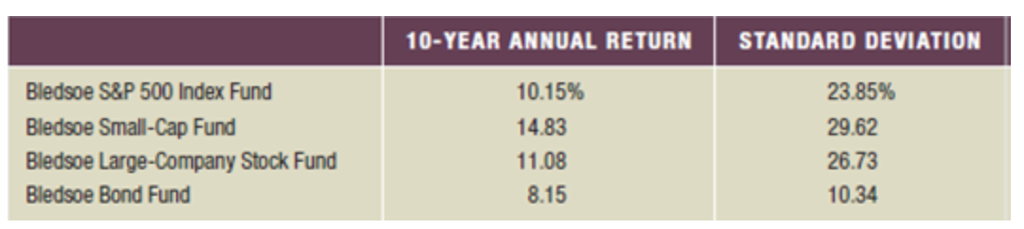

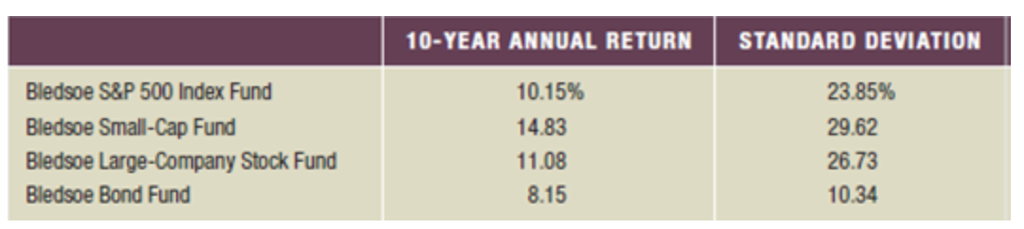

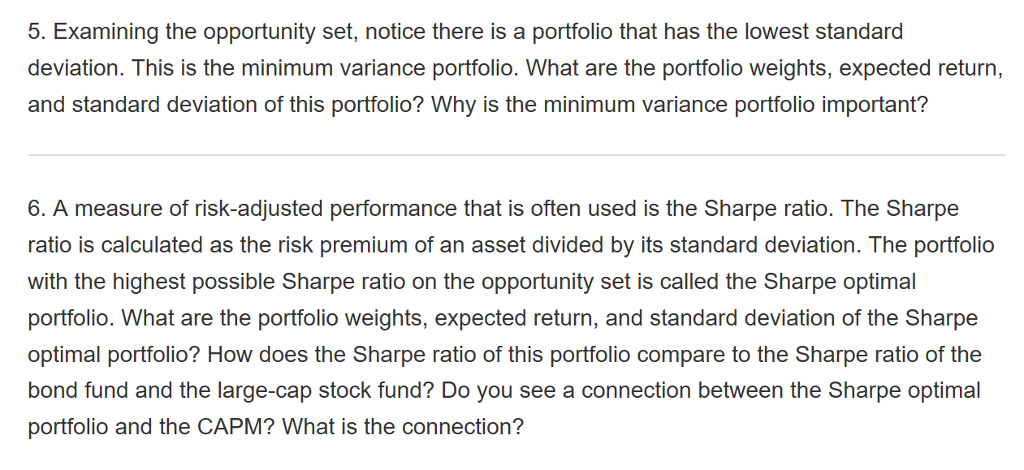

A JOB AT EAST COAST YACHTS, PART 2 You are discussing your 401 (k) with Dan Ervin when he mentions that Sarah Brown, a representative from Bledsoe Financial Services, is visiting E that you should meet with Sarah, so Dan sets up an appointment for you later in the day When you sit down with Sarah, she discusses the various investment options available in the company's 401(k) account. You mention to Sarah that you researched East Coast Yachts before you accepted your new job. You are confident in management's ability to lead the company Analysis of the company has led to your belief that the company is growing and will achieve a greater market share in the future. You also feel you should support your employer. Given these considerations, along with the fact that you are a conservative investor, you are leaning toward investing 100 percent of your 401(k) account in East Coast Yachts Assume the risk-free rate is the historical average risk-free rate (in Chapter 10). The correlation between the bond fund and the large-cap stock fund is.16. (Note: The spreadsheet graphing and "Solver" functions may assist you in answering the following questions.) 1. Considering the effects of diversification, how should Sarah respond to the suggestion that you invest 100 percent of your 401(k) account in East Coast Yachts stock? ast Coast Yachts today. You decide 2. After hearing Sarah's response to investing your 401(k) account entirely in East Coast Yachts stock, she has convinced you that this may not be the best alternative. Since you are a conservative investor, you tell Sarah that a 100 percent investment in the bond fund may be the best alternative. Is it? 3. Using the returns for the Bledsoe Large-Cap Stock Fund and the Bledsoe Bond Fund, graph the opportunity set of feasible portfolios. 4. After examining the opportunity set, you notice that you can invest in a portfolio consisting of the bond fund and the large-cap stock fund that will have exactly the same standard deviation as the bond fund. This portfolio will also have a greater expected return. What are the portfolio weights and expected return of this portfolio? A JOB AT EAST COAST YACHTS, PART 2 You are discussing your 401 (k) with Dan Ervin when he mentions that Sarah Brown, a representative from Bledsoe Financial Services, is visiting E that you should meet with Sarah, so Dan sets up an appointment for you later in the day When you sit down with Sarah, she discusses the various investment options available in the company's 401(k) account. You mention to Sarah that you researched East Coast Yachts before you accepted your new job. You are confident in management's ability to lead the company Analysis of the company has led to your belief that the company is growing and will achieve a greater market share in the future. You also feel you should support your employer. Given these considerations, along with the fact that you are a conservative investor, you are leaning toward investing 100 percent of your 401(k) account in East Coast Yachts Assume the risk-free rate is the historical average risk-free rate (in Chapter 10). The correlation between the bond fund and the large-cap stock fund is.16. (Note: The spreadsheet graphing and "Solver" functions may assist you in answering the following questions.) 1. Considering the effects of diversification, how should Sarah respond to the suggestion that you invest 100 percent of your 401(k) account in East Coast Yachts stock? ast Coast Yachts today. You decide 2. After hearing Sarah's response to investing your 401(k) account entirely in East Coast Yachts stock, she has convinced you that this may not be the best alternative. Since you are a conservative investor, you tell Sarah that a 100 percent investment in the bond fund may be the best alternative. Is it? 3. Using the returns for the Bledsoe Large-Cap Stock Fund and the Bledsoe Bond Fund, graph the opportunity set of feasible portfolios. 4. After examining the opportunity set, you notice that you can invest in a portfolio consisting of the bond fund and the large-cap stock fund that will have exactly the same standard deviation as the bond fund. This portfolio will also have a greater expected return. What are the portfolio weights and expected return of this portfolio