Answered step by step

Verified Expert Solution

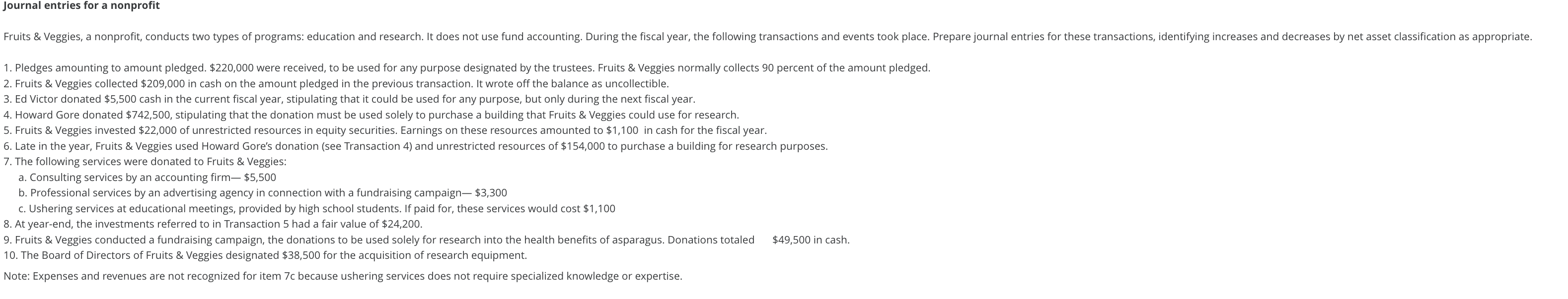

Question

1 Approved Answer

A little help please. its & Veggies collected $209,000 in cash on the amount pledged in the previous transaction. It wrote off the balance as

A little help please.

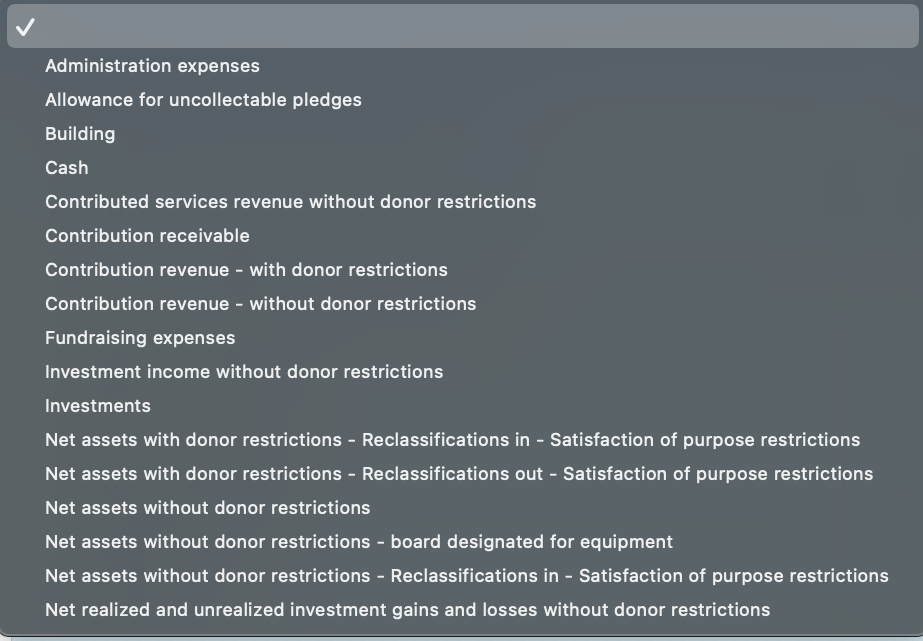

its \& Veggies collected $209,000 in cash on the amount pledged in the previous transaction. It wrote off the balance as uncollectible. Victor donated $5,500 cash in the current fiscal year, stipulating that it could be used for any purpose, but only during the next fiscal year. ward Gore donated $742,500, stipulating that the donation must be used solely to purchase a building that Fruits \& Veggies could use for research. its \& Veggies invested $22,000 of unrestricted resources in equity securities. Earnings on these resources amounted to $1,100 in cash for the fiscal year. e in the year, Fruits \& Veggies used Howard Gore's donation (see Transaction 4) and unrestricted resources of $154,000 to purchase a building for research purposes. following services were donated to Fruits \& Veggies: Consulting services by an accounting firm- $5,500 Professional services by an advertising agency in connection with a fundraising campaign $3,300 Ushering services at educational meetings, provided by high school students. If paid for, these services would cost $1,100 year-end, the investments referred to in Transaction 5 had a fair value of $24,200. e Board of Directors of Fruits \& Veggies designated $38,500 for the acquisition of research equipment. Expenses and revenues are not recognized for item 7c because ushering services does not require specialized knowledge or expertise. Administration expenses Allowance for uncollectable pledges Building Cash Contributed services revenue without donor restrictions Contribution receivable Contribution revenue - with donor restrictions Contribution revenue - without donor restrictions Fundraising expenses Investment income without donor restrictions Investments Net assets with donor restrictions - Reclassifications in - Satisfaction of purpose restrictions Net assets with donor restrictions - Reclassifications out - Satisfaction of purpose restrictions Net assets without donor restrictions Net assets without donor restrictions - board designated for equipment Net assets without donor restrictions - Reclassifications in - Satisfaction of purpose restrictions Net realized and unrealized investment gains and losses without donor restrictions

its \& Veggies collected $209,000 in cash on the amount pledged in the previous transaction. It wrote off the balance as uncollectible. Victor donated $5,500 cash in the current fiscal year, stipulating that it could be used for any purpose, but only during the next fiscal year. ward Gore donated $742,500, stipulating that the donation must be used solely to purchase a building that Fruits \& Veggies could use for research. its \& Veggies invested $22,000 of unrestricted resources in equity securities. Earnings on these resources amounted to $1,100 in cash for the fiscal year. e in the year, Fruits \& Veggies used Howard Gore's donation (see Transaction 4) and unrestricted resources of $154,000 to purchase a building for research purposes. following services were donated to Fruits \& Veggies: Consulting services by an accounting firm- $5,500 Professional services by an advertising agency in connection with a fundraising campaign $3,300 Ushering services at educational meetings, provided by high school students. If paid for, these services would cost $1,100 year-end, the investments referred to in Transaction 5 had a fair value of $24,200. e Board of Directors of Fruits \& Veggies designated $38,500 for the acquisition of research equipment. Expenses and revenues are not recognized for item 7c because ushering services does not require specialized knowledge or expertise. Administration expenses Allowance for uncollectable pledges Building Cash Contributed services revenue without donor restrictions Contribution receivable Contribution revenue - with donor restrictions Contribution revenue - without donor restrictions Fundraising expenses Investment income without donor restrictions Investments Net assets with donor restrictions - Reclassifications in - Satisfaction of purpose restrictions Net assets with donor restrictions - Reclassifications out - Satisfaction of purpose restrictions Net assets without donor restrictions Net assets without donor restrictions - board designated for equipment Net assets without donor restrictions - Reclassifications in - Satisfaction of purpose restrictions Net realized and unrealized investment gains and losses without donor restrictions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started