Question

A life insurance company issues 20-year critical illness term assurance policies. The benefits, payable during the policy term, are a lump sum of 50,000

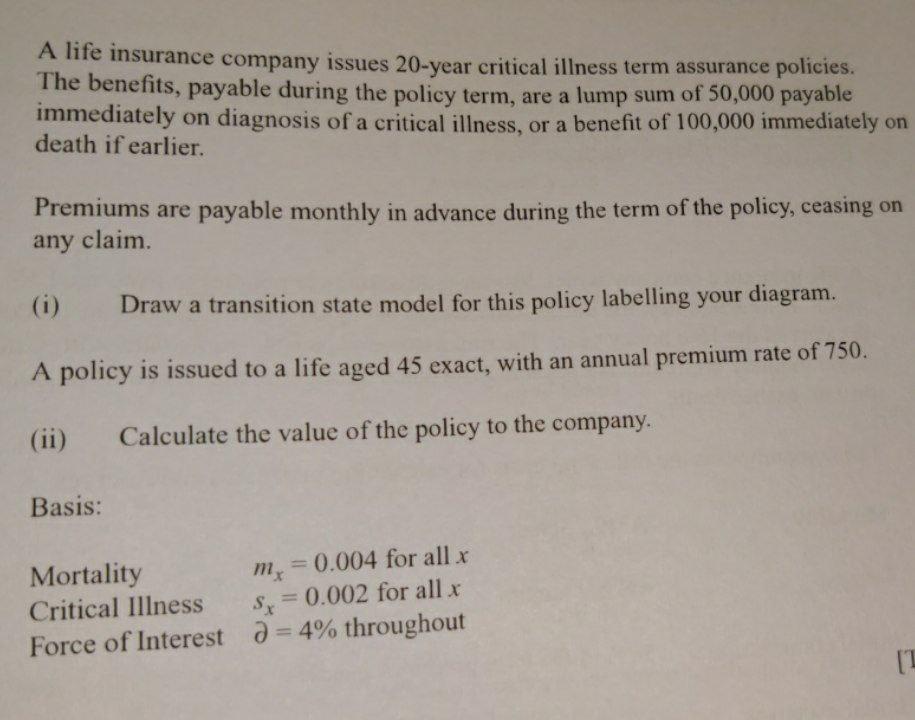

A life insurance company issues 20-year critical illness term assurance policies. The benefits, payable during the policy term, are a lump sum of 50,000 payable immediately on diagnosis of a critical illness, or a benefit of 100,000 immediately on death if earlier. Premiums are payable monthly in advance during the term of the policy, ceasing on any claim. (i) Draw a transition state model for this policy labelling your diagram. A policy is issued to a life aged 45 exact, with an annual premium rate of 750. (ii) Calculate the value of the policy to the company. Basis: Mortality Critical Illness Force of Interest m = 0.004 for all x S=0.002 for all x d=4% throughout (2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i ii Healthy H Hx ox 625x Dead D 10398519 10996174 2 mark plus 12 for not including the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Probability And Statistical Inference

Authors: Robert V. Hogg, Elliot Tanis, Dale Zimmerman

9th Edition

321923278, 978-0321923271

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App