Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A little help please. 1. Cash of $48,000 was received from donors, who stated that it could be used for any purpose desired by the

A little help please.

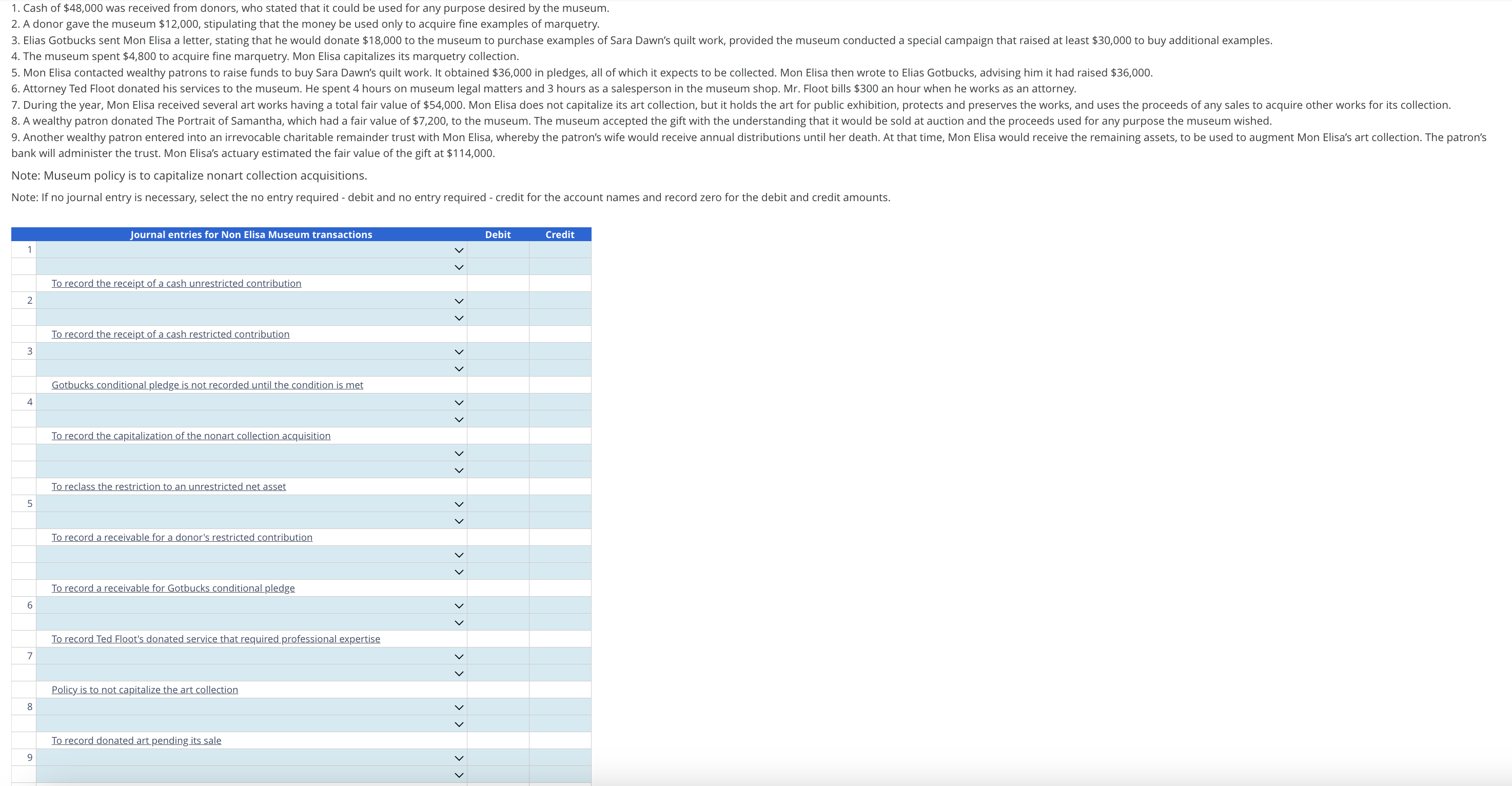

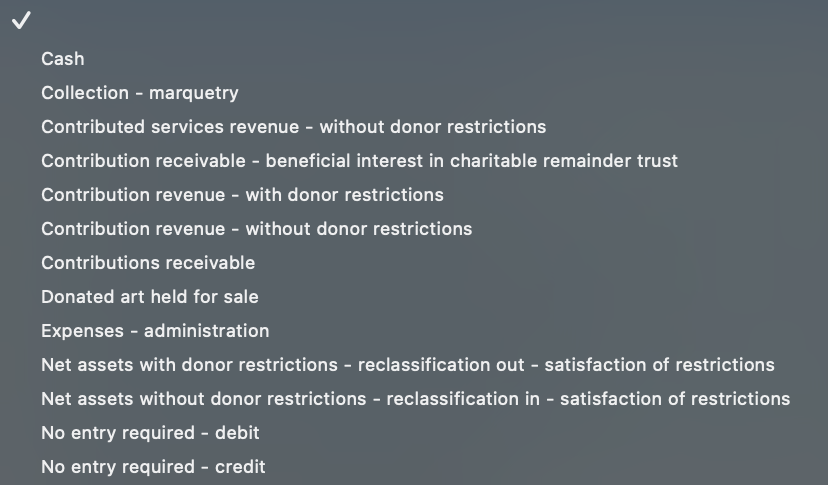

1. Cash of $48,000 was received from donors, who stated that it could be used for any purpose desired by the museum. 2. A donor gave the museum $12,000, stipulating that the money be used only to acquire fine examples of marquetry. 3. Elias Gotbucks sent Mon Elisa a letter, stating that he would donate $18,000 to the museum to purchase examples of Sara Dawn's quilt work, provided the museum conducted a special campaign that raised at least $30,000 to buy additional examples. 4. The museum spent $4,800 to acquire fine marquetry. Mon Elisa capitalizes its marquetry collection. 5. Mon Elisa contacted wealthy patrons to raise funds to buy Sara Dawn's quilt work. It obtained $36,000 in pledges, all of which it expects to be collected. Mon Elisa then wrote to Elias Gotbucks, advising him it had raised $36,000. 6. Attorney Ted Floot donated his services to the museum. He spent 4 hours on museum legal matters and 3 hours as a salesperson in the museum shop. Mr. Floot bills $300 an hour when he works as an attorney. 8. A wealthy patron donated The Portrait of Samantha, which had a fair value of $7,200, to the museum. The museum accepted the gift with the understanding that it would be sold at auction and the proceeds used for any purpose the museum wished. bank will administer the trust. Mon Elisa's actuary estimated the fair value of the gift at $114,000. Note: Museum policy is to capitalize nonart collection acquisitions. Note: If no journal entry is necessary, select the no entry required - debit and no entry required - credit for the account names and record zero for the debit and credit amounts. Cash Collection - marquetry Contributed services revenue - without donor restrictions Contribution receivable - beneficial interest in charitable remainder trust Contribution revenue - with donor restrictions Contribution revenue - without donor restrictions Contributions receivable Donated art held for sale Expenses - administration Net assets with donor restrictions - reclassification out - satisfaction of restrictions Net assets without donor restrictions - reclassification in - satisfaction of restrictions No entry required - debit No entry required - credit

1. Cash of $48,000 was received from donors, who stated that it could be used for any purpose desired by the museum. 2. A donor gave the museum $12,000, stipulating that the money be used only to acquire fine examples of marquetry. 3. Elias Gotbucks sent Mon Elisa a letter, stating that he would donate $18,000 to the museum to purchase examples of Sara Dawn's quilt work, provided the museum conducted a special campaign that raised at least $30,000 to buy additional examples. 4. The museum spent $4,800 to acquire fine marquetry. Mon Elisa capitalizes its marquetry collection. 5. Mon Elisa contacted wealthy patrons to raise funds to buy Sara Dawn's quilt work. It obtained $36,000 in pledges, all of which it expects to be collected. Mon Elisa then wrote to Elias Gotbucks, advising him it had raised $36,000. 6. Attorney Ted Floot donated his services to the museum. He spent 4 hours on museum legal matters and 3 hours as a salesperson in the museum shop. Mr. Floot bills $300 an hour when he works as an attorney. 8. A wealthy patron donated The Portrait of Samantha, which had a fair value of $7,200, to the museum. The museum accepted the gift with the understanding that it would be sold at auction and the proceeds used for any purpose the museum wished. bank will administer the trust. Mon Elisa's actuary estimated the fair value of the gift at $114,000. Note: Museum policy is to capitalize nonart collection acquisitions. Note: If no journal entry is necessary, select the no entry required - debit and no entry required - credit for the account names and record zero for the debit and credit amounts. Cash Collection - marquetry Contributed services revenue - without donor restrictions Contribution receivable - beneficial interest in charitable remainder trust Contribution revenue - with donor restrictions Contribution revenue - without donor restrictions Contributions receivable Donated art held for sale Expenses - administration Net assets with donor restrictions - reclassification out - satisfaction of restrictions Net assets without donor restrictions - reclassification in - satisfaction of restrictions No entry required - debit No entry required - credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started