Answered step by step

Verified Expert Solution

Question

1 Approved Answer

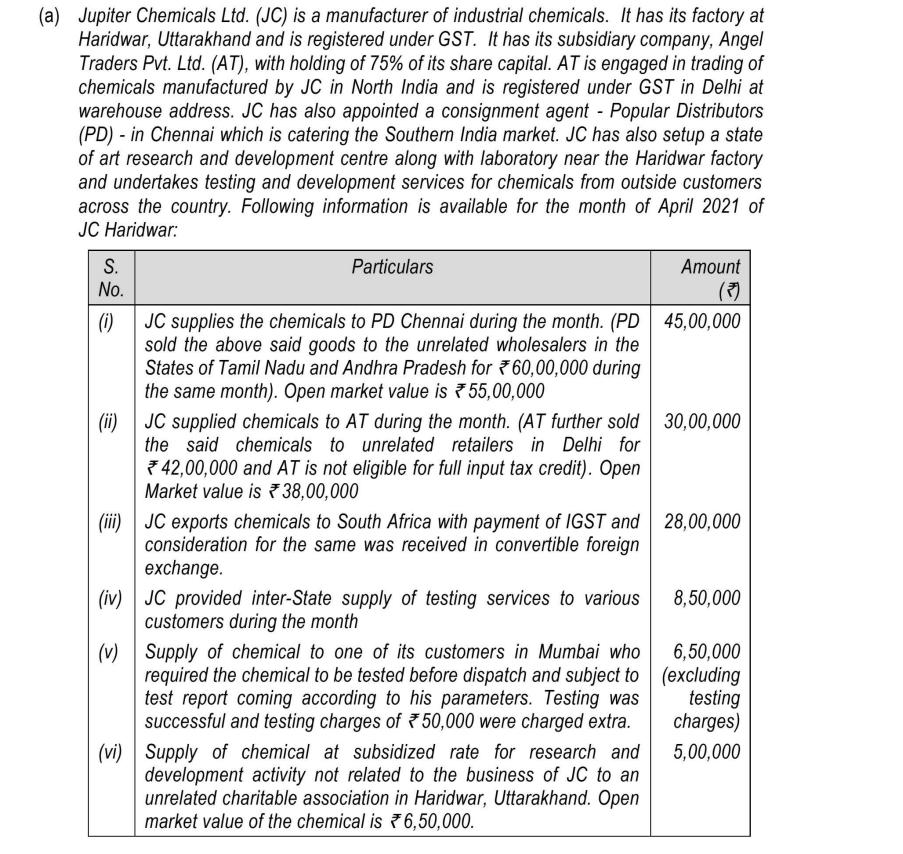

(a) Jupiter Chemicals Ltd. (JC) is a manufacturer of industrial chemicals. It has its factory at Haridwar, Uttarakhand and is registered under GST. It

(a) Jupiter Chemicals Ltd. (JC) is a manufacturer of industrial chemicals. It has its factory at Haridwar, Uttarakhand and is registered under GST. It has its subsidiary company, Angel Traders Pvt. Ltd. (AT), with holding of 75% of its share capital. AT is engaged in trading of chemicals manufactured by JC in North India and is registered under GST in Delhi at warehouse address. JC has also appointed a consignment agent - Popular Distributors (PD) - in Chennai which is catering the Southern India market. JC has also setup a state of art research and development centre along with laboratory near the Haridwar factory and undertakes testing and development services for chemicals from outside customers across the country. Following information is available for the month of April 2021 of JC Haridwar: S. No. (i) Particulars JC supplies the chemicals to PD Chennai during the month. (PD 45,00,000 sold the above said goods to the unrelated wholesalers in the States of Tamil Nadu and Andhra Pradesh for 60,00,000 during the same month). Open market value is 55,00,000 (ii) JC supplied chemicals to AT during the month. (AT further sold 30,00,000 the said chemicals to unrelated retailers in Delhi for 42,00,000 and AT is not eligible for full input tax credit). Open Market value is 38,00,000 Amount (iii) JC exports chemicals to South Africa with payment of IGST and 28,00,000 consideration for the same was received in convertible foreign exchange. (iv) JC provided inter-State supply of testing services to various customers during the month (v) Supply of chemical to one of its customers in Mumbai who required the chemical to be tested before dispatch and subject to test report coming according to his parameters. Testing was successful and testing charges of 50,000 were charged extra. (vi) Supply of chemical at subsidized rate for research and development activity not related to the business of JC to an unrelated charitable association in Haridwar, Uttarakhand. Open market value of the chemical is 6,50,000. 8,50,000 6,50,000 (excluding testing charges) 5,00,000 Assume that the rates of GST on chemicals are IGST-12%, CGST-6% and SGST-6%, and on testing and development services are IGST-18% and SGST-9%. You are required to determine the taxable value (most beneficial) and GST liability (IGST, CGST and SGST separately) of Jupiter Chemicals (JC) Haridwar for the month of April 2021. (9 Marks) (b) PPR Engineering, a manufacturer of tools and spares of Punjab, imports a CNC machine from USA. Contracted CIF price for import was US $ 15,500. Due to fluctuation of price of machine in international market, price of the machine was re-negotiated after placing the order and finally the machine was agreed to be imported at US$ 14,000 CIF. Actual freight paid was US $3,000 and insurance cost was US $ 1,800. Other information is given below: (i) Cost of inspection carried out by foreign supplier on his own account was US $ 300, and the same was neither required under the terms of contract nor for making the goods ready for shipment. Commission payable to local agent of the exporter was US $184. (It is not a buying commission). (ii) (iii) Date of bill of entry presentation is 25th February, 2021. On this date, rate of BCD is 10%, rate of exchange notified by CBIC for 1 US $ is 73, RBI rate is 71. (iv) Date of arrival of aircraft at customs station is 5th March, 2021. On this date, rate of BCD is 15%, rate of exchange notified by CBIC for 1 US $ is 74, RBI rate is 72. You are required to compute the assessable value and calculate payable by PPR Engineering. basic customs duty (5 Marks)

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started