Question: a. In parallel columns, list the accounts that would be debited and credited for each of the following unrelated transactions: Event Account Debited Account

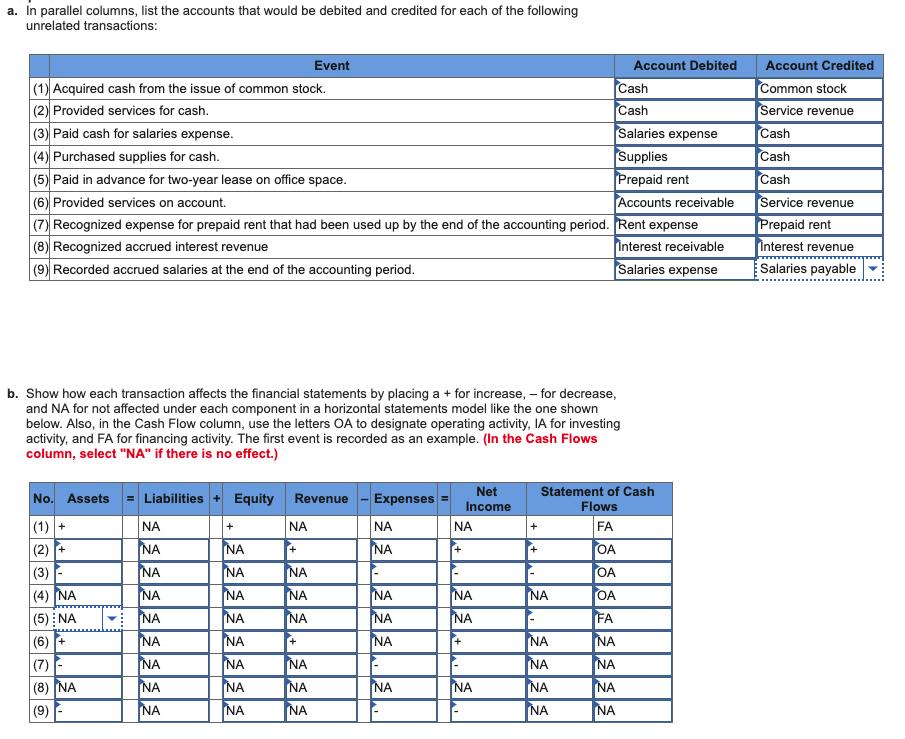

a. In parallel columns, list the accounts that would be debited and credited for each of the following unrelated transactions: Event Account Debited Account Credited (1) Acquired cash from the issue of common stock. (2) Provided services for cash. (3) Paid cash for salaries expense. (4) Purchased supplies for cash. (5) Paid in advance for two-year lease on office space. (6) Provided services on account. (7) Recognized expense for prepaid rent that had been used up by the end of the accounting period. Rent expense (8) Recognized accrued interest revenue (9) Recorded accrued salaries at the end of the accounting period. Cash Cash Salaries expense Supplies Prepaid rent Accounts receivable Common stock Service revenue Cash Cash Cash Service revenue Prepaid rent Interest revenue Interest receivable Salaries expense Salaries payable b. Show how each transaction affects the financial statements by placing a + for increase, - for decrease, and NA for not affected under each component in a horizontal statements model like the one shown below. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, and FA for financing activity. The first event is recorded as an example. (In the Cash Flows column, select "NA" if there is no effect.) No. Assets Equity Revenue Net Income Statement of Cash Flows = Liabilities Expenses NA NA NA FA OA (1) + (2) + (3) (4) NA (5) NA (6) + NA NA NA NA NA NA NA OA NA NA NA NA NA NA NA OA v NA [NA NA NA FA NA NA NA NA NA [+ (7)- NA [NA NA NA NA NA NA (8) NA NA NA NA NA NA NA (9) NA NA NA NA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts