Answered step by step

Verified Expert Solution

Question

1 Approved Answer

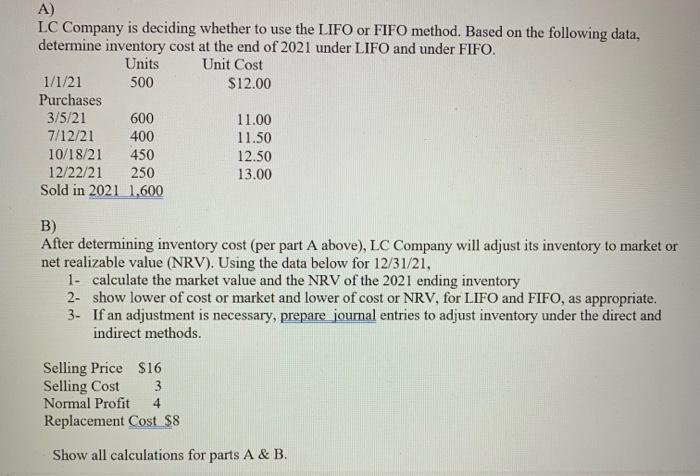

A) LC Company is deciding whether to use the LIFO or FIFO method. Based on the following data, determine inventory cost at the end

A) LC Company is deciding whether to use the LIFO or FIFO method. Based on the following data, determine inventory cost at the end of 2021 under LIFO and under FIFO. Units Unit Cost 500 1/1/21 Purchases 3/5/21 600 7/12/21 400 10/18/21 450 12/22/21 250 Sold in 2021 1,600 $12.00 11.00 11.50 12.50 13.00 B) After determining inventory cost (per part A above), LC Company will adjust its inventory to market or net realizable value (NRV). Using the data below for 12/31/21, 1- calculate the market value and the NRV of the 2021 ending inventory 2- show lower of cost or market and lower of cost or NRV, for LIFO and FIFO, as appropriate. 3- If an adjustment is necessary, prepare journal entries to adjust inventory under the direct and indirect methods. Selling Price $16 Selling Cost 3 Normal Profit 4 Replacement Cost $8 Show all calculations for parts A & B.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A Determine Inventory lost at end of 2021 Und...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started