Answered step by step

Verified Expert Solution

Question

1 Approved Answer

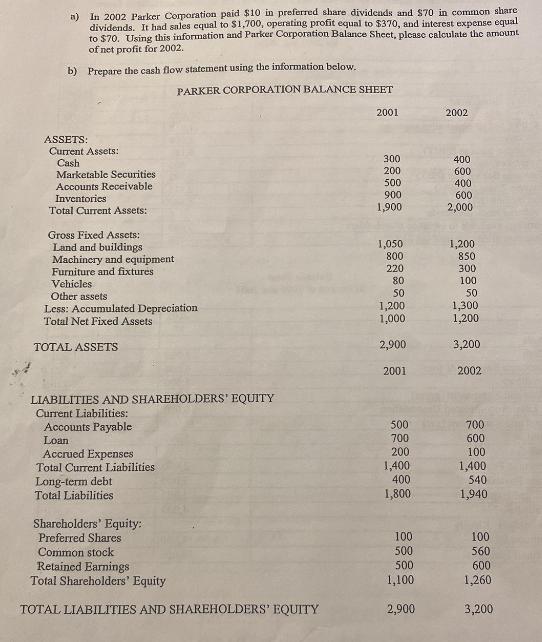

a) In 2002 Parker Corporation paid $10 in preferred share dividends and $70 in common share dividends. It had sales equal to $1,700, operating

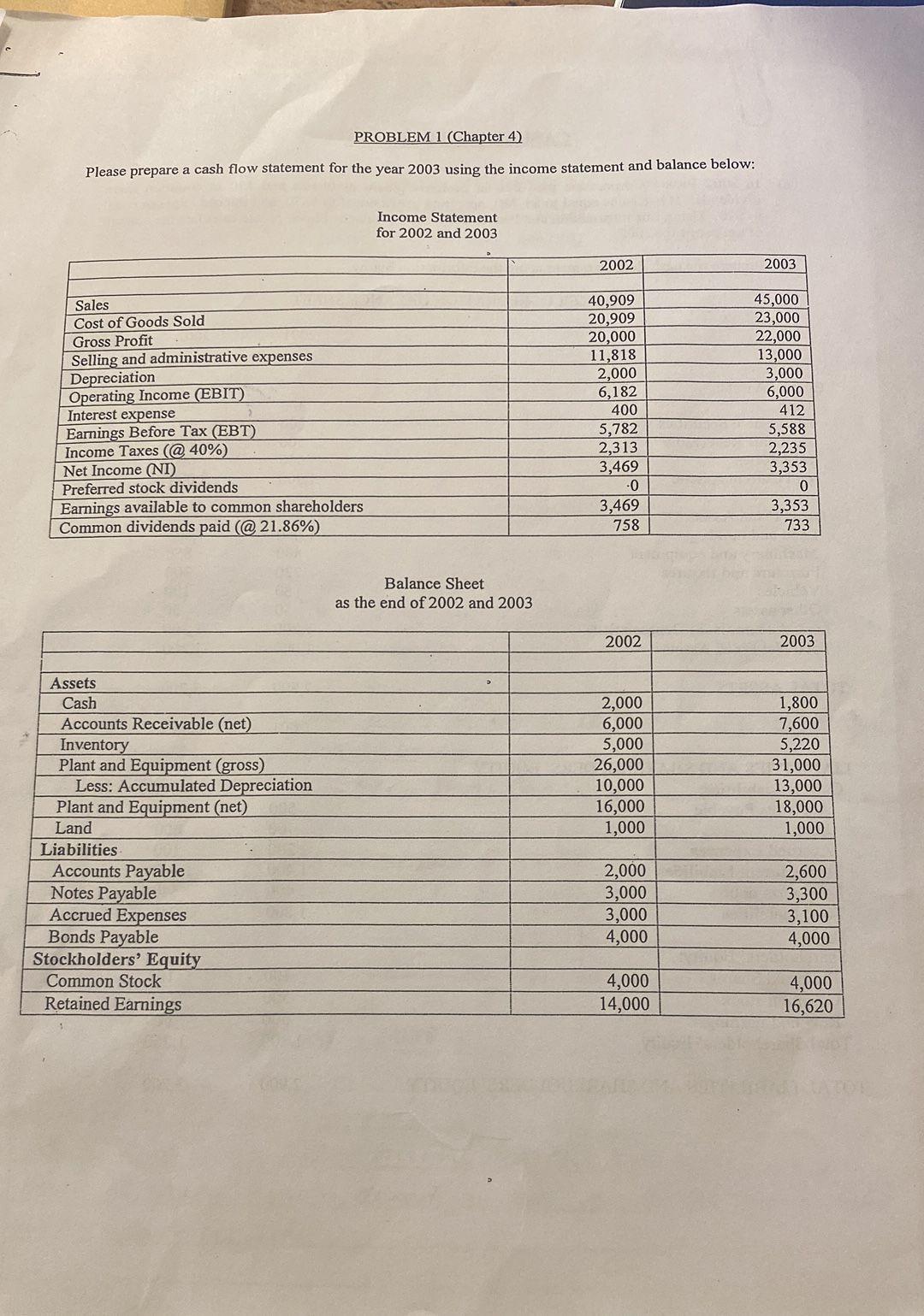

a) In 2002 Parker Corporation paid $10 in preferred share dividends and $70 in common share dividends. It had sales equal to $1,700, operating profit equal to $370, and interest expense equal to $70. Using this information and Parker Corporation Balance Sheet, please calculate the amount of net profit for 2002. b) Prepare the cash flow statement using the information below. ASSETS: Current Assets: Cash Marketable Securities Accounts Receivable Inventories Total Current Assets: Gross Fixed Assets: Land and buildings. Machinery and equipment Furniture and fixtures Vehicles PARKER CORPORATION BALANCE SHEET Other assets Less: Accumulated Depreciation Total Net Fixed Assets TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Accounts Payable Loan Accrued Expenses Total Current Liabilities Long-term debt Total Liabilities Shareholders' Equity: Preferred Shares Common stock Retained Earnings Total Shareholders' Equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 2001 300 200 500 900 1,900 1,050 800 220 80 50 1,200 1,000 2,900 2001 500 700 200 1,400 400 1,800 100 500 500 1,100 2,900 2002 400 600 400 600 2,000 1,200 850 300 100 50 1,300 1,200 3,200 2002 700 600 100 1,400 540 1,940 100 560 600 1,260 3,200 PROBLEM 1 (Chapter 4) Please prepare a cash flow statement for the year 2003 using the income statement and balance below: Sales Cost of Goods Sold Gross Profit Selling and administrative expenses Depreciation Operating Income (EBIT) Interest expense Earnings Before Tax (EBT) Income Taxes (@ 40%) Net Income (NI) Preferred stock dividends Earnings available to common shareholders Common dividends paid (@21.86%) Assets Cash Accounts Receivable (net) Inventory Plant and Equipment (gross) Less: Accumulated Depreciation Plant and Equipment (net) Land Liabilities Accounts Payable Notes Payable Accrued Expenses Bonds Payable Stockholders' Equity Common Stock Retained Earnings Income Statement for 2002 and 2003 Balance Sheet as the end of 2002 and 2003 2002 40,909 20,909 20,000 11,818 2,000 6,182 400 5,782 2,313 3,469 -0 3,469 758 2002 2,000 6,000 5,000 26,000 10,000 16,000 1,000 2,000 3,000 3,000 4,000 4,000 14,000 2003 45,000 23,000 22,000 13,000 3,000 6,000 412 5,588 2,235 3,353 0 3,353 733 2003 1,800 7,600 5,220 31,000 13,000 18,000 1,000 2,600 3,300 3,100 4,000 4,000 16,620

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Part A Sales 1700 Les Operating expense including depreciation 1700370 1330 Operating profit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started