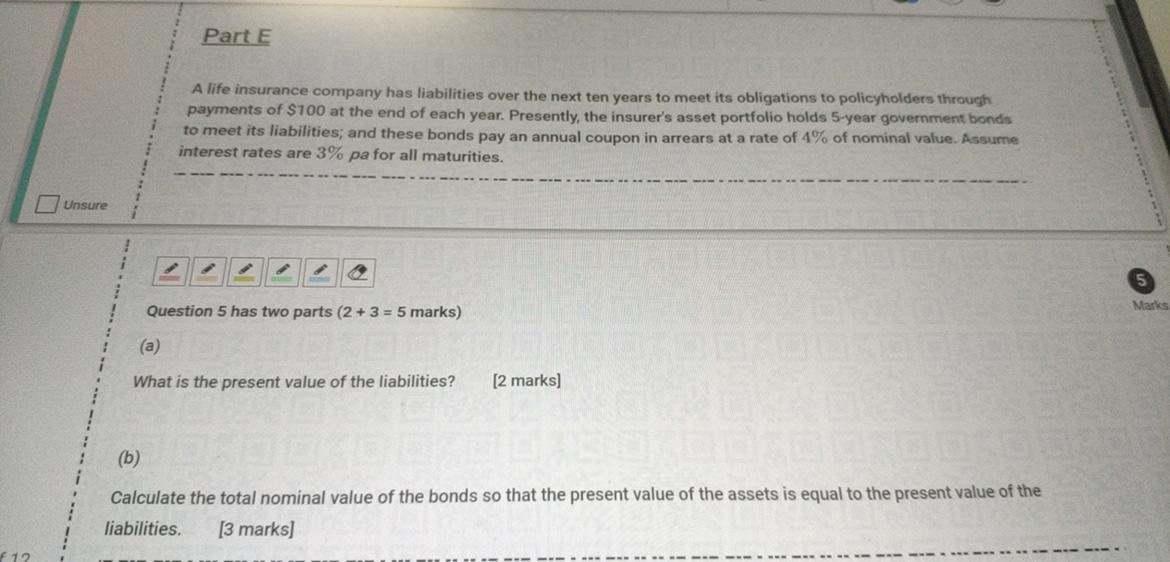

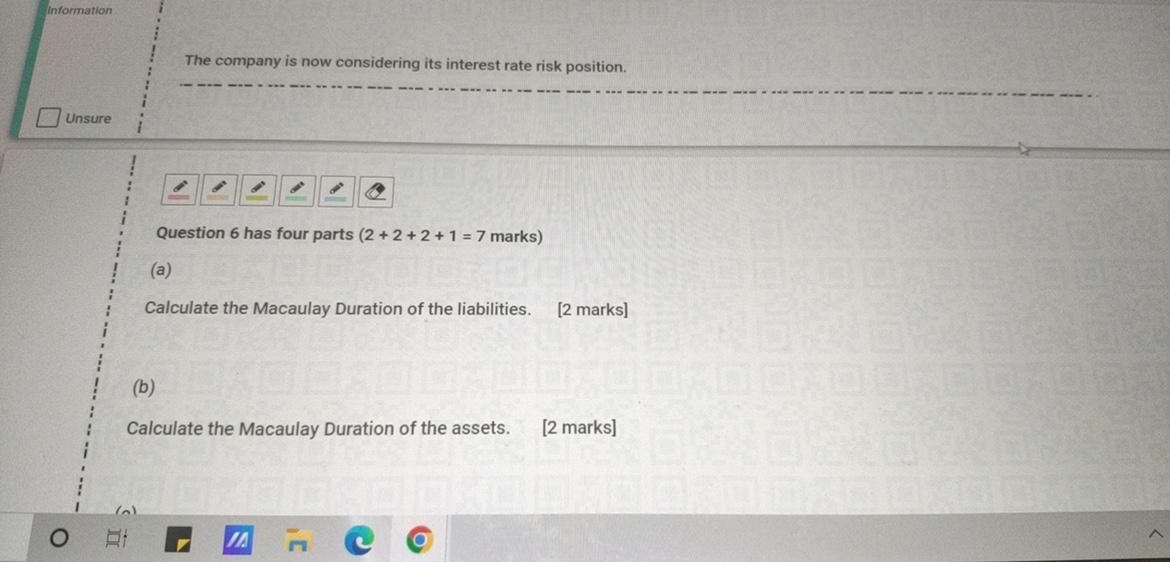

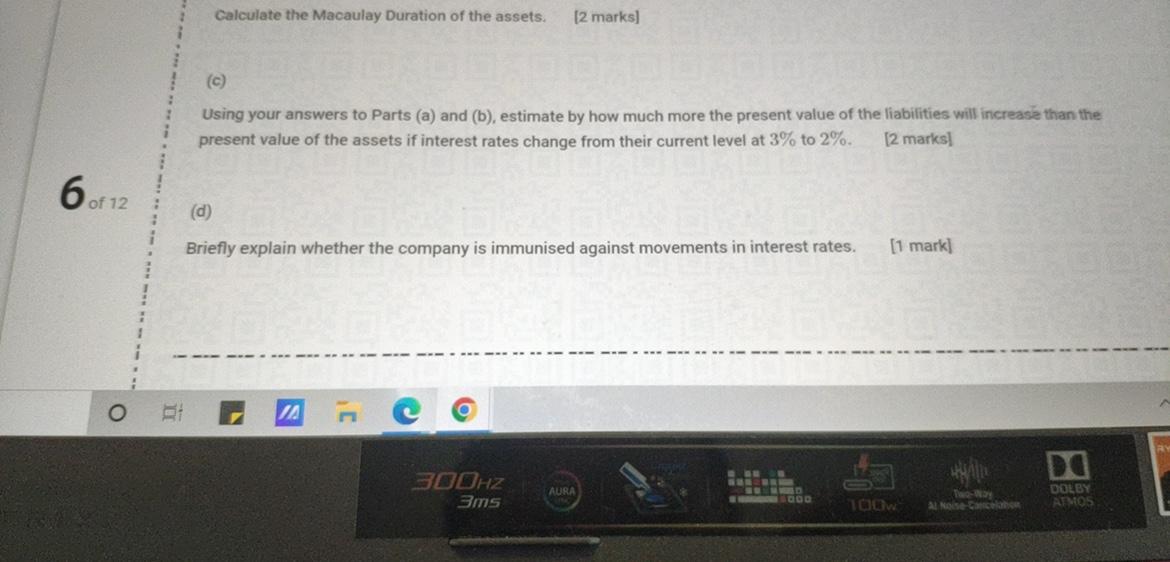

A life insurance company has liabilities over the next ten years to meet its obligations to policyholders through payments of $100 at the end of each year. Presently, the insurer's asset portfolio holds 5 -year government bondis to meet its liabilities; and these bonds pay an annual coupon in arrears at a rate of 4% of nominal value. interest rates are 3% pa for all maturities. Question 5 has two parts (2+3=5 marks) (a) What is the present value of the liabilities? [2 marks] (b) Calculate the total nominal value of the bonds so that the present value of the assets is equal to the present value of the liabilities. [3 marks] The company is now considering its interest rate risk position. Question 6 has four parts (2+2+2+1=7 marks ) (a) Calculate the Macaulay Duration of the liabilities. [2 marks] Using your answers to Parts (a) and (b), estimate by how much more the present value of the liabilities will increase than the present value of the assets if interest rates change from their current level at 3% to 2%. [2 marks] (d) Briefly explain whether the company is immunised against movements in interest rates. [1 mark] To better hedge interest rate risk, the company now wishes to add 20 -year zero coupon bonds to its asset portfolio, and will also re-evaluate the amount of nominal held in the 5-year bonds. Question 7 has two parts (4+2=6 marks) (a) Calculate the nominal amounts for the 5-year coupon bearing bonds and the 20-year zero-coupon bonds so that the asset and liability portfolios satisfies Redington's first two conditions of equal present value and equal duration at the current interest rate of 3% pa. [4 marks] (b) By testing Redington's third condition on the resulting portfolios from your answer to Question 7 (a), confirm that the surplus ortfolio (assets less liabilities) is immunised against small movements in interest rates. [2 marks] A life insurance company has liabilities over the next ten years to meet its obligations to policyholders through payments of $100 at the end of each year. Presently, the insurer's asset portfolio holds 5 -year government bondis to meet its liabilities; and these bonds pay an annual coupon in arrears at a rate of 4% of nominal value. interest rates are 3% pa for all maturities. Question 5 has two parts (2+3=5 marks) (a) What is the present value of the liabilities? [2 marks] (b) Calculate the total nominal value of the bonds so that the present value of the assets is equal to the present value of the liabilities. [3 marks] The company is now considering its interest rate risk position. Question 6 has four parts (2+2+2+1=7 marks ) (a) Calculate the Macaulay Duration of the liabilities. [2 marks] Using your answers to Parts (a) and (b), estimate by how much more the present value of the liabilities will increase than the present value of the assets if interest rates change from their current level at 3% to 2%. [2 marks] (d) Briefly explain whether the company is immunised against movements in interest rates. [1 mark] To better hedge interest rate risk, the company now wishes to add 20 -year zero coupon bonds to its asset portfolio, and will also re-evaluate the amount of nominal held in the 5-year bonds. Question 7 has two parts (4+2=6 marks) (a) Calculate the nominal amounts for the 5-year coupon bearing bonds and the 20-year zero-coupon bonds so that the asset and liability portfolios satisfies Redington's first two conditions of equal present value and equal duration at the current interest rate of 3% pa. [4 marks] (b) By testing Redington's third condition on the resulting portfolios from your answer to Question 7 (a), confirm that the surplus ortfolio (assets less liabilities) is immunised against small movements in interest rates. [2 marks]