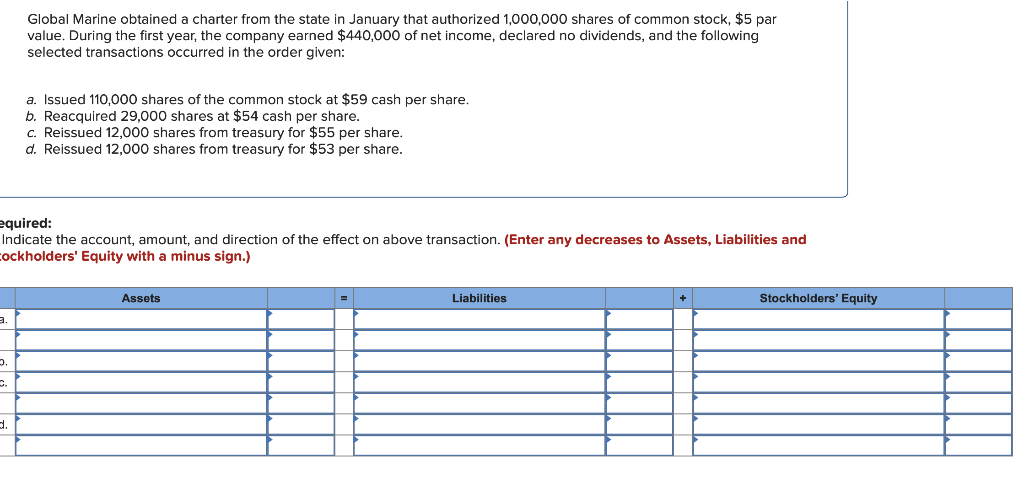

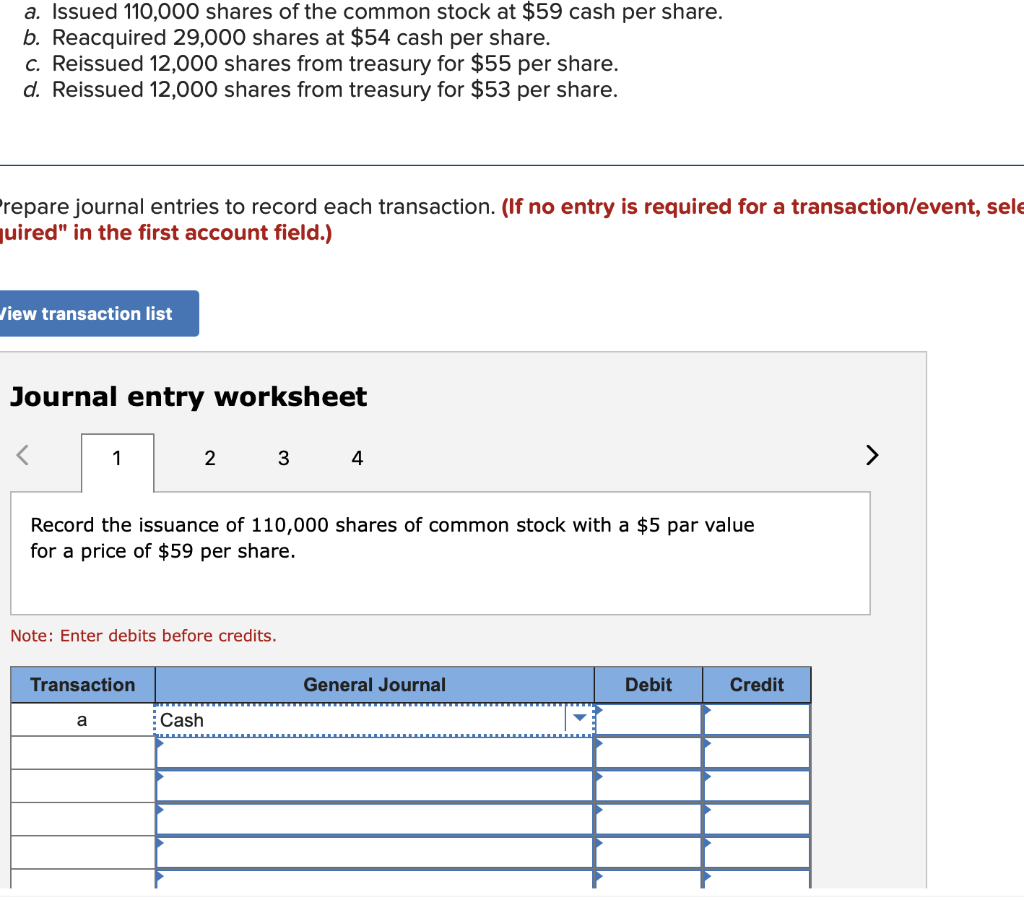

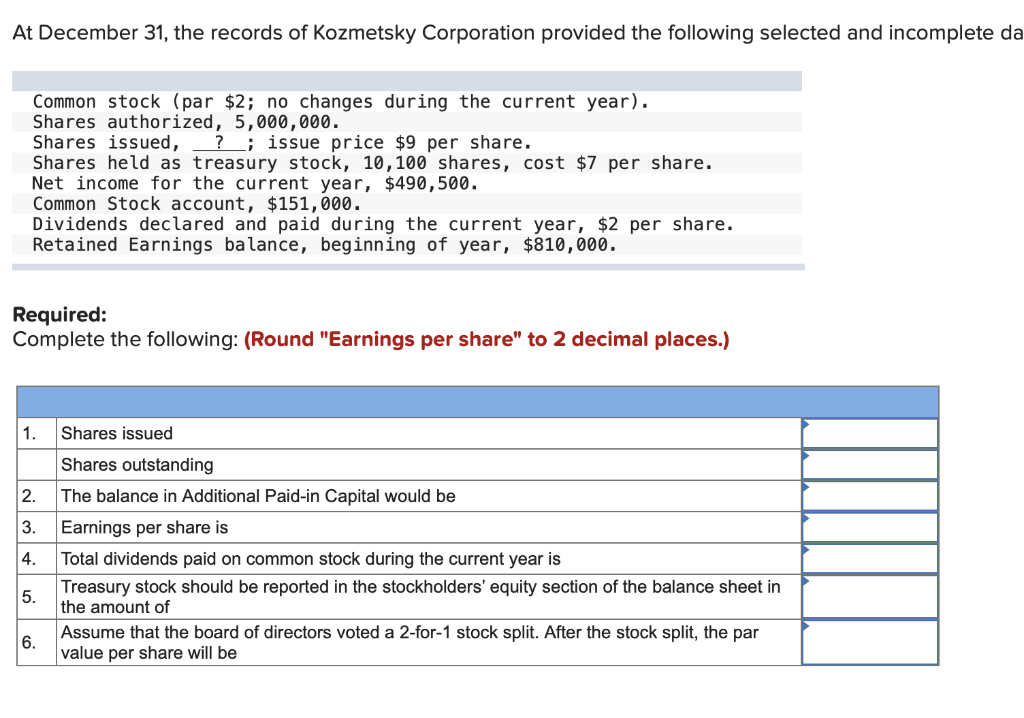

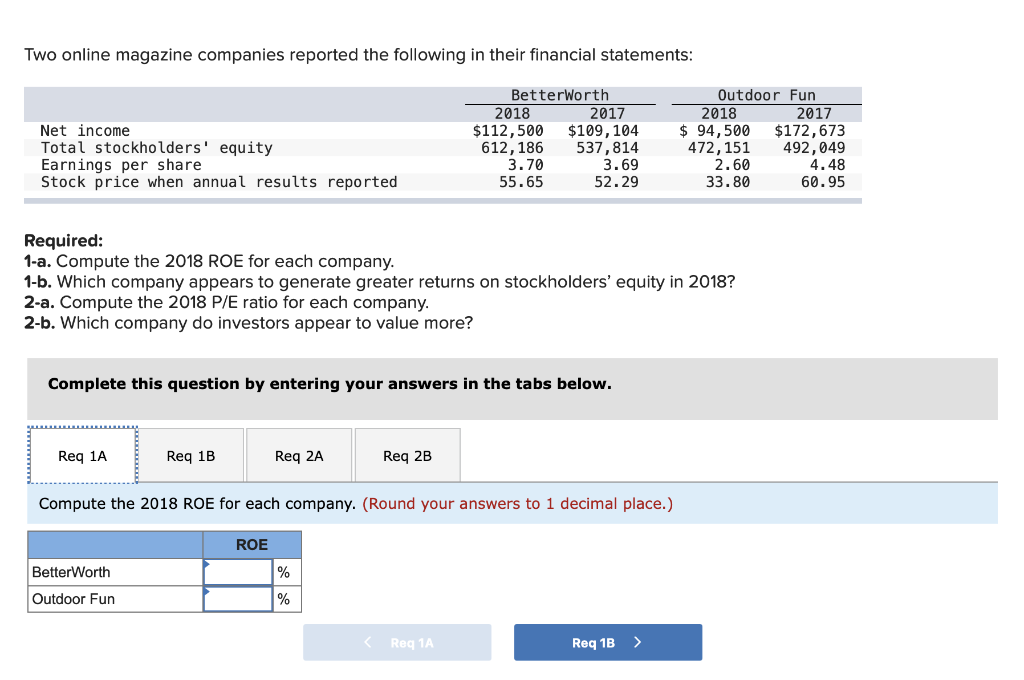

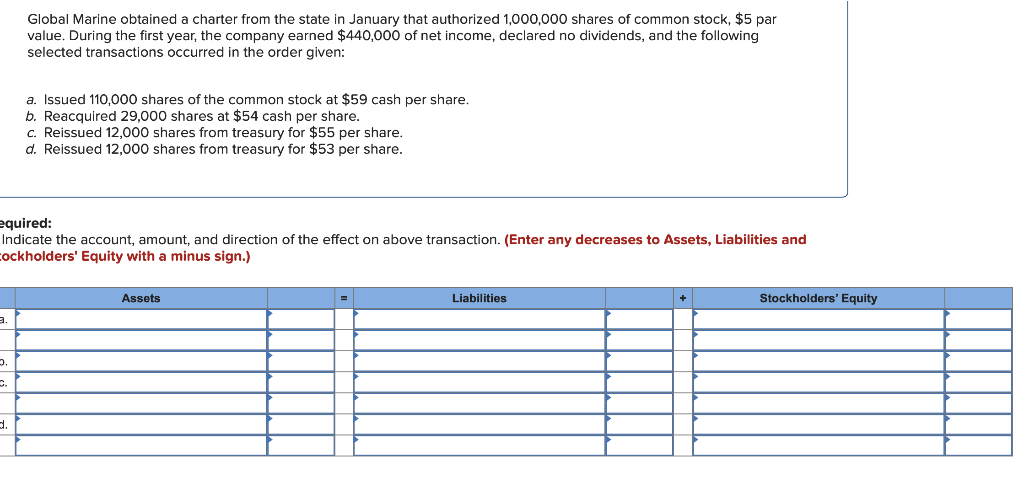

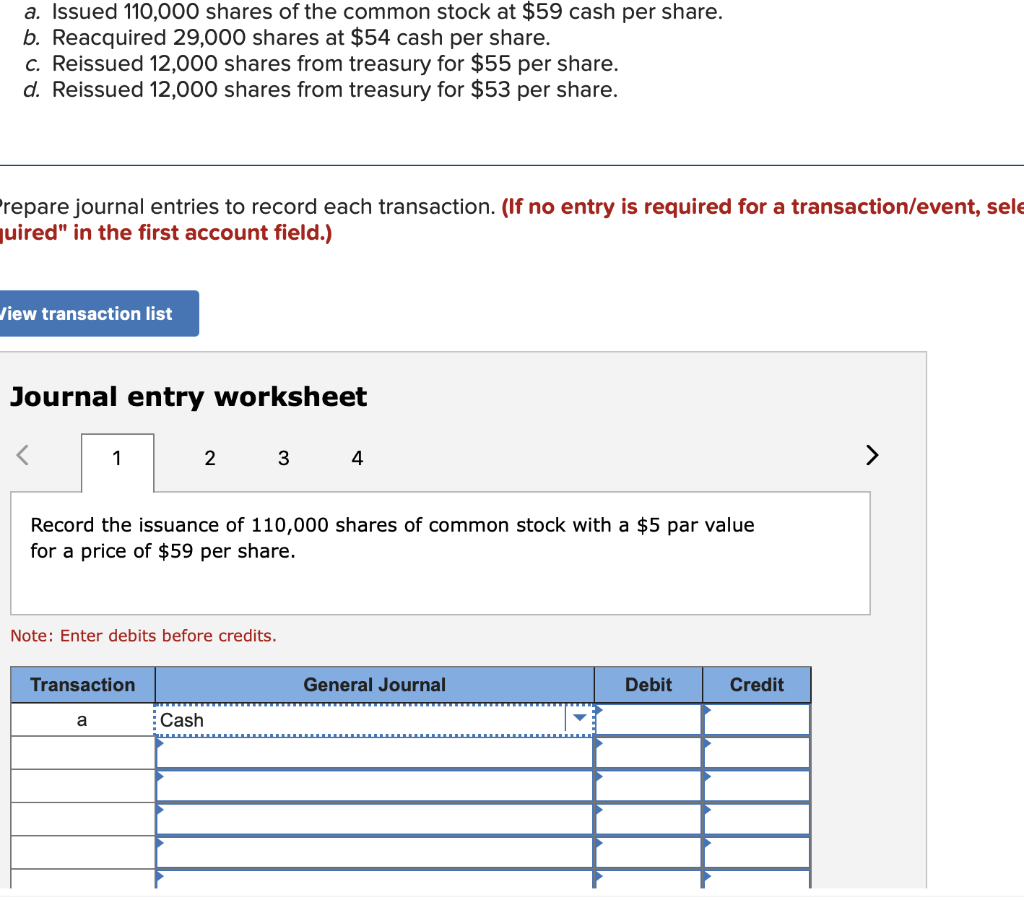

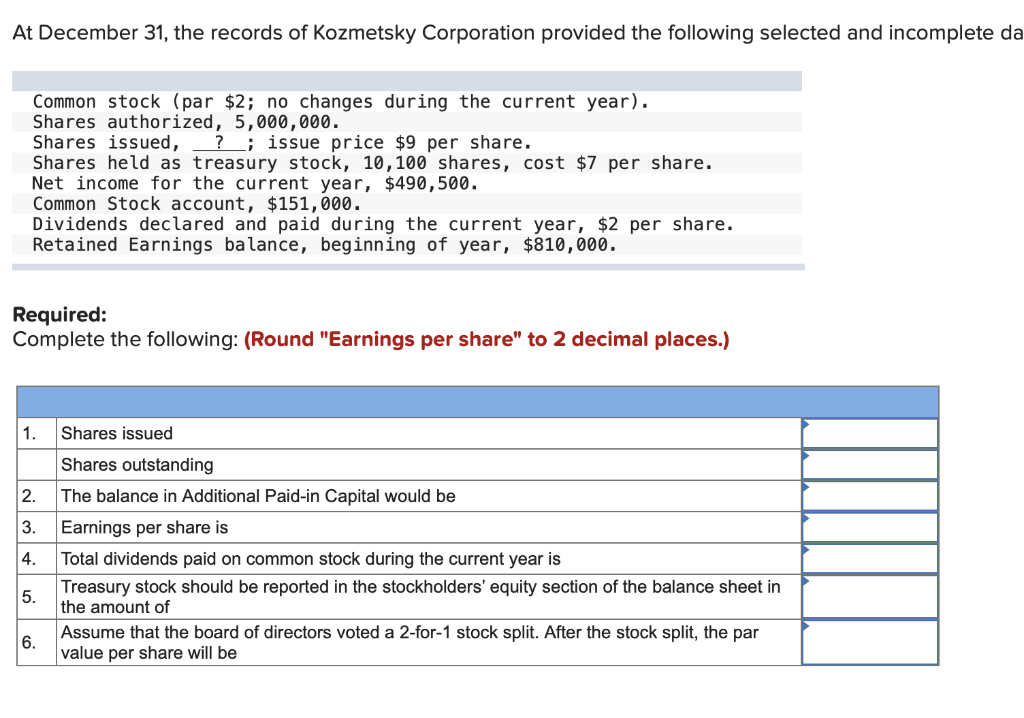

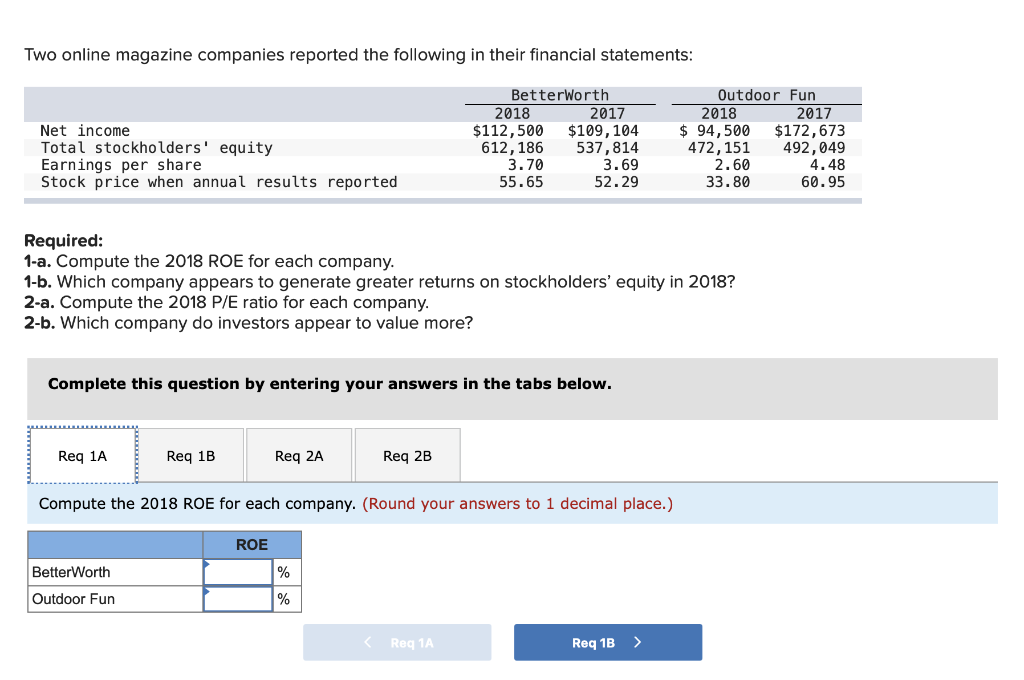

a. Issued 110,000 shares of the common stock at $59 cash per share. b. Reacquired 29,000 shares at $54 cash per share. C. Reissued 12,000 shares from treasury for $55 per share. d. Reissued 12,000 shares from treasury for $53 per share. repare journal entries to record each transaction. (If no entry is required for a transaction/event, sele uired" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 Record the issuance of 110,000 shares of common stock with a $5 par value for a price of $59 per share. Note: Enter debits before credits. Transaction General Journal Debit Credit a Cash At December 31, the records of Kozmetsky Corporation provided the following selected and incomplete da Common stock (par $2; no changes during the current year). Shares authorized, 5,000,000. Shares issued, ?__; issue price $9 per share. Shares held as treasury stock, 10, 100 shares, cost $7 per share. Net income for the current year, $490,500. Common Stock account, $151,000. Dividends declared and paid during the current year, $2 per share. Retained Earnings balance, beginning of year, $810,000. Required: Complete the following: (Round "Earnings per share" to 2 decimal places.) 1. 2. 3. Shares issued Shares outstanding The balance in Additional Paid-in Capital would be Earnings per share is Total dividends paid on common stock during the current year is Treasury stock should be reported in the stockholders' equity section of the balance sheet in the amount of Assume that the board of directors voted a 2-for-1 stock split. After the stock split, the par value per share will be 4. 5. 6. Two online magazine companies reported the following in their financial statements: Net income Total stockholders' equity Earnings per share Stock price when annual results reported Betterworth 2018 2017 $112,500 $109, 104 612,186 537,814 3.70 3.69 55.65 52.29 Outdoor Fun 2018 2017 $ 94,500 $172,673 472, 151 492,049 2.60 4.48 33.80 60.95 Required: 1-a. Compute the 2018 ROE for each company. 1-b. Which company appears to generate greater returns on stockholders' equity in 2018? 2-a. Compute the 2018 P/E ratio for each company. 2-b. Which company do investors appear to value more? Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2A Req 2B Compute the 2018 ROE for each company. (Round your answers to 1 decimal place.) ROE % BetterWorth Outdoor Fun %