Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Kriss Berhad has just issued a convertible bond with a coupon rate of 8% semi-annual coupon payments. The bond is selling for RM993. It

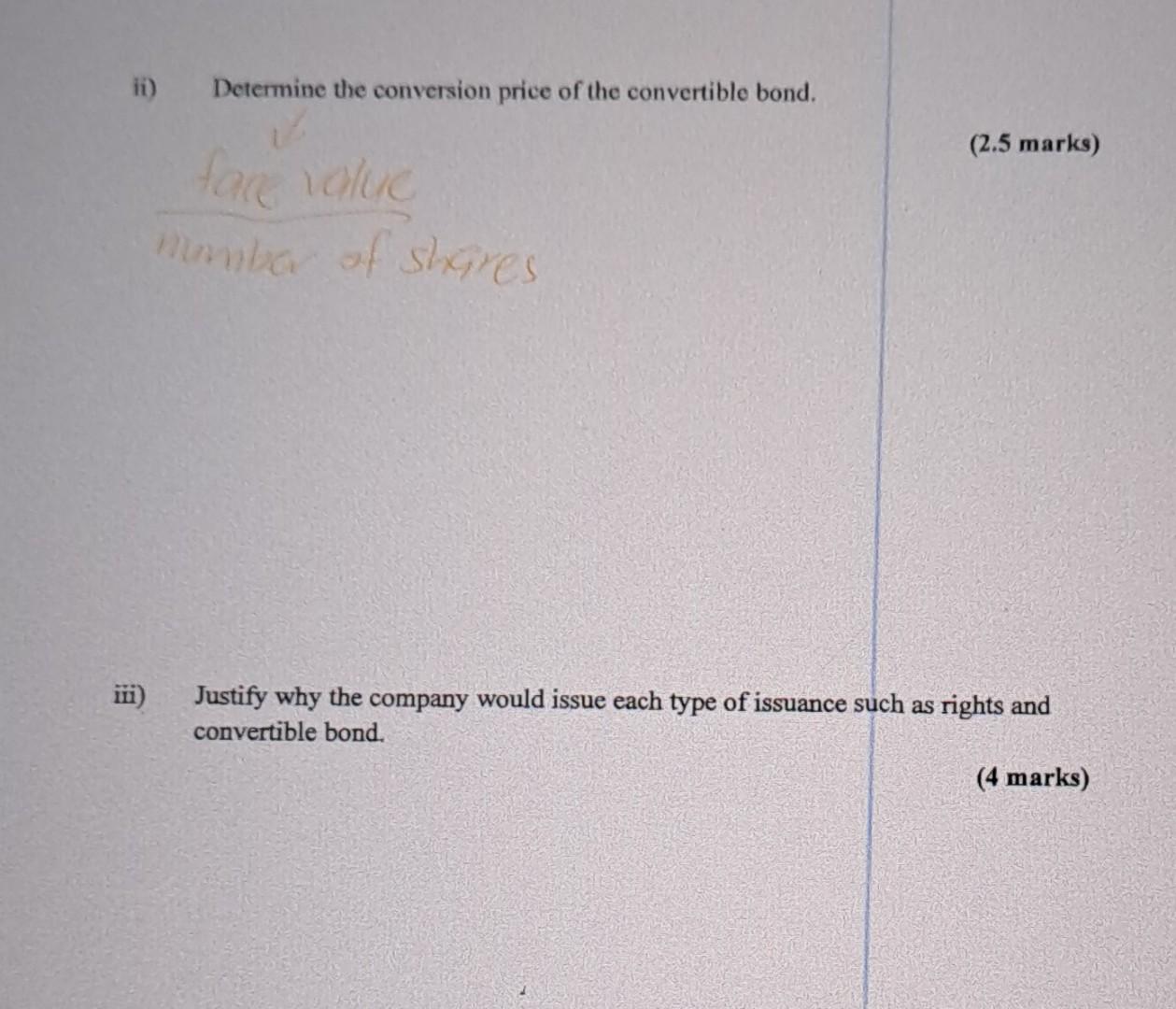

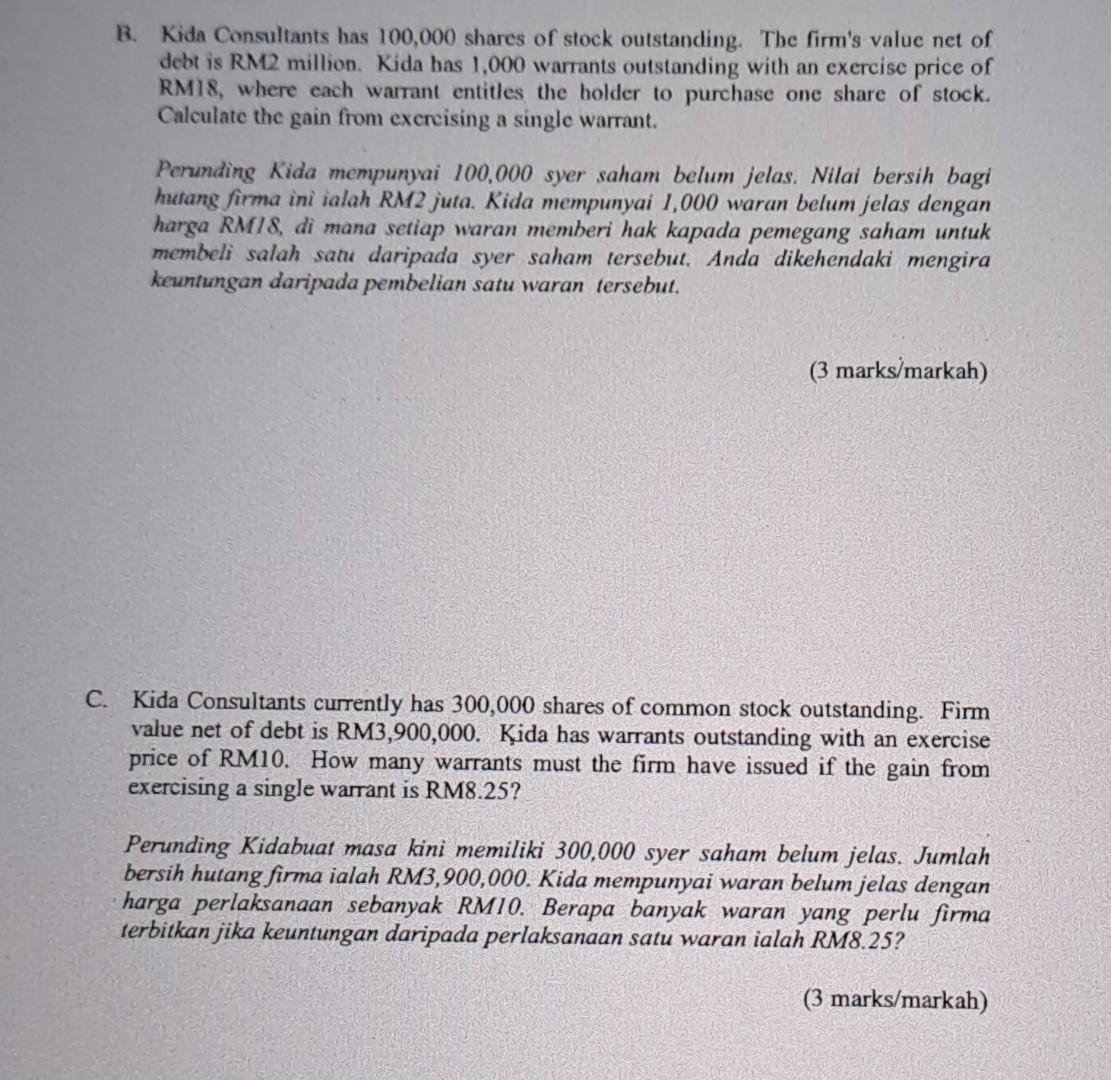

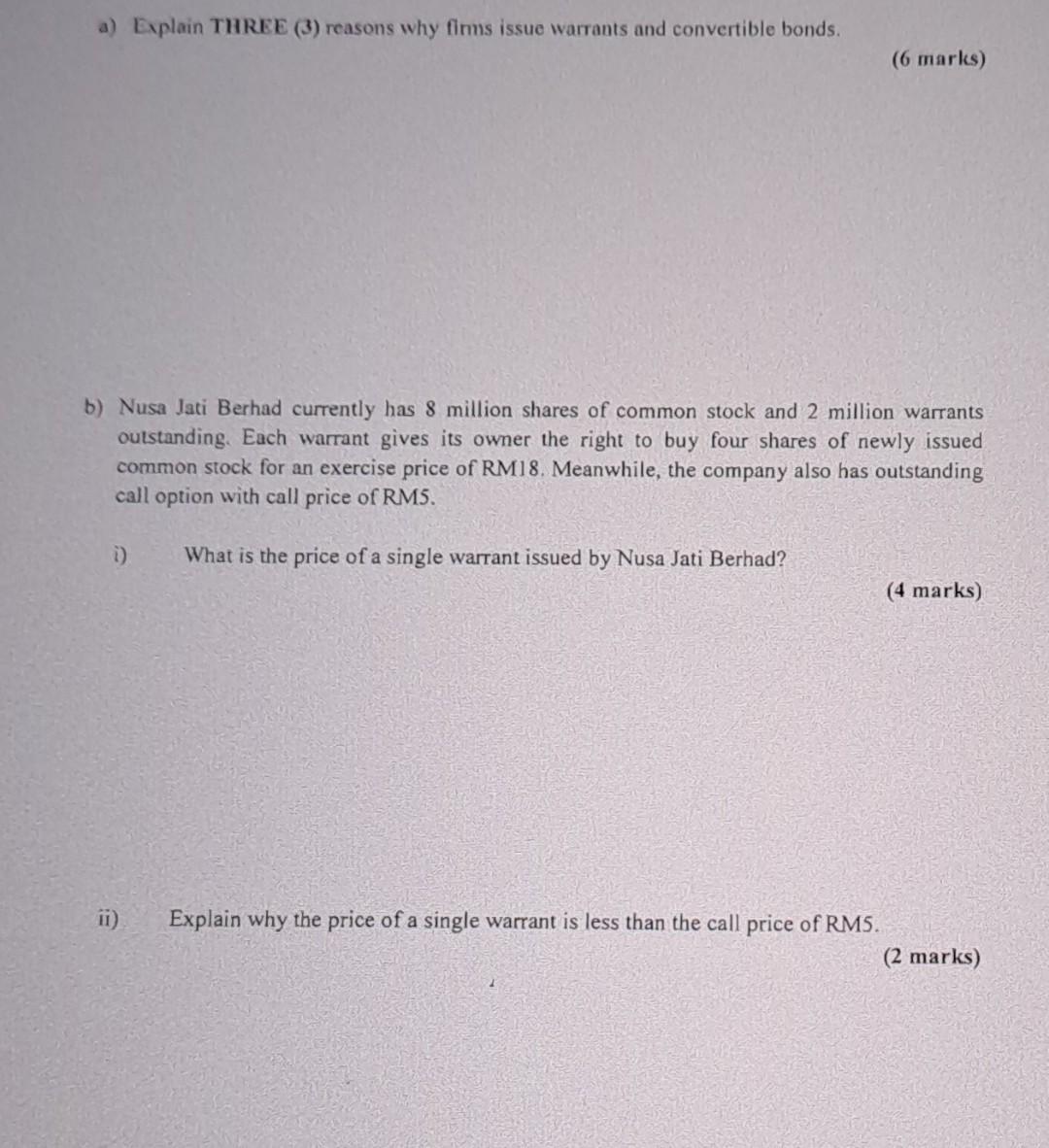

A. Kriss Berhad has just issued a convertible bond with a coupon rate of 8% semi-annual coupon payments. The bond is selling for RM993. It has 15 years to maturity and a RMI,000 face value. The required return on an otherwise identical non-convertible bond is 8.5%. The conversion ratio is 20 . The stock currently sells for RM47.50 per share. Calculate the convertible bond's option value. (6 marks) B. Why do firms issue warrants and convertibles? (4 marks) C. Petro Ranger Bhd. is considering a project that will cost RM50 million and have a yearend after-tax cost savings of RM7 million in perpetuity. The company's before tax cost of debt is 10% and its cost of equity is 16%. The project has risk similar to that of the operation of the firm, and the target debt-equity ratio is 1.5 . What is the NPV for the project if the tax rate is 34% ? (4 marks) A. Oggy's has 15,000 shares of stock outstanding with a par value of RM1.00 per share and a market price of RM36 a share. The balance sheet shows RM15,000 in the common stock account, RM315,000 in the capital in excess of par account, and RM189,000 in the retained earnings account. The firm just announced a 3 -for- 2 stock split. How many shares of stock will be outstanding after the split? (2 marks) B. Briefly explain TWO (2) differences between Warrants and Call Options. (4 marks) A. A firm has 2,000 shares of stock and 200 warrants outstanding. The warrants are about to expire, and all of them will be exercised. The market value of the firm's assets is RM14,000, and the firm has no debt. Each warrant gives the owner the right to buy 1 share at RM5. What is the warrant's effective exercise price? Sebuah firma mempunyai 2,000 syer saham dan 200 waran belum jelas. Waran tersebut akan tamat tempoh dan kesemua waran itu akan diniagakan. Nilai pasaran untuk aset firma ialah RM14,000 dan firma tidak mempunyai hutang. Setiap waran akan memberikan peluang kepada pemilik syarikat untuk membeli I saham dengan harga RMS. Apakah harga terbaik bagi waran tersebut? D. Haikom announced on May 1,2009, that it will pay a dividend of RM5.00 per share on June 15 to all holders on record as of May 31st. The firm's stock price is currently at RM70 per share. Assume that all investors are in the 33\% tax bracket. Given that the ex-dividend date is May 29, what should happen to Haikom's stock price on May 29? (7 marks) a) Explain THREE (3) reasons why firms issue warrants and convertible bonds. (6 marks) b) Nusa Jati Berhad currently has 8 million shares of common stock and 2 million warrants outstanding. Each warrant gives its owner the right to buy four shares of newly issued common stock for an exercise price of RM18. Meanwhile, the company also has outstanding call option with call price of RM5. i) What is the price of a single warrant issued by Nusa Jati Berhad? (4 marks) ii) Explain why the price of a single warrant is less than the call price of RM5. (2 marks) B. Kida Consultants has 100,000 shares of stock outstanding. The firm's value net of debt is RM12 million. Kida has 1,000 warrants outstanding with an exercise price of RM18, where each warrant entitles the holder to purchase one share of stock. Calculate the gain from exereising a single warrant. Perunding Kida mempunyai 100,000 syer saham belum jelas. Nilai bersih bagi hutang firma ini ialah RM2 juta. Kida mempunyai 1,000 waran belum jelas dengan harga RMI\&, di mana setiap waran memberi hak kapada pemegang saham untuk membeli salah sahu daripada syer saham tersebut. Anda dikehendaki mengira keuntungan daripada pembelian satu waran tersebut. (3 marksimarkah) C. Kida Consultants currently has 300,000 shares of common stock outstanding. Firm value net of debt is RM3,900,000. Kida has warrants outstanding with an exercise price of RM10. How many warrants must the firm have issued if the gain from exercising a single warrant is RM8.25? Perunding Kidabuat masa kini memiliki 300,000 syer saham belum jelas. Jumlah bersih hutang firma ialah RM3,900,000. Kida mempunyai waran belum jelas dengan harga perlaksanaan sebanyak RMIO. Berapa banyak waran yang perlu firma terbitkan jika keuntungan daripada perlaksanaan satu waran ialah RM8.25? ii) Determine the conversion price of the convertible bond. (2.5 marks) ii) Justify why the company would issue each type of issuance such as rights and convertible bond. A. Why are warrants and convertibles issued? Explain your answer (4 marks) B Blue Tiger currently has 300,000 shares of common outstanding. Firm value net of debt is RM3,900,000. Blue Tiger has warrants outstanding with an exercise price of RM10. How many warrants must the company have issued if the gain from exercising a single warrant is RM8.25? (4 marks) C. Rojax has 100 shares of stock and 40 warrants outstanding. The warrants are about to expire, and all of them will be exercised. The market value of the firm's assets is RM2,000, and the firm has no debt. Each warrant gives the owner the right to buy 2 shares at RM15 per share. Calculate the price per share of the stock. (5 marks) d) List FIVE (5) reasons why firms opt to lease rather than purchase an asset. (5 marks) Keilos Corporation, an all equity firm, has ten shares of stock outstanding. Yesterday, the firm's assets consisted of eight ounces of platinum, currently worth RM710 per ounce. Today, the company issues Ms. Chang a warrant for its fair value of RM710. The warrant gives Ms.Chang the night to buy a single share of the firm's stock for RM1,200 and can be exercised only on its expiration date one year from today. The firm uses the proceeds from the issuance to immediately purchase an additional ounce of platinum. 1. What was the pnce of a single share of stock before the warrant was issued? (5 marks) What was the price of a single share of stock immediately after the warrant was issued

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started