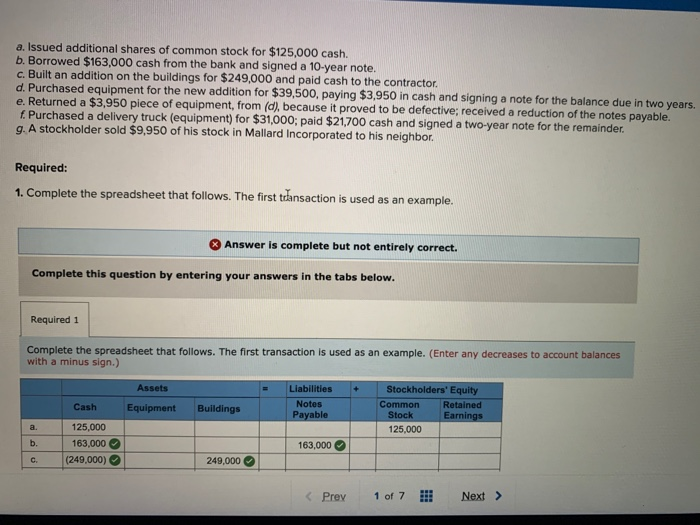

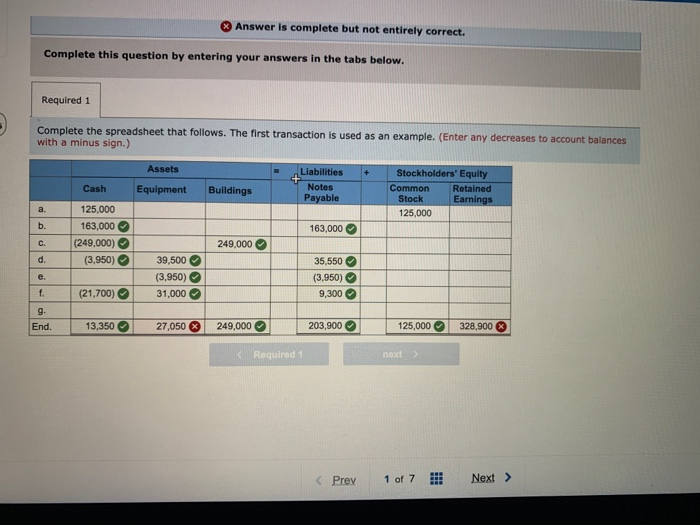

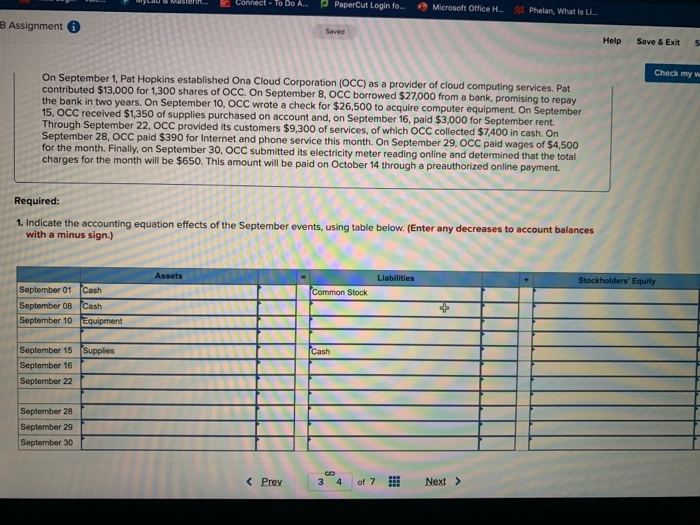

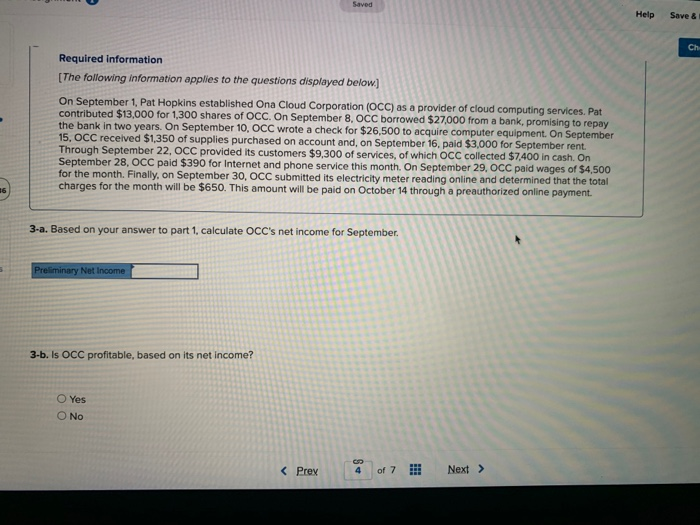

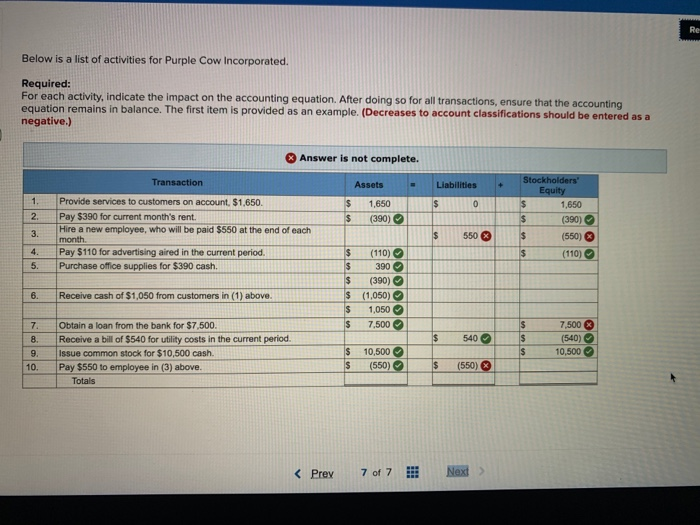

a. Issued additional shares of common stock for $125,000 cash. b. Borrowed $163,000 cash from the bank and signed a 10-year note. c. Built an addition on the buildings for $249,000 and paid cash to the contractor d. Purchased equipment for the new addition for $39,500, paying $3,950 in cash and signing a note for the balance due in two years. e. Returned a $3,950 piece of equipment, from (d), because it proved to be defective; received a reduction of the notes payable. f. Purchased a delivery truck (equipment) for $31,000; paid $21,700 cash and signed a two-year note for the remainder. 9. A stockholder sold $9,950 of his stock in Mallard Incorporated to his neighbor. Required: 1. Complete the spreadsheet that follows. The first transaction is used as an example. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Complete the spreadsheet that follows. The first transaction is used as an example. (Enter any decreases to account balances with a minus sign.) Assets Cash Liabilities Notes Payable Equipment Buildings Stockholders' Equity Common Retained Stock Earnings 125,000 a. b. 125,000 163,000 (249,000) 163,000 c. 249,000 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Complete the spreadsheet that follows. The first transaction is used as an example. (Enter any decreases to account balances with a minus sign.) Assets Cash Equipment Buildings Liabilities Notes Payable Stockholders' Equity Common Retained Stock Earnings 125,000 a. b. 163,000 125,000 163,000 (249,000) (3.950) C. 249,000 d. 39,500 (3,950) 31,000 35,550 (3,950) 9,300 f. (21,700) 9 End. 13,350 27,050 x 249,000 203,900 125,000 328,900 Required 1 next 1 of 7 BB Prey Next > Connect - To Do A... PaperCut Loginfo... Microsoft Office H... Phelan, What is L. B Assignment Saved Help Save & Exit S Check my w On September 1, Pat Hopkins established Ona Cloud Corporation (OCC) as a provider of cloud computing services. Pat contributed $13,000 for 1,300 shares of OCC. On September 8, OCC borrowed $27,000 from a bank, promising to repay the bank in two years. On September 10, OCC wrote a check for $26,500 to acquire computer equipment. On September 15, OCC received $1,350 of supplies purchased on account and, on September 16, paid $3,000 for September rent. Through September 22, OCC provided its customers $9,300 of services, of which OCC collected $7,400 in cash. On September 28, OCC paid $390 for Internet and phone service this month. On September 29, OCC paid wages of $4,500 for the month. Finally, on September 30, OCC submitted its electricity meter reading online and determined that the total charges for the month will be $650. This amount will be paid on October 14 through a preauthorized online payment. Required: 1. Indicate the accounting equation effects of the September events, using table below. (Enter any decreases to account balances with a minus sign.) Assets Liabilities Stockholders' Equity Common Stock September 01 Cash September 08 Cash September 10 Equipment Cash September 15 Supplies September 16 September 22 September 28 September 29 September 30 Saved Help Save & Ch Required information [The following information applies to the questions displayed below.] On September 1, Pat Hopkins established Ona Cloud Corporation (OCC) as a provider of cloud computing services. Pat contributed $13,000 for 1,300 shares of OCC. On September 8, OCC borrowed $27,000 from a bank, promising to repay the bank in two years. On September 10, OCC wrote a check for $26,500 to acquire computer equipment. On September 15, OCC received $1,350 of supplies purchased on account and, on September 16, paid $3,000 for September rent. Through September 22, OCC provided its customers $9,300 of services, of which OCC collected $7,400 in cash. On September 28, OCC paid $390 for Internet and phone service this month. On September 29, OCC paid wages of $4,500 for the month. Finally, on September 30, OCC submitted its electricity meter reading online and determined that the total charges for the month will be $650. This amount will be paid on October 14 through a preauthorized online payment. 36 3-a. Based on your answer to part 1, calculate OCC's net income for September. Preliminary Net Income 3-b. Is OCC profitable, based on its net income? O Yes O No S Re Below is a list of activities for Purple Cow Incorporated. Required: For each activity, indicate the impact on the accounting equation. After doing so for all transactions, ensure that the accounting equation remains in balance. The first item is provided as an example. (Decreases to account classifications should be entered as a negative.) Answer is not complete. Transaction Assets Liabilities + $ 1 2. 0 $ $ 1.650 (390) Stockholders Equity $ 1,650 $ (390) $ (550) Provide services to customers on account. $1,650 Pay $390 for current month's rent. Hire a new employee, who will be paid $550 at the end of each month Pay $110 for advertising aired in the current period. Purchase office supplies for $390 cash. 3. $ 550 $ (110) 5. 390 $ (110) $ $ (390) $ (1,050) $ 1,050 $ 7.500 6. Receive cash of $1,050 from customers in (1) above. N. $ 540 Obtain a loan from the bank for $7,500. Receive a bill of $540 for utility costs in the current period. Issue common stock for $10,500 cash. Pay $550 to employee in (3) above. Totals $ $ $ 7,500 (540) 10,500 9 10. $ $ 10,500 (550) $ (550)