Question: A large profitable corporation bought a small jet plane for use by the firm's executives in January. The plane costs $1.5 million and, for depreciation

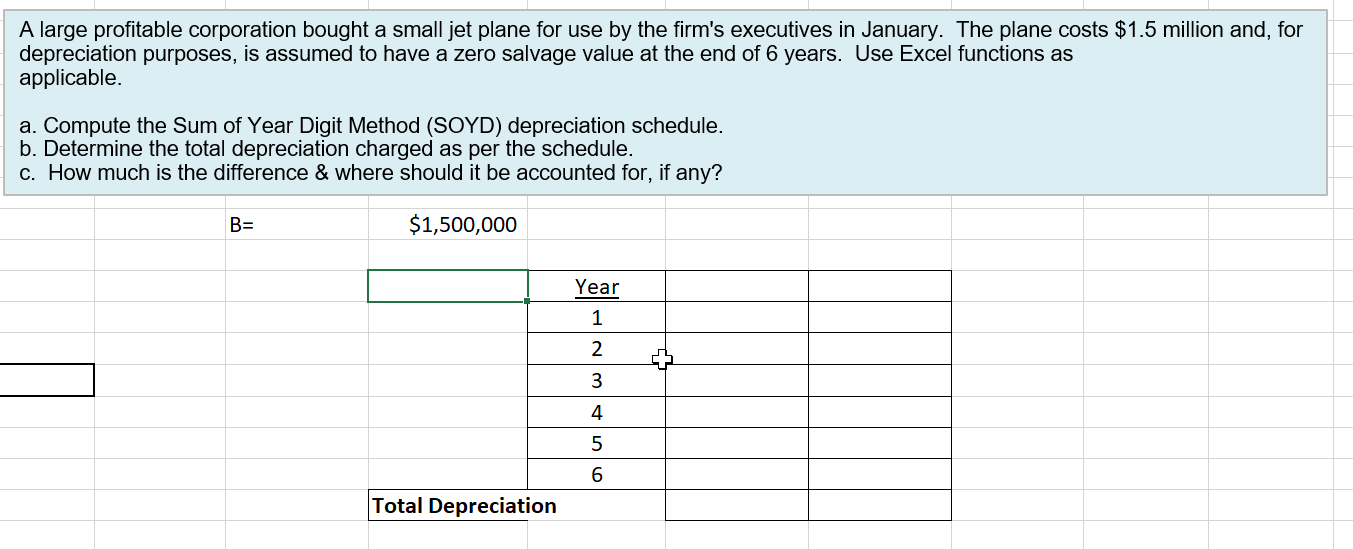

A large profitable corporation bought a small jet plane for use by the firm's executives in January. The plane costs $1.5 million and, for depreciation purposes, is assumed to have a zero salvage value at the end of 6 years. Use Excel functions as applicable. a. Compute the Sum of Year Digit Method (SOYD) depreciation schedule. b. Determine the total depreciation charged as per the schedule. c. How much is the difference & where should it be accounted for, if any? B= $1,500,000 Year 1 2 3 4 5 6 Total Depreciation A large profitable corporation bought a small jet plane for use by the firm's executives in January. The plane costs $1.5 million and, for depreciation purposes, is assumed to have a zero salvage value at the end of 6 years. Use Excel functions as applicable. a. Compute the Sum of Year Digit Method (SOYD) depreciation schedule. b. Determine the total depreciation charged as per the schedule. c. How much is the difference & where should it be accounted for, if any? B= $1,500,000 Year 1 2 3 4 5 6 Total Depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts