Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A labor market consists of 20 workers that get disutility from dirty jobs. These workers can choose to work at one of two firms.

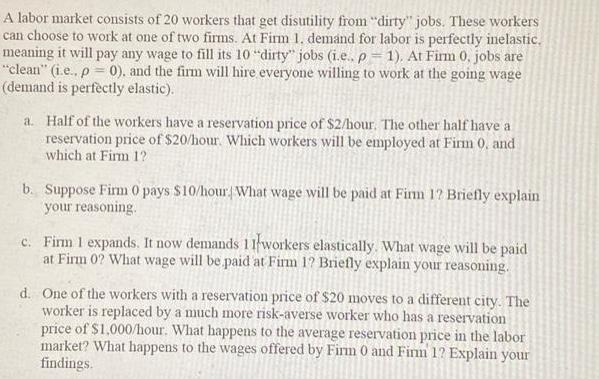

A labor market consists of 20 workers that get disutility from "dirty" jobs. These workers can choose to work at one of two firms. At Firm 1. demand for labor is perfectly inelastic. meaning it will pay any wage to fill its 10 "dirty" jobs (i.e.. p= 1). At Firm 0. jobs are "clean" (i.e.. p 0), and the firm will hire everyone willing to work at the going wage (demand is perfectly elastic). a. Half of the workers have a reservation price of $2/hour. The other half have a reservation price of $20/hour. Which workers will be employed at Firm 0. and which at Firm 1? b. Suppose Firm 0 pays $10/hour What wage will be paid at Firm 12 Briefly explain your reasoning. c. Firm 1 expands. It now demands 11 workers elastically. What wage will be paid at Firm 0? What wage will be paid at Firm 17 Briefly explain your reasoning. d. One of the workers with a reservation price of $20 moves to a different city. The worker is replaced by a much more risk-averse worker who has a reservation price of $1,000/hour. What happens to the average reservation price in the labor market? What happens to the wages offered by Firm 0 and Firm 1? Explain your findings.

Step by Step Solution

★★★★★

3.47 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

a ANSWER The workers with the reservation price of 2hour will be employed at Firm 0 and the workers ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started