(a) If SampleCo decides to raise $1M instead of $750K, what would the cap table look like given a post-money option pool of 10% and

(a) If SampleCo decides to raise $1M instead of $750K, what would the cap table look like given a post-money option pool of 10% and the same share price and pre-money valuation?

(b)If no options are granted from the option pool, what would a $10M exit look like for the founders and investors at the original terms?

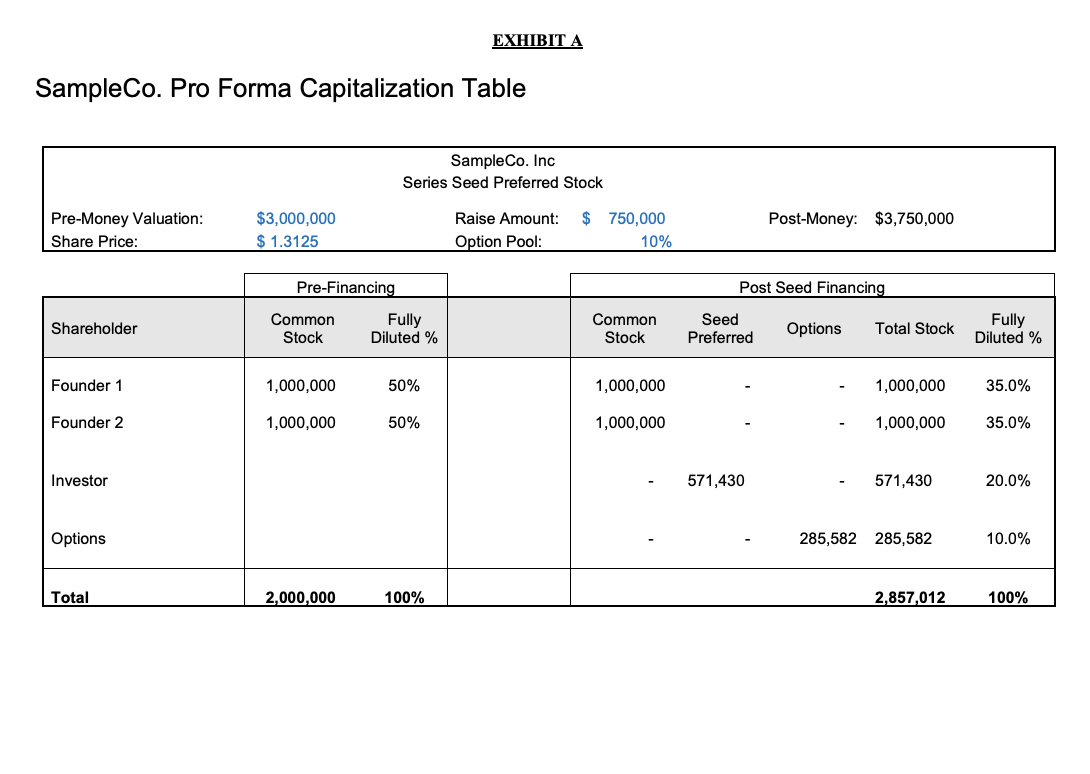

EXHIBIT A SampleCo. Pro Forma Capitalization Table SampleCo. Inc Series Seed Preferred Stock Pre-Money Valuation: Share Price: $3,000,000 $ 1.3125 Raise Amount: $ 750,000 Option Pool: Post-Money: $3,750,000 10% Pre-Financing Post Seed Financing Common Fully Shareholder Stock Diluted % Common Stock Seed Preferred Options Total Stock Fully Diluted % Founder 1 1,000,000 50% 1,000,000 Founder 2 1,000,000 50% 1,000,000 1,000,000 35.0% 1,000,000 35.0% Investor Options Total 2,000,000 100% - 571,430 571,430 20.0% 285,582 285,582 10.0% 2,857,012 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started