Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. In 2020, VQQ Inc. received $350,000 in dividends from Cohen Labratories Inc. VQQ's taxable income before the dividends received deduction (but including the

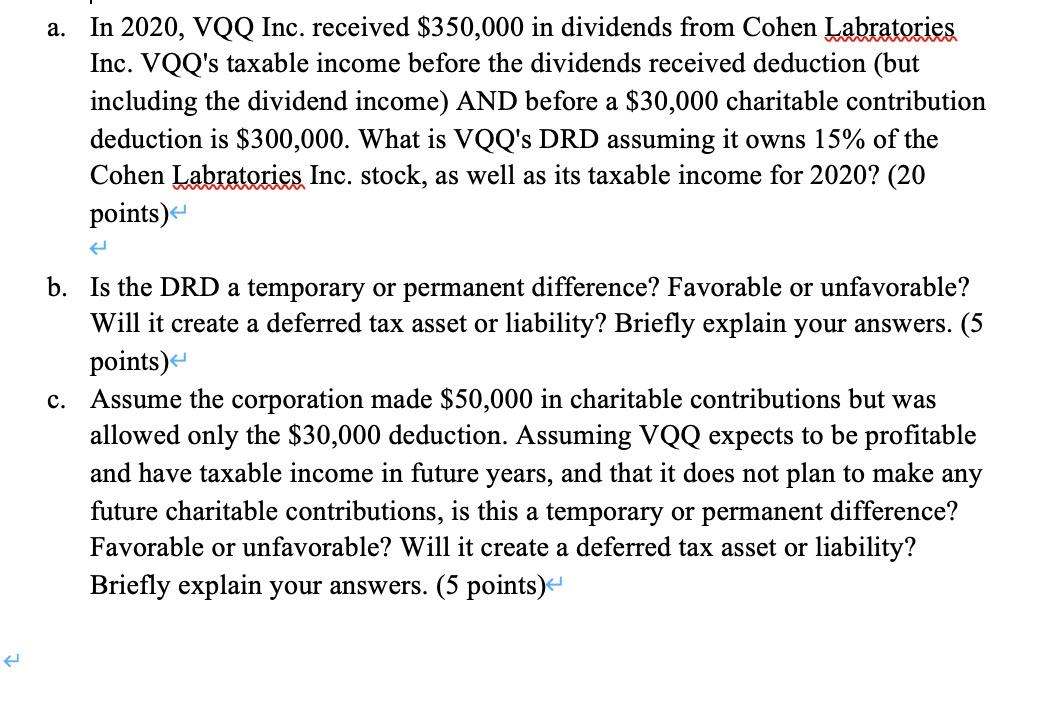

a. In 2020, VQQ Inc. received $350,000 in dividends from Cohen Labratories Inc. VQQ's taxable income before the dividends received deduction (but including the dividend income) AND before a $30,000 charitable contribution deduction is $300,000. What is VQQ's DRD assuming it owns 15% of the Cohen Labratories Inc. stock, as well as its taxable income for 2020? (20 points) b. Is the DRD a temporary or permanent difference? Favorable or unfavorable? Will it create a deferred tax asset or liability? Briefly explain your answers. (5 points)e c. Assume the corporation made $50,000 in charitable contributions but was allowed only the $30,000 deduction. Assuming VQQ expects to be profitable and have taxable income in future years, and that it does not plan to make any future charitable contributions, is this a temporary or permanent difference? Favorable or unfavorable? Will it create a deferred tax asset or liability? Briefly explain your answers. (5 points)

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Required a Since VQQ inc owns 15 stock in Cehen laboratories inc VQQ Inc would be allowed a DRD of 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started