Question

A is a one-third partner in Partnership ABC. A sells his one-third interest in ABC to D on June 30 of the current year for

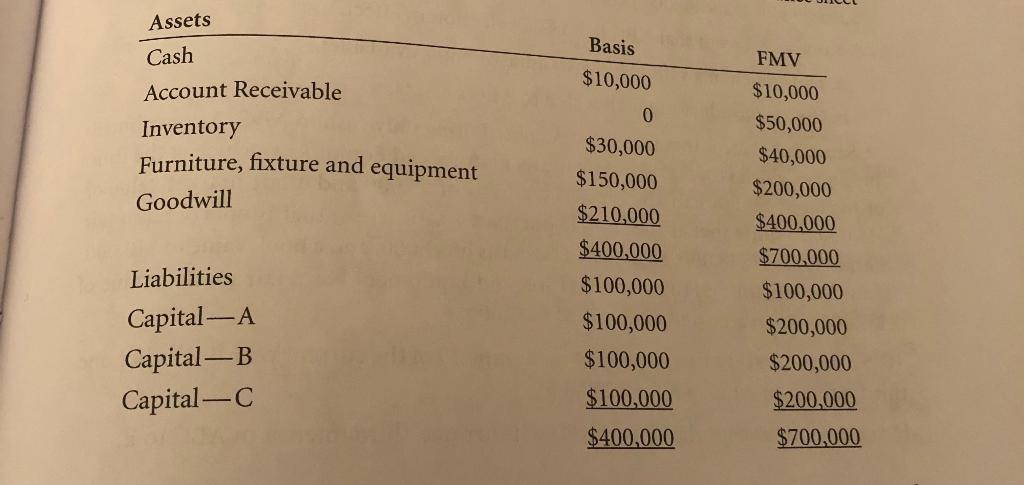

A is a one-third partner in Partnership ABC. A sells his one-third interest in ABC to D on June 30 of the current year for $200,000. ABC is a cash-method, calendar year partnership. ABC does not have a section 754 election in effect. ABC has income of $200,000 for the year of sale, none of which is distributed. The balance sheet of ABC is as follows:

$150,000 of depreciation was taken on the furniture, fixtures, and equipment, and thus the original basis was $300,000. Assume for the sake of the problem that the outside basis of the partners in their partnership interests (without taking into consideration their allocable share of debt under I.R.C section 752) is equal to their capital as shown on the balance sheet.

a. What is A's amount realized and gain recognized? What is the character of A's gain?

b. What is D's basis for her partnership interest?

Assets Basis $10,000 FMV Cash Account Receivable Inventory 0 Furniture, fixture and equipment Goodwill Liabilities $30,000 $150,000 $210,000 $400,000 $100,000 $100,000 $100,000 $100,000 $10,000 $50,000 $40,000 $200,000 $400,000 $700,000 $100,000 $200,000 $200,000 $200,000 $700,000 Capital A Capital-B Capital $400,000 Assets Basis $10,000 FMV Cash Account Receivable Inventory 0 Furniture, fixture and equipment Goodwill Liabilities $30,000 $150,000 $210,000 $400,000 $100,000 $100,000 $100,000 $100,000 $10,000 $50,000 $40,000 $200,000 $400,000 $700,000 $100,000 $200,000 $200,000 $200,000 $700,000 Capital A Capital-B Capital $400,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started