Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Johnson plans to use the preceding ratios as the starting point for discussions with RR's operating team. Based on the data, does RR seem

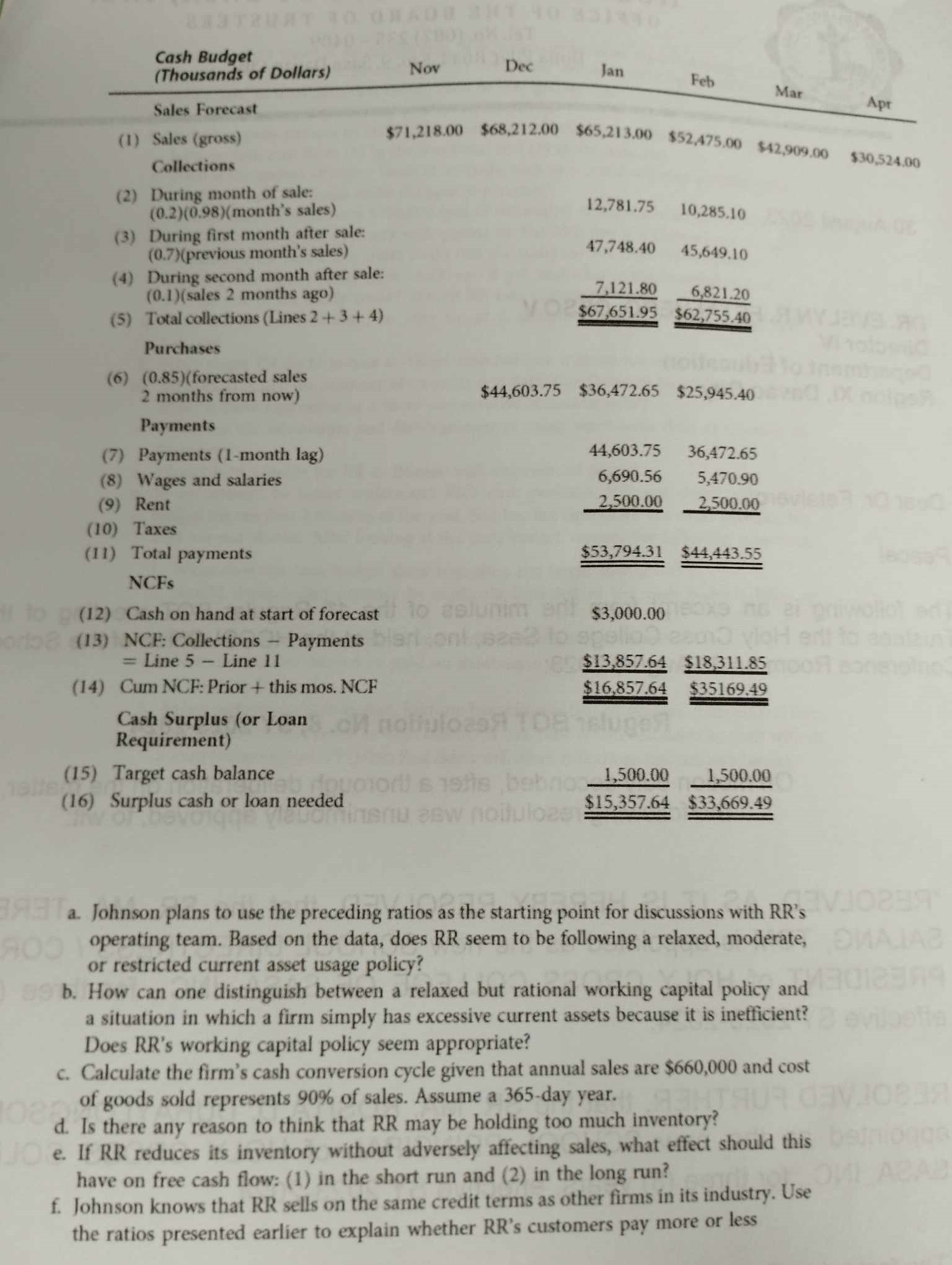

a. Johnson plans to use the preceding ratios as the starting point for discussions with RR's operating team. Based on the data, does RR seem to be following a relaxed, moderate, or restricted current asset usage policy? b. How can one distinguish between a relaxed but rational working capital policy and a situation in which a firm simply has excessive current assets because it is inefficient? Does RR's working capital policy seem appropriate? c. Calculate the firm's cash conversion cycle given that annual sales are $660,000 and cost of goods sold represents 90% of sales. Assume a 365-day year. d. Is there any reason to think that RR may be holding too much inventory? e. If RR reduces its inventory without adversely affecting sales, what effect should this have on free cash flow: (1) in the short run and (2) in the long run? f. Johnson knows that RR sells on the same credit terms as other firms in its industry. Use the ratios presented earlier to explain whether RR's customers pay more or less a. Johnson plans to use the preceding ratios as the starting point for discussions with RR's operating team. Based on the data, does RR seem to be following a relaxed, moderate, or restricted current asset usage policy? b. How can one distinguish between a relaxed but rational working capital policy and a situation in which a firm simply has excessive current assets because it is inefficient? Does RR's working capital policy seem appropriate? c. Calculate the firm's cash conversion cycle given that annual sales are $660,000 and cost of goods sold represents 90% of sales. Assume a 365-day year. d. Is there any reason to think that RR may be holding too much inventory? e. If RR reduces its inventory without adversely affecting sales, what effect should this have on free cash flow: (1) in the short run and (2) in the long run? f. Johnson knows that RR sells on the same credit terms as other firms in its industry. Use the ratios presented earlier to explain whether RR's customers pay more or less

a. Johnson plans to use the preceding ratios as the starting point for discussions with RR's operating team. Based on the data, does RR seem to be following a relaxed, moderate, or restricted current asset usage policy? b. How can one distinguish between a relaxed but rational working capital policy and a situation in which a firm simply has excessive current assets because it is inefficient? Does RR's working capital policy seem appropriate? c. Calculate the firm's cash conversion cycle given that annual sales are $660,000 and cost of goods sold represents 90% of sales. Assume a 365-day year. d. Is there any reason to think that RR may be holding too much inventory? e. If RR reduces its inventory without adversely affecting sales, what effect should this have on free cash flow: (1) in the short run and (2) in the long run? f. Johnson knows that RR sells on the same credit terms as other firms in its industry. Use the ratios presented earlier to explain whether RR's customers pay more or less a. Johnson plans to use the preceding ratios as the starting point for discussions with RR's operating team. Based on the data, does RR seem to be following a relaxed, moderate, or restricted current asset usage policy? b. How can one distinguish between a relaxed but rational working capital policy and a situation in which a firm simply has excessive current assets because it is inefficient? Does RR's working capital policy seem appropriate? c. Calculate the firm's cash conversion cycle given that annual sales are $660,000 and cost of goods sold represents 90% of sales. Assume a 365-day year. d. Is there any reason to think that RR may be holding too much inventory? e. If RR reduces its inventory without adversely affecting sales, what effect should this have on free cash flow: (1) in the short run and (2) in the long run? f. Johnson knows that RR sells on the same credit terms as other firms in its industry. Use the ratios presented earlier to explain whether RR's customers pay more or less Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started