Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A life insurance company is considering selling 25-year term with-profit endowment policies with an will vest at the end of each po icy year

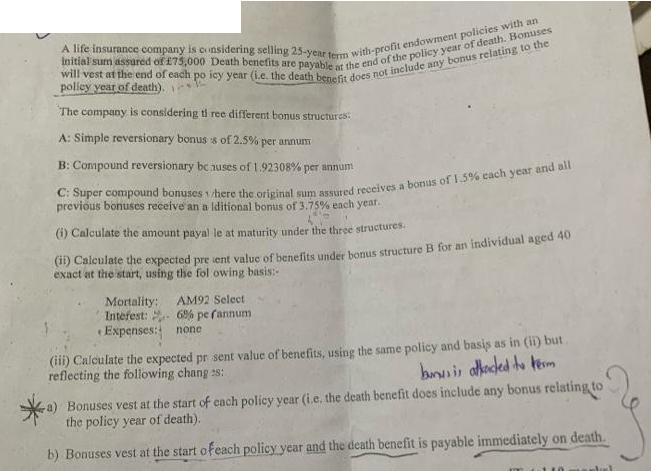

A life insurance company is considering selling 25-year term with-profit endowment policies with an will vest at the end of each po icy year (i.e. the death benefit does not include any bonus relating to the initial sum assured of 75,000 Death benefits are payable at the end of the policy year of death. Bonuses polley year of death). The company is considering ti ree different bonus structures: A: Simple reversionary bonus 8 of 2.5% per annum B: Compound reversionary be auses of 1.92308% per annum C: Super compound bonuses 1/here the original sum assured receives a bonus of 1.5% each year and all previous bonuses receive an a Iditional bonus of 3.75% each year.. (i) Calculate the amount payal le at maturity under the three structures. (ii) Calculate the expected present value of benefits under bonus structure B for an individual aged 40 exact at the start, using the fol owing basis:- Mortality: Intefest: AM92 Select 6% pe fannum Expenses: none (iii) Calculate the expected pr sent value of benefits, using the same policy and basis as in (ii) but reflecting the following changes: bunus is attached to term a) Bonuses vest at the start of each policy year (i.e. the death benefit does include any bonus relating to the policy year of death). b) Bonuses vest at the start ofeach policy year and the death benefit is payable immediately on death. 110 stoel

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

A 1 For bonus structure A the amount payable at maturity is 175000 x 1 2525 41857...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started