Answered step by step

Verified Expert Solution

Question

1 Approved Answer

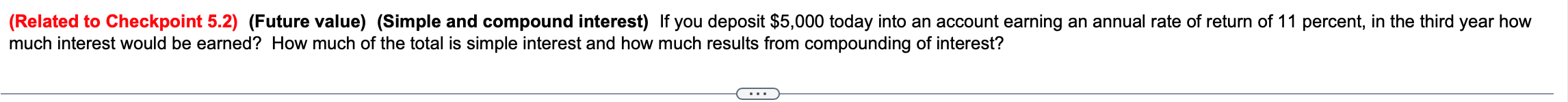

a. If you deposit $5,000 today into an account earning an annual rate of return of 11%, in the third year how much interest would

a. If you deposit $5,000 today into an account earning an annual rate of return of 11%, in the third year how much interest would be earned? $ (Round to the nearest cent.) b. How much of the total is simple interest? (Round to the nearest cent.) c. How much results from compounding of interest?

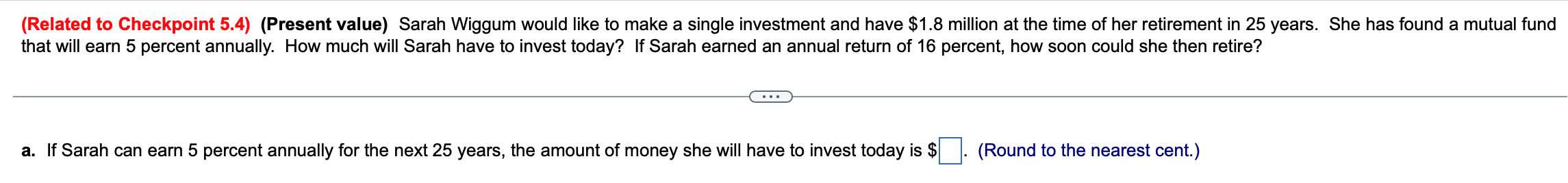

b. If sarah can earn an annual return return of 16 percent how soon can she then retire?

(Related to Checkpoint 5.2) (Future value) (Simple and compound interest) If you deposit $5,000 today into an account earning an annual rate of return of 11 percent, in the third year how much interest would be earned? How much of the total is simple interest and how much results from compounding of interest? (Related to Checkpoint 5.4) (Present value) Sarah Wiggum would like to make a single investment and have $1.8 million at the time of her retirement in 25 years. She has found a mutual fund that will earn 5 percent annually. How much will Sarah have to invest today? If Sarah earned an annual return of 16 percent, how soon could she then retire? (Related to Checkpoint 5.2) (Future value) (Simple and compound interest) If you deposit $5,000 today into an account earning an annual rate of return of 11 percent, in the third year how much interest would be earned? How much of the total is simple interest and how much results from compounding of interest? (Related to Checkpoint 5.4) (Present value) Sarah Wiggum would like to make a single investment and have $1.8 million at the time of her retirement in 25 years. She has found a mutual fund that will earn 5 percent annually. How much will Sarah have to invest today? If Sarah earned an annual return of 16 percent, how soon could she then retireStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started