Question

a. James (aged 33) and his wife, Jennie (aged 30), have just purchased a new condominium in Bandar Sunway for RM550,000. They plan to take

a. James (aged 33) and his wife, Jennie (aged 30), have just purchased a new condominium in Bandar Sunway for RM550,000. They plan to take a 80% mortgage loan of RM440,000 for the next 35 years. James has the following assets: a Nissan Cefiro worth RM65,000, stocks on Bursa Malaysia worth RM180,000, group insurance by his employer worth RM400,000 and personal insurance with a face amount of RM250,000. He has a hire purchase loan on the Nissan Cefiro amounting to RM40,000. Should he pre-decease jennie , james plans to provide RM36,000 per annum for jennie till she reaches age 70. He would also like to create an Emergency Buffer fund of RM50,000 and Final Expenses fund of RM35,000. Using the Capital Liquidation method, compute the amount of additional life insurance that james needs to purchase. Assume a discount rate of 4% per annum and that income is received at the end of the period.

a. James (aged 33) and his wife, Jennie (aged 30), have just purchased a new condominium in Bandar Sunway for RM550,000. They plan to take a 80% mortgage loan of RM440,000 for the next 35 years. James has the following assets: a Nissan Cefiro worth RM65,000, stocks on Bursa Malaysia worth RM180,000, group insurance by his employer worth RM400,000 and personal insurance with a face amount of RM250,000. He has a hire purchase loan on the Nissan Cefiro amounting to RM40,000. Should he pre-decease jennie , james plans to provide RM36,000 per annum for jennie till she reaches age 70. He would also like to create an Emergency Buffer fund of RM50,000 and Final Expenses fund of RM35,000. Using the Capital Liquidation method, compute the amount of additional life insurance that james needs to purchase. Assume a discount rate of 4% per annum and that income is received at the end of the period.

b. In the example above; as life mortality is uncertain, james would like to provide for his wife, jennie, an income of RM36,000 for an indefinite time period. Using the Capital Preservation method, compute the amount of additional life insurance that jennie needs to purchase. Assume a discount rate of 4% per annum and that income is received at the end of the period.

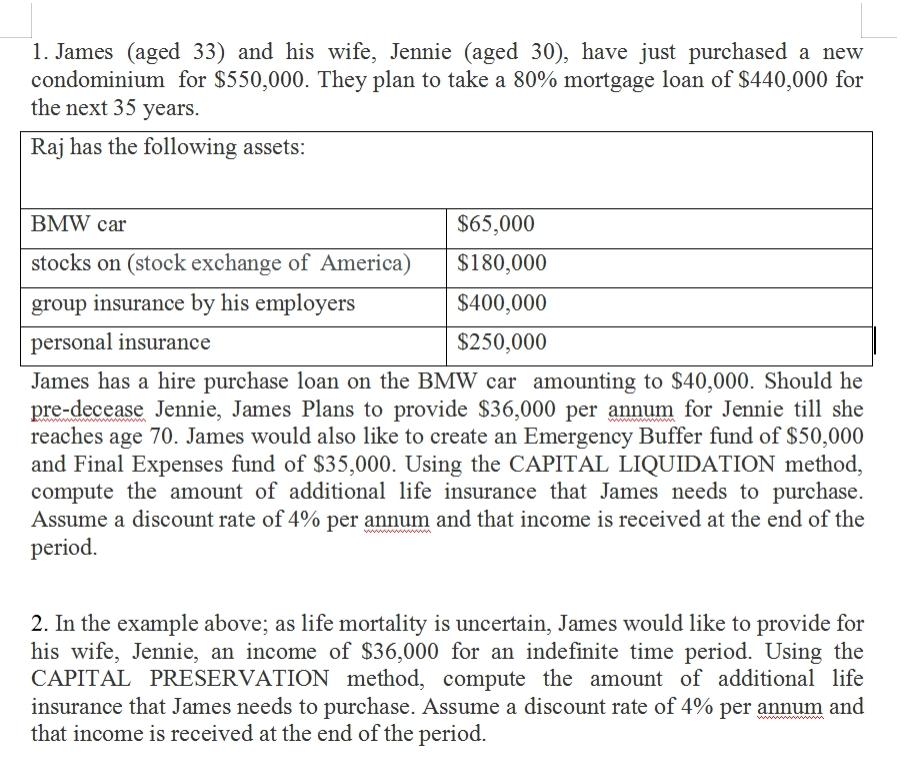

1. James (aged 33) and his wife, Jennie (aged 30), have just purchased a new ( condominium for $550,000. They plan to take a 80% mortgage loan of $440,000 for the next 35 years. Raj has the following assets: BMW car $65,000 stocks on (stock exchange of America) $180,000 group insurance by his employers $400,000 personal insurance $250,000 James has a hire purchase loan on the BMW car amounting to $40,000. Should he pre-decease Jennie, James Plans to provide $36,000 per annum for Jennie till she reaches age 70. James would also like to create an Emergency Buffer fund of $50,000 and Final Expenses fund of $35,000. Using the CAPITAL LIQUIDATION method, compute the amount of additional life insurance that James needs to purchase. Assume a discount rate of 4% per annum and that income is received at the end of the period. 2. In the example above; as life mortality is uncertain, James would like to provide for his wife, Jennie, an income of $36,000 for an indefinite time period. Using the CAPITAL PRESERVATION method, compute the amount of additional life insurance that James needs to purchase. Assume a discount rate of 4% per annum and that income is received at the end of the periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started