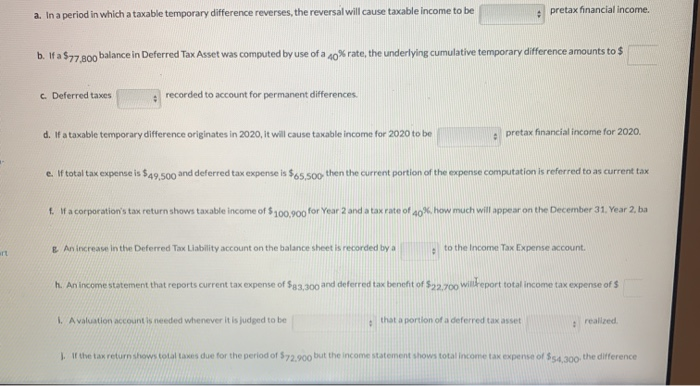

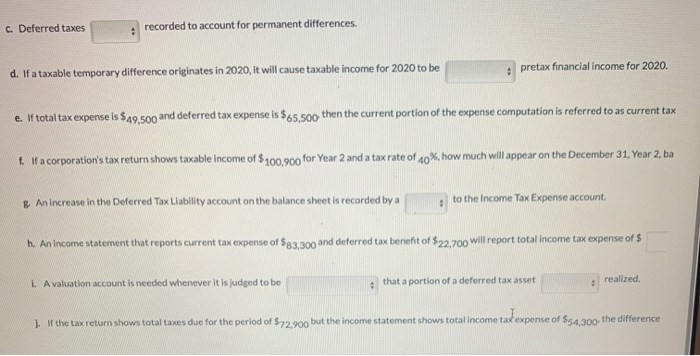

a. In a period in which a taxable temporary difference reverses, the reversal will cause taxable income to be pretax financial income. b. If a $ 77,800 balance in Deferred Tax Asset was computed by use of a 40% rate, the underlying cumulative temporary difference amounts to $ c Deferred taxes recorded to account for permanent differences d. If atacable temporary difference originates in 2020, it will cause taxable income for 2020 to be e pretax financial income for 2020. e. If total tax expense is $49,500 and deferred tax expense is $65,500 then the current portion of the expense computation is referred to as current tax f. If a corporation's tax return shows taxable income of $100,000 for Year 2 and a tax rate of 40% how much will appear on the December 31. Year 2, ba An increase in the Deferred Tax Liability account on the balance sheet is recorded by a to the Income Tax Expense account. h. An income statement that reports current tax expense of $ 300 and deferred tax benefit of $2.700 Wilcheport total income tax expense of $ Avaluation account is needed whenever it is judged to be that a portion of a deferred tax asset realized. If the tax return shows total taxes due for the period of 572.000 but the income statement shows total income tax expense of $54,300 the difference c. Deferred taxes recorded to account for permanent differences. d. If a taxable temporary difference originates in 2020, it will cause taxable income for 2020 to be pretax financial income for 2020. e. If total tax expense is $49,500 and deferred tax expense is $65,500 then the current portion of the expense computation is referred to as current tax If a corporation's tax return shows taxable income of $100,900 for Year 2 and a tax rate of 40%, how much will appear on the December 31, Year 2, ba An increase in the Deferred Tax Liability account on the balance sheet is recorded by a to the Income Tax Expense account. h. An income statement that reports current tax expense of $82.300 and deferred tax benefit of $22.700 will report total income tax expense of $ LA valuation account is needed whenever it is judged to be that a portion of a deferred tax asset reallred 1. If the tax return shows total taxes due for the period of $72.900 but the income statement shows total income tast expense of $54.300 the difference