Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A life insurance company is issuing a single premium policy which will pay out 200,000 in 20 years' time. The interest rate the company

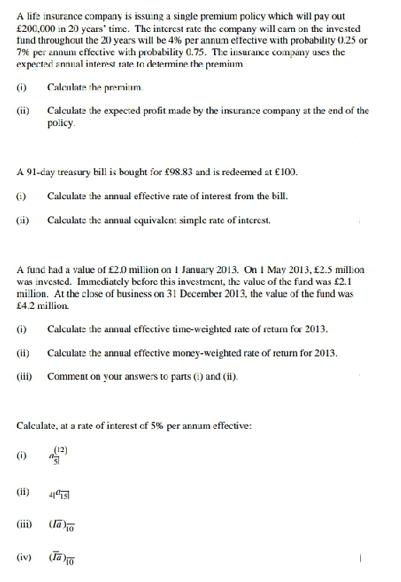

A life insurance company is issuing a single premium policy which will pay out 200,000 in 20 years' time. The interest rate the company will cam on the invested fund throughout the 20 years will be 4% per annum effective with probability 0.25 or 7% per annum effective with probability 0.75. The insurance company uses the expected annual interest rate to determine the premium (1) Calculate the premium Calculate the expected profit made by the insurance company at the end of the policy. A 91-day treasury bill is bought for 98.83 and is redeemed at 100. Calculate the annual effective rate of interest from the bill. Calculate the annual equivalen: simple rate of interest. (i) A fund had a value of 2.0 million on 1 January 2013. On 1 May 2013, 2.5 million was invested. Immediately before this investment, the value of the fund was 2.1 million. At the close of business on 31 December 2013, the value of the fund was 4.2 million Calculate the annual effective time-weighted rate of retam for 2013. (ii) Calculate the annual effective money-weighted rate of return for 2013. (iii) Comment on your answers to parts (1) and (ii). Calculate, at a rate of interest of 5% per annum effective: (12) (1) (ii) (iii) (iv) 4413 la) (Tayo

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations i Expected annual interest rate 025 4 075 7 6 To find the premi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started