Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) In order to prepare to send his child to a medical school in future, Encik Ishak wants to accumulate RM1.5 million at the

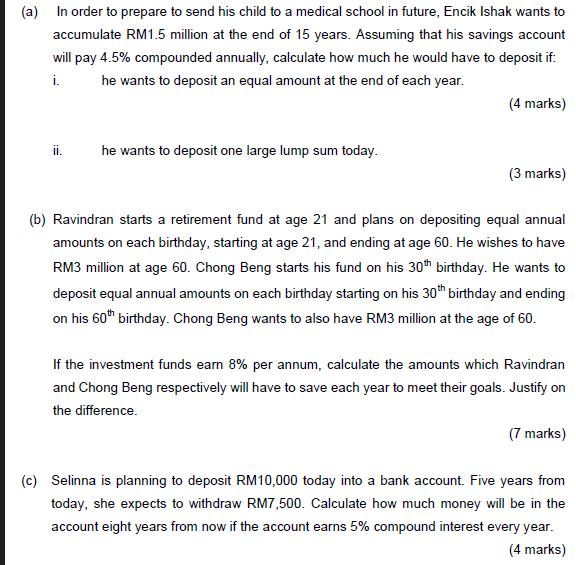

(a) In order to prepare to send his child to a medical school in future, Encik Ishak wants to accumulate RM1.5 million at the end of 15 years. Assuming that his savings account will pay 4.5% compounded annually, calculate how much he would have to deposit if: he wants to deposit an equal amount at the end of each year. i. ii. he wants to deposit one large lump sum today. (4 marks) (3 marks) (b) Ravindran starts a retirement fund at age 21 and plans on depositing equal annual amounts on each birthday, starting at age 21, and ending at age 60. He wishes to have RM3 million at age 60. Chong Beng starts his fund on his 30th birthday. He wants to deposit equal annual amounts on each birthday starting on his 30th birthday and ending on his 60th birthday. Chong Beng wants to also have RM3 million at the age of 60. If the investment funds earn 8% per annum, calculate the amounts which Ravindran and Chong Beng respectively will have to save each year to meet their goals. Justify on the difference. (7 marks) (c) Selinna is planning to deposit RM10,000 today into a bank account. Five years from today, she expects to withdraw RM7,500. Calculate how much money will be in the account eight years from now if the account earns 5% compound interest every year. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a i To accumulate RM15 million at the end of 15 years Encik Ishak would have to deposit an equal amount at the end of each year The formula to calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started