Answered step by step

Verified Expert Solution

Question

1 Approved Answer

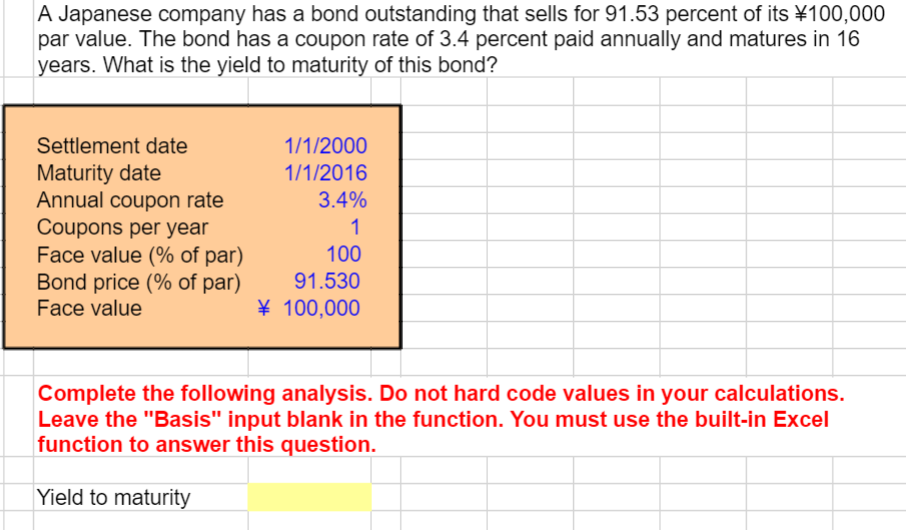

A Japanese company has a bond outstanding that sells for 91.53 percent of its 100,000 par value. The bond has a coupon rate of

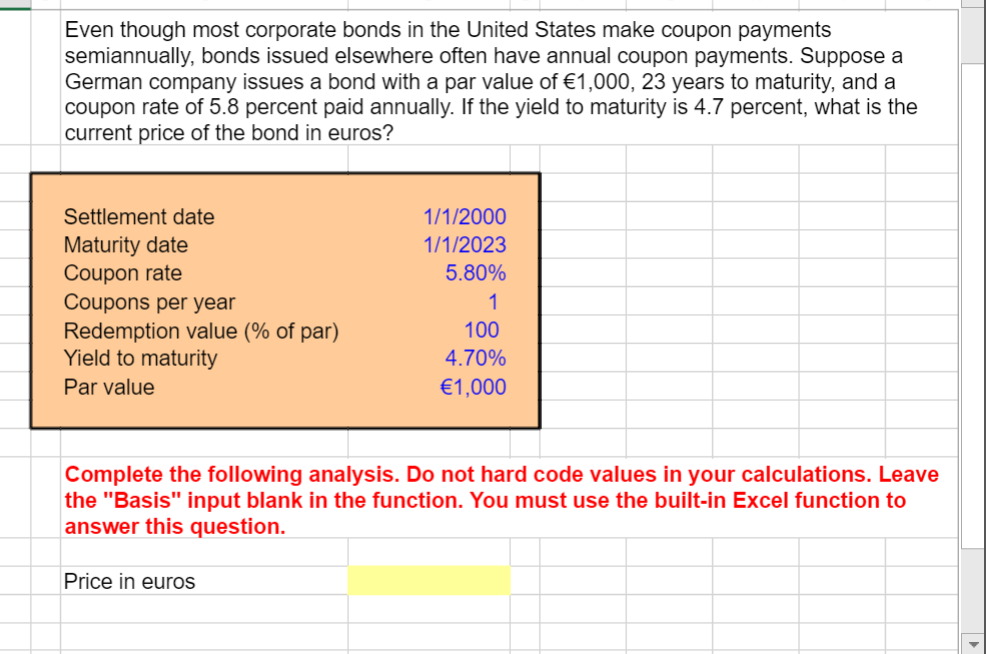

A Japanese company has a bond outstanding that sells for 91.53 percent of its 100,000 par value. The bond has a coupon rate of 3.4 percent paid annually and matures in 16 years. What is the yield to maturity of this bond? Settlement date 1/1/2000 Maturity date 1/1/2016 Annual coupon rate 3.4% Coupons per year Face value (% of par) Bond price (% of par) Face value 1 100 91.530 \ 100,000 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. Yield to maturity Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of 1,000, 23 years to maturity, and a coupon rate of 5.8 percent paid annually. If the yield to maturity is 4.7 percent, what is the current price of the bond in euros? Settlement date 1/1/2000 Maturity date 1/1/2023 Coupon rate 5.80% Coupons per year 1 Redemption value (% of par) 100 Yield to maturity Par value 4.70% 1,000 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. Price in euros

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Yield to maturity The yield to maturity of the Japanese bond can be calculated using the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started