Answered step by step

Verified Expert Solution

Question

1 Approved Answer

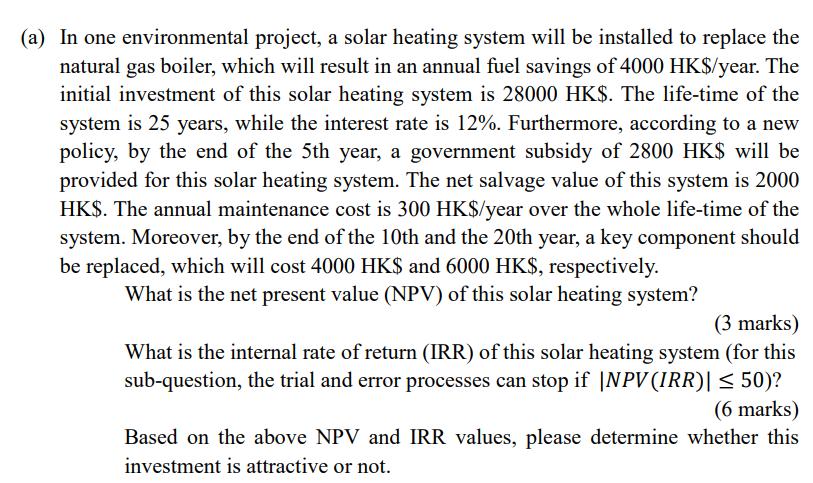

(a) In one environmental project, a solar heating system will be installed to replace the natural gas boiler, which will result in an annual

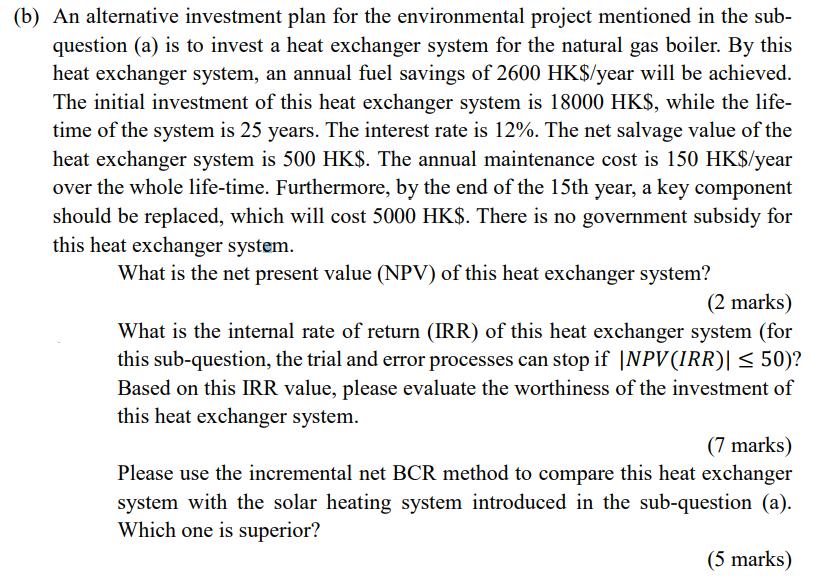

(a) In one environmental project, a solar heating system will be installed to replace the natural gas boiler, which will result in an annual fuel savings of 4000 HK$/year. The initial investment of this solar heating system is 28000 HK$. The life-time of the system is 25 years, while the interest rate is 12%. Furthermore, according to a new policy, by the end of the 5th year, a government subsidy of 2800 HK$ will be provided for this solar heating system. The net salvage value of this system is 2000 HK$. The annual maintenance cost is 300 HK$/year over the whole life-time of the system. Moreover, by the end of the 10th and the 20th year, a key component should be replaced, which will cost 4000 HK$ and 6000 HK$, respectively. What is the net present value (NPV) of this solar heating system? (3 marks) What is the internal rate of return (IRR) of this solar heating system (for this sub-question, the trial and error processes can stop if |NPV (IRR)| 50)? (6 marks) Based on the above NPV and IRR values, please determine whether this investment is attractive or not. (b) An alternative investment plan for the environmental project mentioned in the sub- question (a) is to invest a heat exchanger system for the natural gas boiler. By this heat exchanger system, an annual fuel savings of 2600 HK$/year will be achieved. The initial investment of this heat exchanger system is 18000 HK$, while the life- time of the system is 25 years. The interest rate is 12%. The net salvage value of the heat exchanger system is 500 HK$. The annual maintenance cost is 150 HK$/year over the whole life-time. Furthermore, by the end of the 15th year, a key component should be replaced, which will cost 5000 HK$. There is no government subsidy for this heat exchanger system. What is the net present value (NPV) of this heat exchanger system? (2 marks) What is the internal rate of return (IRR) of this heat exchanger system (for this sub-question, the trial and error processes can stop if |NPV (IRR)| 50)? Based on this IRR value, please evaluate the worthiness of the investment of this heat exchanger system. (7 marks) Please use the incremental net BCR method to compare this heat exchanger system with the solar heating system introduced in the sub-question (a). Which one is superior? (5 marks) (a) In one environmental project, a solar heating system will be installed to replace the natural gas boiler, which will result in an annual fuel savings of 4000 HK$/year. The initial investment of this solar heating system is 28000 HK$. The life-time of the system is 25 years, while the interest rate is 12%. Furthermore, according to a new policy, by the end of the 5th year, a government subsidy of 2800 HK$ will be provided for this solar heating system. The net salvage value of this system is 2000 HK$. The annual maintenance cost is 300 HK$/year over the whole life-time of the system. Moreover, by the end of the 10th and the 20th year, a key component should be replaced, which will cost 4000 HK$ and 6000 HK$, respectively. What is the net present value (NPV) of this solar heating system? (3 marks) What is the internal rate of return (IRR) of this solar heating system (for this sub-question, the trial and error processes can stop if |NPV (IRR)| 50)? (6 marks) Based on the above NPV and IRR values, please determine whether this investment is attractive or not. (b) An alternative investment plan for the environmental project mentioned in the sub- question (a) is to invest a heat exchanger system for the natural gas boiler. By this heat exchanger system, an annual fuel savings of 2600 HK$/year will be achieved. The initial investment of this heat exchanger system is 18000 HK$, while the life- time of the system is 25 years. The interest rate is 12%. The net salvage value of the heat exchanger system is 500 HK$. The annual maintenance cost is 150 HK$/year over the whole life-time. Furthermore, by the end of the 15th year, a key component should be replaced, which will cost 5000 HK$. There is no government subsidy for this heat exchanger system. What is the net present value (NPV) of this heat exchanger system? (2 marks) What is the internal rate of return (IRR) of this heat exchanger system (for this sub-question, the trial and error processes can stop if |NPV (IRR)| 50)? Based on this IRR value, please evaluate the worthiness of the investment of this heat exchanger system. (7 marks) Please use the incremental net BCR method to compare this heat exchanger system with the solar heating system introduced in the sub-question (a). Which one is superior? (5 marks)

Step by Step Solution

★★★★★

3.29 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

A Net Present Value NPV NPV 28000 4000 300 x PVIFA 1225 2800 x PVIF 125 4000 6000 x PVIF 12 10 x PVI...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started