Question

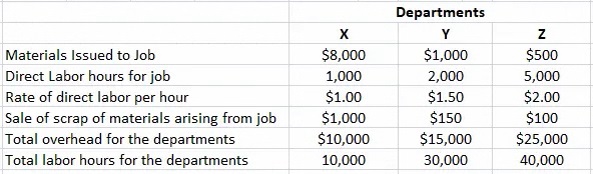

A job No. 58 passes through three departments namely X, Y and Z. The following information is given to you regarding this job. (please see

A job No. 58 passes through three departments namely X, Y and Z. The following information is given to you regarding this job. (please see attached image)

How much is the cost of Job No. 58?

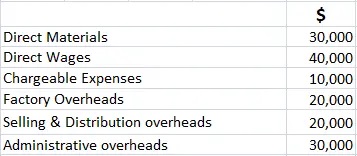

Problem 2. (Please see attached image)

The following expenses were incurred for a job during the year ended on 31st March 2019. (please see attached image)

Single price for the above job was $1,80,000. You are required to prepare the statement showing the profit earned during the year ended 31.3.2019 from the job and an estimated price of a job which is to be executed in the year 2019-20, charging the same percentage of profit on sales as it was during the year 2019-20. Materials, wages and chargeable expenses will be required of $50,000, $70,000 and $20,000 respectively for the job. The various overheads should be recovered on the following basis while calculating the estimated price:

(a). Factory overheads as a percentage of direct wages.

(b). Administrative and selling and distribution overheads as a percentage of factory cost.

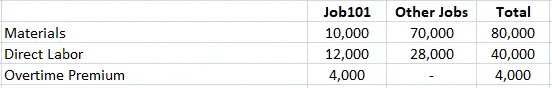

Problem 3. (Please see attached image)

M/s. Perfect Printers Ltd. operates a printing press. During November 2019, the plant was operating at full capacity. The material and labor costs of Job 101 and all other jobs worked on, in November, are shown in the image.

In addition to the foregoing costs, factory overhead incurred in November amounted to $44,000. Overhead is allocated to production on the basis of direct labor costs.

Required:

You are required to:

(i). Show what factory Profit or Loss on Job 101 would be, using two different methods of accounting for overtime premium. Assume that the contract price for this job is $40,000.

(ii). Indicate under what circumstances each method should be used.

(iii). State whether the profit or loss of the company during November would be affected by the choice of one method or another.

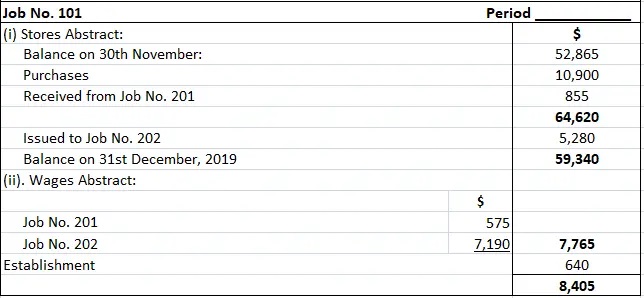

Problem 4. (Please see attached image)

The following particulars are drawn from the costing books of a contractor for the month of December, 2019.

The respective Job Accounts showed the following balance in Contract Ledger on 30th November 2019.

Job No. 201 = $3,21,580

Job No. 202 = $1,41,865

A certificate of completion was obtained for Job No. 201; of the balance of this account standing on 30th Nov. 2019, $61,500 was in respect of plant and machinery, the remainder consisting of wages and materials. A machine costing $5,500 specially brought for this contract, was sold during December, 2019 for $2,000. Of the remainder of the balance on plant and machinery $40,000 worth had been utilized on the Job for eight months and the rest for six months. Of the former, half was transferred to Job No. 202 and the whole of the remaining plant was returned to stores. The contract price for Job No. 201 was fixed at $3,75,000.

Prepare Contract Accounts for the two Jobs and state the profit made on Job certified as completed, allowing depreciation on machinery at 15 percent per annum. Assume 10 percent for establishment charges on the cost of wages and materials consumed.

Departments X Y Z Materials Issued to Job $8,000 $1,000 $500 Direct Labor hours for job 1,000 2,000 5,000 Rate of direct labor per hour $1.00 $1.50 $2.00 Sale of scrap of materials arising from job $1,000 $150 $100 Total overhead for the departments $10,000 $15,000 $25,000 Total labor hours for the departments 10,000 30,000 40,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started