Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Investors face a trade-off between risk and expected return. Historical data confirm our intuition that assets with low degrees of risk should provide

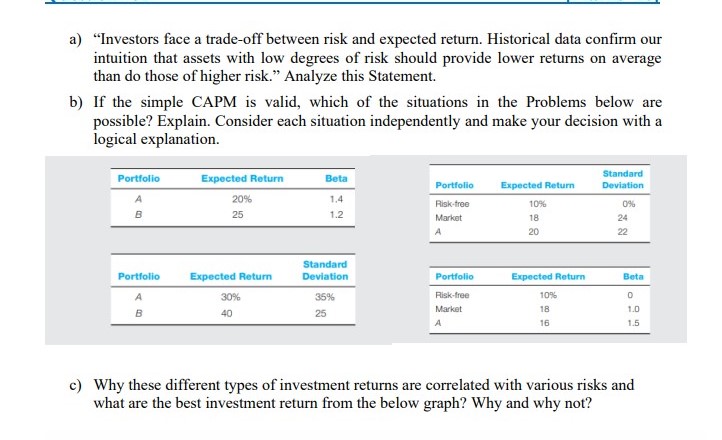

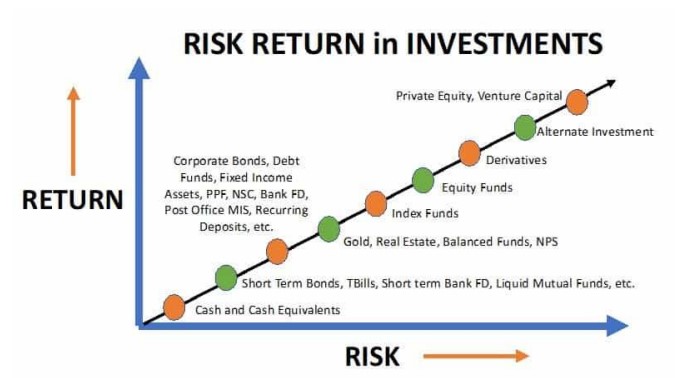

a) "Investors face a trade-off between risk and expected return. Historical data confirm our intuition that assets with low degrees of risk should provide lower returns on average than do those of higher risk." Analyze this Statement. b) If the simple CAPM is valid, which of the situations in the Problems below are possible? Explain. Consider each situation independently and make your decision with a logical explanation. Portfolio A B Portfolio A B Expected Return 20% 25 Expected Return 30% 40 Beta 1.4 1.2 Standard Deviation 35% 25 Portfolio Risk-free Market A Portfolio Risk-free Market A Expected Return 10% 18 20 Expected Return 10% 18 16 Standard Deviation 0% 24 22 Beta 0 1.0 1.5 c) Why these different types of investment returns are correlated with various risks and what are the best investment return from the below graph? Why and why not? RETURN RISK RETURN in INVESTMENTS Corporate Bonds, Debt Funds, Fixed Income Assets, PPF, NSC, Bank FD, Post Office MIS, Recurring Deposits, etc. Private Equity, Venture Capital Cash and Cash Equivalents Alternate Investment Derivatives Equity Funds RISK Index Funds Gold, Real Estate, Balanced Funds, NPS Short Term Bonds, TBills, Short term Bank FD, Liquid Mutual Funds, etc.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The statement Investors face a tradeoff between risk and expected return Historical data confirm our intuition that assets with low degrees of risk should provide lower returns on average than do th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started