Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A large percentage of the firm's value is often found in the terminal value. The terminal value, in turn, is influenced by The perpetuity

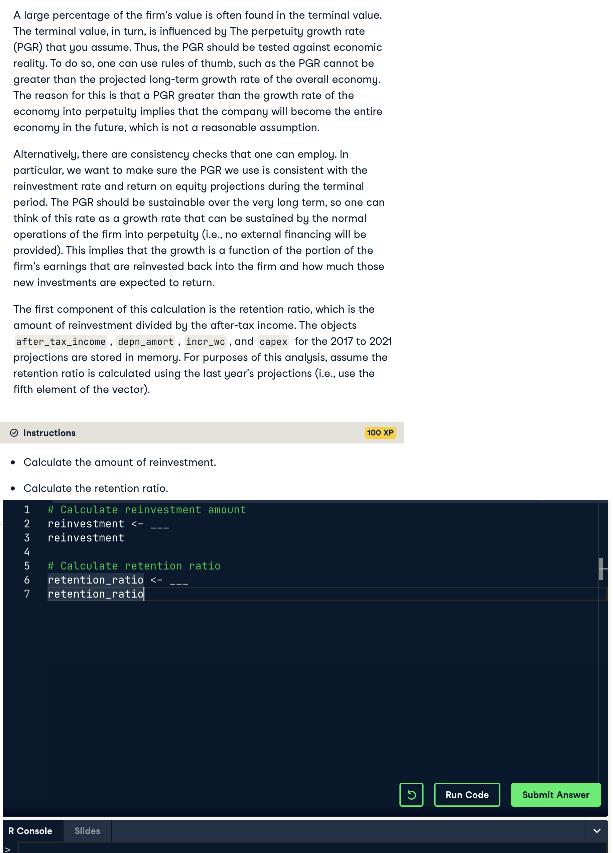

A large percentage of the firm's value is often found in the terminal value. The terminal value, in turn, is influenced by The perpetuity growth rate (PGR) that you assume. Thus, the PGR should be tested against economic reality. To do so, one can use rules of thumb, such as the PGR cannot be greater than the projected long-term growth rate of the overall economy. The reason for this is that a PGR greater than the growth rate of the economy into perpetuity implies that the company will become the entire economy in the future, which is not a reasonable assumption. Alternatively, there are consistency checks that one can employ. In particular, we want to make sure the PGR we use is consistent with the reinvestment rate and return on equity projections during the terminal period. The PGR should be sustainable over the very long term, so one can think of this rate as a growth rate that can be sustained by the normal operations of the firm into perpetuity (i.e., no external financing will be provided). This implies that the growth is a function of the portion of the firm's earnings that are reinvested back into the firm and how much those new investments are expected to return. The first component of this calculation is the retention ratio, which is the amount of reinvestment divided by the after-tax income. The objects after_tax_income, depn_amort, incr_wc, and capex for the 2017 to 2021 projections are stored in memory. For purposes of this analysis, assume the retention ratio is calculated using the last year's projections (i.e., use the fifth element of the vector). Instructions Calculate the amount of reinvestment. Calculate the retention ratio. 2 1 # Calculate reinvestment amount reinvestment

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Query SELECT useridDATEPARTweek logindate AS loginweek FROM login GROUP BY userid D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started