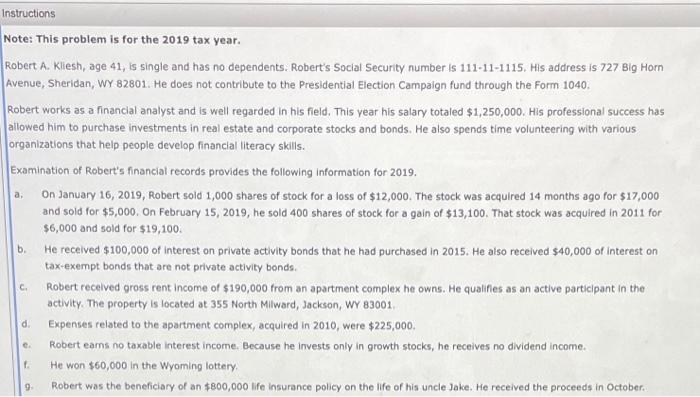

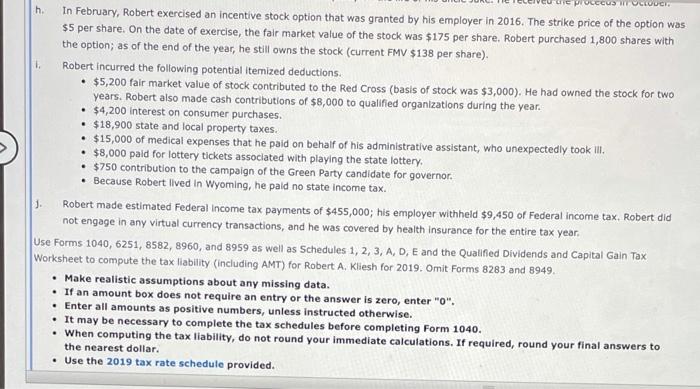

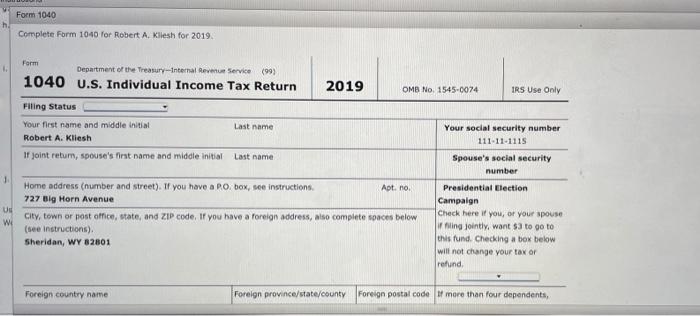

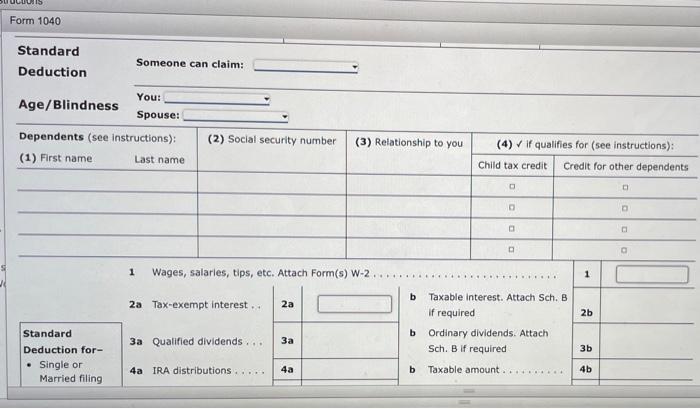

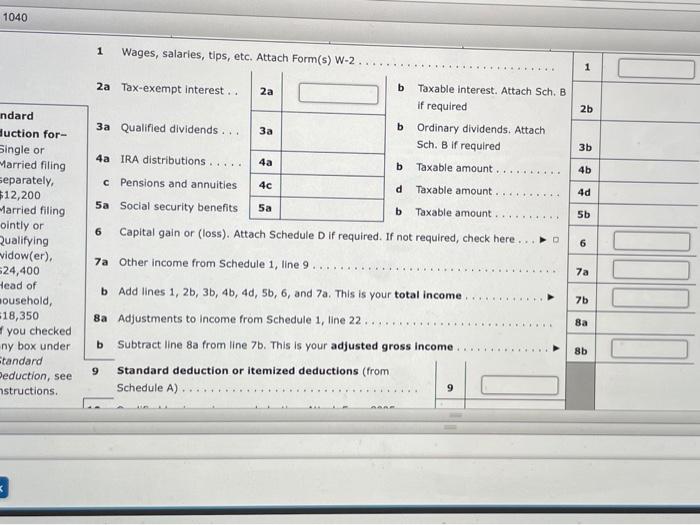

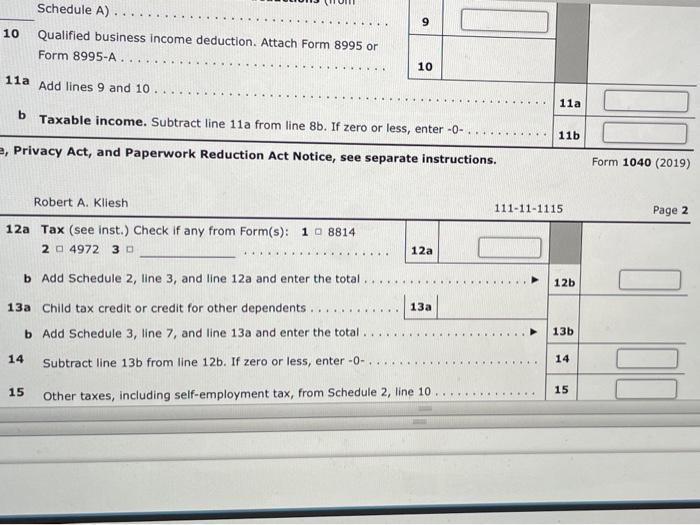

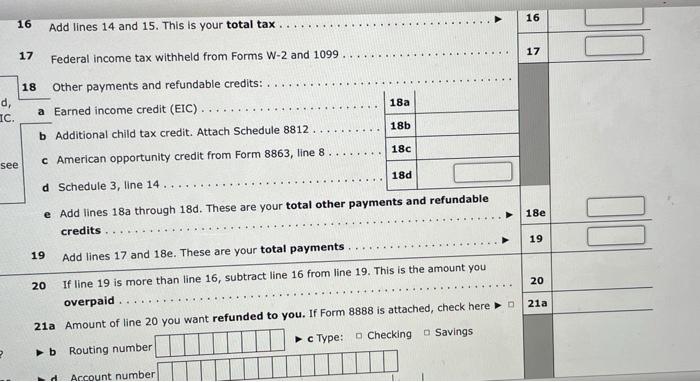

a. Instructions Note: This problem is for the 2019 tax year. Robert A. Kliesh, age 41, is single and has no dependents. Robert's Social Security number is 111-11-1115. His address is 727 Big Horn Avenue, Sheridan, WY 82801. He does not contribute to the Presidential Election Campaign fund through the Form 1040 Robert works as a financial analyst and is well regarded in his field. This year his salary totaled $1,250,000. His professional success has allowed him to purchase investments in real estate and corporate stocks and bonds. He also spend time volunteering with various organizations that help people develop financial literacy skills. Examination of Robert's financial records provides the following information for 2019. On January 16, 2019, Robert sold 1,000 shares of stock for a loss of $12,000. The stock was acquired 14 months ago for $17,000 and sold for $5,000. On February 15, 2019, he sold 400 shares of stock for a gain of $13,100. That stock was acquired in 2011 for $6,000 and sold for $19,100 He received $100,000 of Interest on private activity bonds that he had purchased in 2015. He also received $40,000 of interest on tax-exempt bonds that are not private activity bonds. Robert received gross rent Income of $190,000 from an apartment complex he owns. He qualifies as an active participant in the activity. The property is located at 355 North Milward, Jackson, WY 83001 Expenses related to the apartment complex, acquired in 2010, were $225,000 Robert eams no taxable interest income. Because he invests only in growth stocks, he receives no dividend income. He won $60,000 in the Wyoming lottery, Robert was the beneficiary of an $800,000 life insurance policy on the life of his uncle Jake. He received the proceeds in October. b. C d e 9 h. OCCUS OCIO In February, Robert exercised an incentive stock option that was granted by his employer in 2016. The strike price of the option was $5 per share. On the date of exercise, the fair market value of the stock was $175 per share. Robert purchased 1,800 shares with the option; as of the end of the year, he still owns the stock (current FMV $138 per share). Robert incurred the following potential iternized deductions $5,200 fair market value of stock contributed to the Red Cross (basis of stock was $3,000). He had owned the stock for two years. Robert also made cash contributions of $8,000 to qualified organizations during the year. $4,200 interest on consumer purchases. $18,900 state and local property taxes. $15,000 of medical expenses that he paid on behalf of his administrative assistant, who unexpectedly took Ill. $8,000 paid for lottery tickets associated with playing the state lottery, $750 contribution to the campaign of the Green Party candidate for governor. Because Robert lived in Wyoming, he paid no state income tax. Robert made estimated Federal Income tax payments of $455,000; his employer withheld $9,450 of Federal income tax, Robert did not engage in any virtual currency transactions, and he was covered by health insurance for the entire tax year. Use Forms 1040, 6251, 8582, 8960, and 8959 as well as Schedules 1, 2, 3, A, D, E and the Qualified Dividends and Capital Gain Tax Worksheet to compute the tax liability (including AMT) for Robert A. Kliesh for 2019. Omit Forms 8283 and 8949. Make realistic assumptions about any missing data. If an amount box does not require an entry or the answer is zero, enter "O". Enter all amounts as positive numbers, unless instructed otherwise. It may be necessary to complete the tax schedules before completing Form 1040. When computing the tax liability, do not round your immediate calculations. If required, round your final answers to the nearest dollar. Use the 2019 tax rate schedule provided. 1. Form 1040 h Complete Form 1040 for Robert A. Kliesh for 2019 2019 OMB No 1545-0074 IRS Use Only Form Department of the Treasury-internal Revenue Service (99) 1040 U.S. Individual Income Tax Return Filing Status Your first name and middle initial Last name Robert A. Kliesh If joint retur, spouse's first name and middle initial Last name 1 Apt. no Your social security number 111-11-1115 Spouse's social security number Presidential Election Campaign Check here if you, or your spouse iling jointly, wants to go to this fund. Checking a box below will not change your tax or refund Home address (number and street). If you have a PO box, see instructions 727 Big Horn Avenue Chy, town or post office, state and ZIP code. If you have a foreign address, also complete sonces below (see instructions) Sheridan, WY 82801 Us WA Foreign country name Foreign province/state/county Foreign postal code of more than four dependents, Form 1040 Standard Deduction Someone can claim: Age/Blindness You: Spouse: (2) Social security number Dependents (see instructions): (1) First name Last name (3) Relationship to you (4) V If qualifies for (see instructions): Child tax credit Credit for other dependents 1 Wages, salarles, tips, etc. Attach Form(s) W-2. 1 2a Tax-exempt interest 2a 2b b Taxable interest. Attach Sch. B if required b Ordinary dividends. Attach Sch. B if required 3a Qualified dividends... 3b Standard Deduction for- Single or Married filing 4a IRA distributions 4a b Taxable amount 4b 1040 1 Wages, salaries, tips, etc. Attach Form(s) W-2. 1 2a Tax-exempt interest .. 2a 2b 3a Qualified dividends ... 3a b Taxable interest. Attach Sch. B if required b Ordinary dividends. Attach Sch. B if required b Taxable amount.. d Taxable amount 3b 4a IRA distributions .... 4a 4b c Pensions and annuities 4c 4d 5a Social security benefits 5a b Taxable amount. 5b 6 Capital gain or loss). Attach Schedule D if required. If not required, check here. 6 ndard duction for Single or Married filing separately, $12,200 arried filing ointly or Qualifying vidow(er) $24,400 Head of household, 18,350 you checked ny box under Standard eduction, see structions. 7a Other Income from Schedule 1, line 9 7a 7b Ba b Add lines 1, 2b, 35, 46, 40, 56, 6, and 7a. This is your total income 8a Adjustments to income from Schedule 1, line 22 b Subtract line 8a from line 7b. This is your adjusted gross income Standard deduction or itemized deductions (from Schedule A) 8b 9 9 Schedule A). 9 10 Qualified business income deduction. Attach Form 8995 or Form 8995-A 10 11a Add lines 9 and 10. 11a b Taxable income. Subtract line 11a from line 8b. If zero or less, enter -- 11b e, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Form 1040 (2019) Robert A. Kliesh 111-11-1115 Page 2 12a Tax (see inst.) Check if any from Form(s): 1 8814 2 0 4972 30 12a b Add Schedule 2, line 3, and line 12a and enter the total 12b 13a 13a Child tax credit or credit for other dependents .... b Add Schedule 3, line 7, and line 13a and enter the total 13b 14 14 Subtract line 13b from line 12b. If zero or less, enter -0- 15 15 Other taxes, including self-employment tax, from Schedule 2, line 10. 16 16 Add lines 14 and 15. This is your total tax 17 17 Federal income tax withheld from Forms W-2 and 1099 18 Other payments and refundable credits: 18a d, IC. a Earned income credit (EIC). 18b b Additional child tax credit. Attach Schedule 8812 18c see C American opportunity credit from Form 8863, line 8 18d d Schedule 3, line 14 18e e Add lines 18a through 18d. These are your total other payments and refundable credits 19 19 Add lines 17 and 18e. These are your total payments 20 D 21a 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid 21a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here b Routing number c Type: Checking Savings Account number