Question

a) If the company were to issue equity to raise capital, what would be the cost of equity using the capital asset pricing model (CAPM)?

a) If the company were to issue equity to raise capital, what would be the cost of equity using the capital asset pricing model (CAPM)? (4 marks) b. Using the constant dividend growth model, determine the cost of equity. (4 marks) c. If the companys own bond yield is 5 % and the risk premium is 7%, what would be the cost of equity? (4 marks) d. What is the average value of the cost equity based on the three methods in (a), (b) and (c)? (4 marks) e. If the tax rate is 26%, what is the cost of debt after tax? (5 marks) f. If the tax rate of the company is 26%, determine the companys weighted average cost of capital (WACC). (5 marks) g. If the company is considering to venture into an investment whose proposed capital structure mix differs from

h. If the companys own bond yield is 5 % and the risk premium is 7%, what would be the cost of equity?

i. Assume that you are newly appointed as finance officer in the company, the CFO needs your help in preparing the information for Project B. Project B is needed to have an initial outlay of RM 18 million and expected to generate free cash flow of RM 5.6 million every year for 5 years. Giving the cost of capital for this project is 14%, calculate Project Bs net present value (NPV), internal rate of return (IRR), modified internal rate of return (MIRR), payback and discounted payback. If the projects are mutually exclusive, how should the firm decide?

j. Working Capital is the difference between a companys current assets and its current liability. It is a measure of a company's operational efficiency, liquidity, and short-term financial health. With the help of a diagram (diagrams), Discuss and elaborate the working capital financing policy chosen by a company.

k. Next year, Maju Usaha Berhad plans to have a capital budget of RM 650,000. It wants to maintain a target capital structure of 40% debt and 60% equity, and it also wants to pay a dividend of RM 375,000. If the company follows the residual dividend policy, how much net income must it earn to meet its investment requirements, pay the dividend, and keep the capital structure in balance? (5 marks)

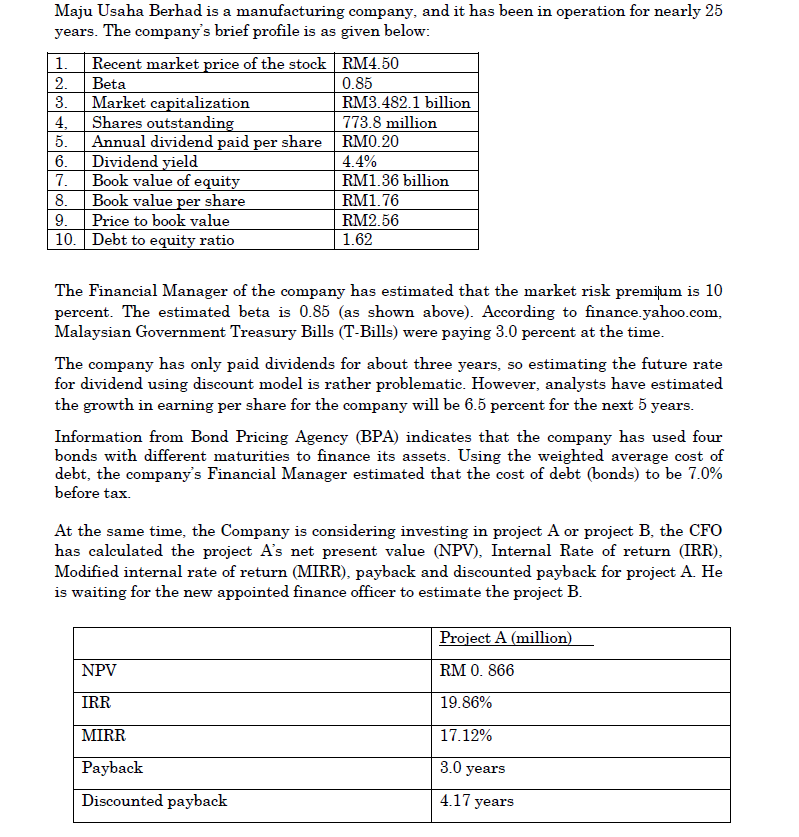

Maju Usaha Berhad is a manufacturing company, and it has been in operation for nearly 25 years. The company's brief profile is as given below: 1. Recent market price of the stock RM4.50 2. Beta 0.85 3. Market capitalization RM3.482.1 billion 4, Shares outstanding 773.8 million 5. Annual dividend paid per share RM0.20 6. Dividend yield 4.4% 7. Book value of equity RM1.36 billion 8. Book value per share RM1.76 9. Price to book value RM2.56 10. Debt to equity ratio 1.62 The Financial Manager of the company has estimated that the market risk premium is 10 percent. The estimated beta is 0.85 (as shown above). According to finance.yahoo.com, Malaysian Government Treasury Bills (T-Bills) were paying 3.0 percent at the time. The company has only paid dividends for about three years, so estimating the future rate for dividend using discount model is rather problematic. However, analysts have estimated the growth in earning per share for the company will be 6.5 percent for the next 5 years. Information from Bond Pricing Agency (BPA) indicates that the company has used four bonds with different maturities to finance its assets. Using the weighted average cost of debt, the company's Financial Manager estimated that the cost of debt (bonds) to be 7.0% before tax At the same time, the Company is considering investing in project A or project B, the CFO has calculated the project A's net present value (NPV), Internal Rate of return (IRR), Modified internal rate of return (MIRR), payback and discounted payback for project A. He is waiting for the new appointed finance officer to estimate the project B. Project A (million) NPV RM 0.866 IRR 19.86% MIRR 17.12% 3.0 years Payback Discounted payback 4.17 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started