Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A lessee company signed a lease for equipment from a lessor on January 1, Year 1. The lease requires equal rental payments of $40,870

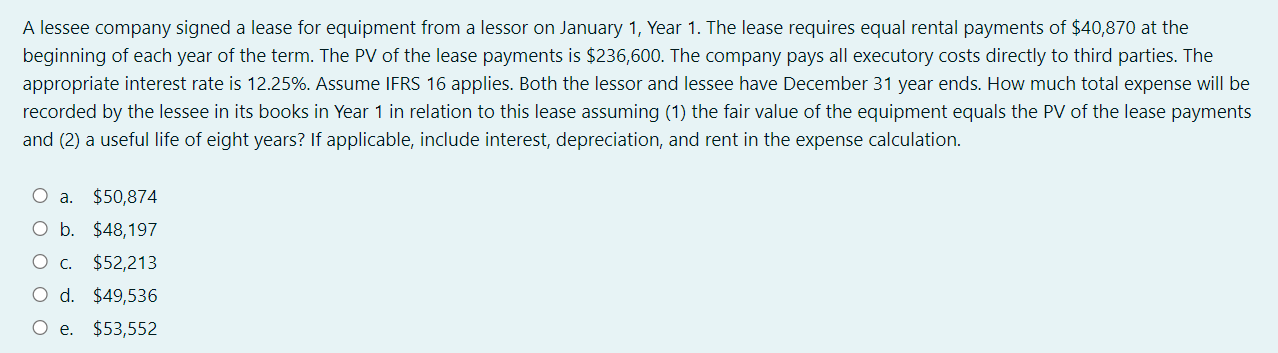

A lessee company signed a lease for equipment from a lessor on January 1, Year 1. The lease requires equal rental payments of $40,870 at the beginning of each year of the term. The PV of the lease payments is $236,600. The company pays all executory costs directly to third parties. The appropriate interest rate is 12.25%. Assume IFRS 16 applies. Both the lessor and lessee have December 31 year ends. How much total expense will be recorded by the lessee in its books in Year 1 in relation to this lease assuming (1) the fair value of the equipment equals the PV of the lease payments and (2) a useful life of eight years? If applicable, include interest, depreciation, and rent in the expense calculation. O a. $50,874 O b. $48,197 . $52,213 O d. $49,536 O e. $53,552

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answers Lease Liability on Jan1 Year 1 236600 Less Payment of Jan1 40870 Balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started