? (Ignore inflation.) Is it worth more or less than $50,000 today? Explain. d. Devon wants to buy a new car. Suppose that Devon is offered a payment plan in which he will pay Pt in months t=1 to 24, where Pt covers principal borrowed and interest. Alternatively, Devon can pay a total of C in cash today (t=0) and make no additional payments. Assume that the interest rate is r. Assume that there is neither inflation nor deflation. What value of C will make Devon indifferent between paying C today and using the payment plan? (Provide an equation.) e. Continuing with the situation described in d, what condition would make the payment plan a better option for Devon? Resident i Total Income Xi Total Taxable Income Xi No Deduction Tax Owed Tax Rate 10% $100 Deduction Taxable Tax Rate 10% Income $100 No Deduction Deduction g. If there is a deduction D, then taxable income for each i is total income minus the deduction. How would you write taxable income for resident i if there is a taxable deduction -- using D for deduction and X; for i's income? h. Use summation notation to represent total taxable income for the town of Konkers TWO ways. (See the rules for summation in the notes!) i. Let D = $100. Fill in column 4. j. Suppose again that the tax rate in Konkers is r. How would you write "tax owed" for resident i using D, r, and Xi ? 3. Suppose the town of Konkers has 6 residents, which we will index with i= 1,2,...,6. Let Xi be the income of resident i, i = 1,2,...,6. Here are their incomes: X = 500, X2= 200, X3=300, X4-800, X5=900, X6=300. a. Put these data into the following table - in the first two columns. b. If there are no deductions, then taxable income is total income. Put total income in the third column, too. C. How would you write Total Income in Konkers (which equals Total Taxable Income if there are no deductions) using summation notation? d. Suppose that the tax rate in Konkers is r. How would you write "tax owed" for resident i using r and Xi? (Write it here. Nothing goes in table - yet.) e. Suppose that r=0.10 (i.e., the tax rate is 10% of income). How would you write tax owed for resident i? (Write it here. Nothing goes in table - yet.) f. Calculate tax owed for i=1,2,..., 6 and fill in column 5 (labeled Tax Rate 10% No Deduction). k. Calculate tax owed for i=1,2,..., 6 and fill in column 6 (Tax Rate 10% $100 Deduction). I. Use summation notation to represent total tax revenue for the town of Konkers, assuming there is no deduction. (See the rules for summation in the notes!) m. Use summation notation to represent total tax revenue for the town of Konkers, assuming there is a deduction D. (See the rules for summation in the notes!) n. Fill in Totals in the table.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a If you invest 30000 today at an interest rate of r the future value after 25 years can be calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started