Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In a perfect market, CYZ Corporation currently has no debt in its capital structure. The firm's assets are $8,000. There are 400 shares of

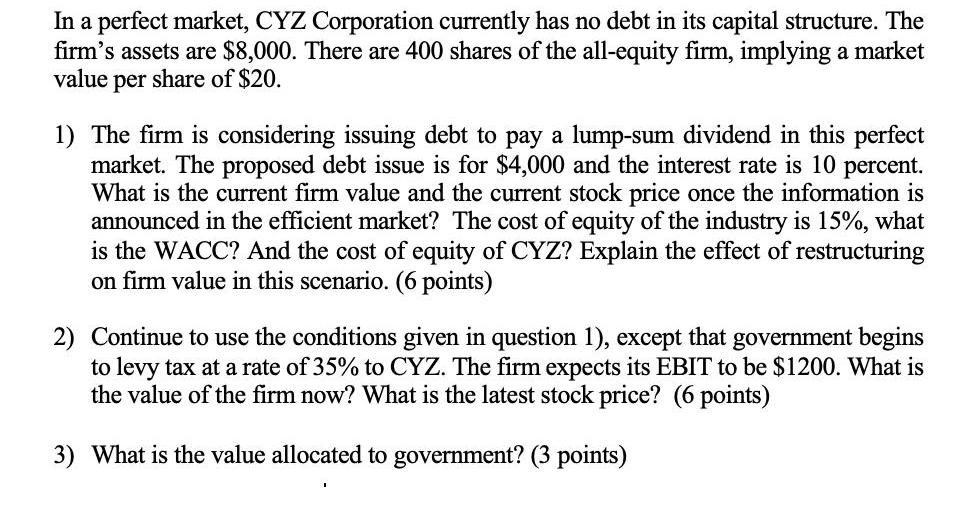

In a perfect market, CYZ Corporation currently has no debt in its capital structure. The firm's assets are $8,000. There are 400 shares of the all-equity firm, implying a market value per share of $20. 1) The firm is considering issuing debt to pay a lump-sum dividend in this perfect market. The proposed debt issue is for $4,000 and the interest rate is 10 percent. What is the current firm value and the current stock price once the information is announced in the efficient market? The cost of equity of the industry is 15%, what is the WACC? And the cost of equity of CYZ? Explain the effect of restructuring on firm value in this scenario. (6 points) 2) Continue to use the conditions given in question 1), except that government begins to levy tax at a rate of 35% to CYZ. The firm expects its EBIT to be $1200. What is the value of the firm now? What is the latest stock price? (6 points) What is the value allocated to government? (3 points)

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 2 of Ke of Industry Current fum value Kd re 10 WACC Ke of CY...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started