Answered step by step

Verified Expert Solution

Question

1 Approved Answer

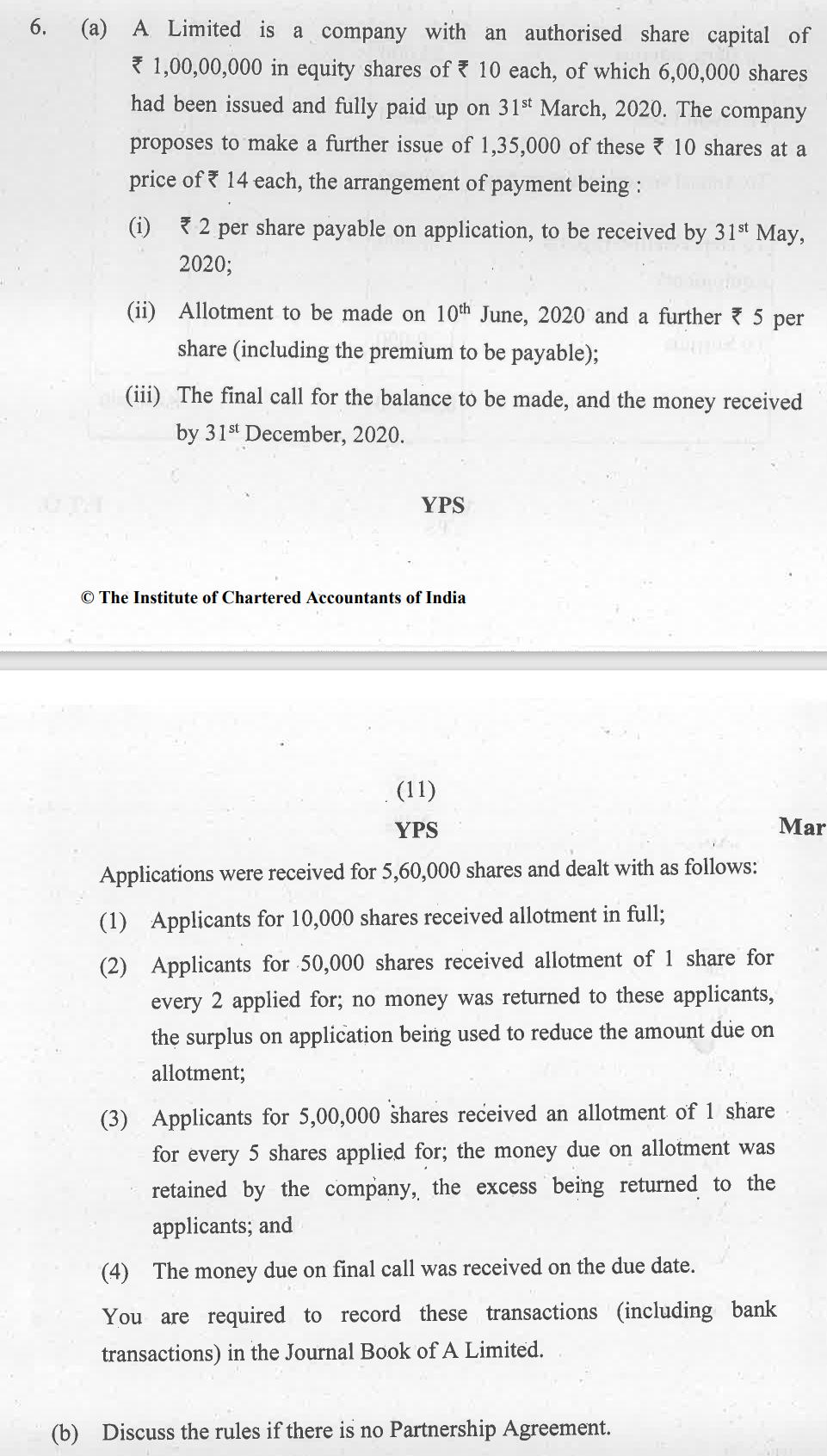

A Limited is a company with an authorised share capital of 1,00,00,000 in equity shares of 10 each, of which 6,00,000 shares had been

A Limited is a company with an authorised share capital of 1,00,00,000 in equity shares of 10 each, of which 6,00,000 shares had been issued and fully paid up on 31st March, 2020. The company proposes to make a further issue of 1,35,000 of these 10 shares at a price of 14 each, the arrangement of payment being : 2 per share payable on application, to be received by 31st May, 2020; (ii) Allotment to be made on 10th June, 2020 and a further 5 per share (including the premium to be payable); (iii) The final call for the balance to be made, and the money received by 31st December, 2020. YPS The Institute of Chartered Accountants of India (11) YPS Applications were received for 5,60,000 shares and dealt with as follows: (1) Applicants for 10,000 shares received allotment in full; (2) Applicants for 50,000 shares received allotment of 1 share for every 2 applied for; no money was returned to these applicants, the surplus on application being used to reduce the amount due on allotment; (3) Applicants for 5,00,000 shares received an allotment of 1 share for every 5 shares applied for; the money due on allotment was retained by the company, the excess being returned to the applicants; and (4) The money due on final call was received on the due date. You are required to record these transactions (including bank transactions) in the Journal Book of A Limited. (b) Discuss the rules if there is no Partnership Agreement. Mar

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started