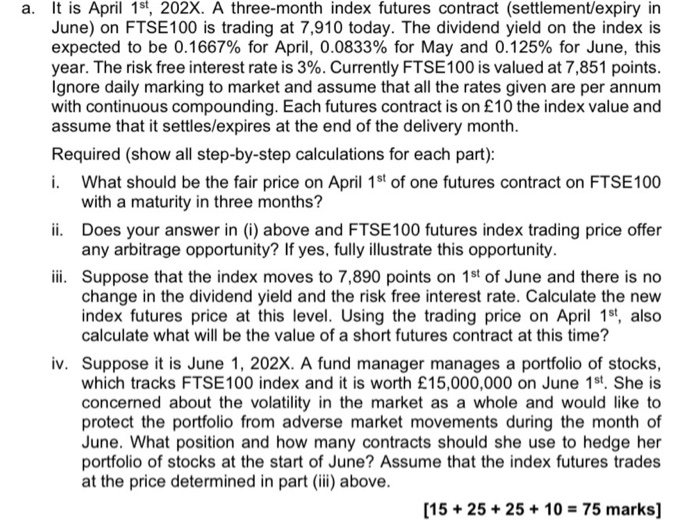

a. It is April 1st, 202X. A three-month index futures contract (settlement/expiry in June) on FTSE100 is trading at 7,910 today. The dividend yield on the index is expected to be 0.1667% for April, 0.0833% for May and 0.125% for June, this year. The risk free interest rate is 3%. Currently FTSE 100 is valued at 7,851 points. Ignore daily marking to market and assume that all the rates given are per annum with continuous compounding. Each futures contract is on 10 the index value and assume that it settles/expires at the end of the delivery month. Required (show all step-by-step calculations for each part): i. What should be the fair price on April 1st of one futures contract on FTSE100 with a maturity in three months? ii. Does your answer (i) above and FTSE100 futures index trading price offer any arbitrage opportunity? If yes, fully illustrate this opportunity. iii. Suppose that the index moves to 7,890 points on 1st of June and there is no change in the dividend yield and the risk free interest rate. Calculate the new index futures price at this level. Using the trading price on April 1st, also calculate what will be the value of a short futures contract at this time? iv. Suppose it is June 1, 202X. A fund manager manages a portfolio of stocks, which tracks FTSE 100 index and it is worth 15,000,000 on June 1st. She is concerned about the volatility in the market as a whole and would like to protect the portfolio from adverse market movements during the month of June. What position and how many contracts should she use to hedge her portfolio of stocks at the start of June? Assume that the index futures trades at the price determined in part (iii) above. [15 + 25 + 25 + 10 = 75 marks] a. It is April 1st, 202X. A three-month index futures contract (settlement/expiry in June) on FTSE100 is trading at 7,910 today. The dividend yield on the index is expected to be 0.1667% for April, 0.0833% for May and 0.125% for June, this year. The risk free interest rate is 3%. Currently FTSE 100 is valued at 7,851 points. Ignore daily marking to market and assume that all the rates given are per annum with continuous compounding. Each futures contract is on 10 the index value and assume that it settles/expires at the end of the delivery month. Required (show all step-by-step calculations for each part): i. What should be the fair price on April 1st of one futures contract on FTSE100 with a maturity in three months? ii. Does your answer (i) above and FTSE100 futures index trading price offer any arbitrage opportunity? If yes, fully illustrate this opportunity. iii. Suppose that the index moves to 7,890 points on 1st of June and there is no change in the dividend yield and the risk free interest rate. Calculate the new index futures price at this level. Using the trading price on April 1st, also calculate what will be the value of a short futures contract at this time? iv. Suppose it is June 1, 202X. A fund manager manages a portfolio of stocks, which tracks FTSE 100 index and it is worth 15,000,000 on June 1st. She is concerned about the volatility in the market as a whole and would like to protect the portfolio from adverse market movements during the month of June. What position and how many contracts should she use to hedge her portfolio of stocks at the start of June? Assume that the index futures trades at the price determined in part (iii) above. [15 + 25 + 25 + 10 = 75 marks]