Question

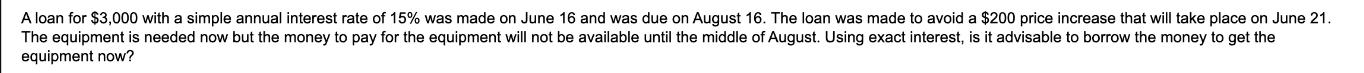

A loan for $3,000 with a simple annual interest rate of 15% was made on June 16 and was due on August 16. The

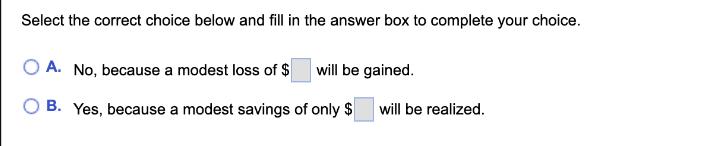

A loan for $3,000 with a simple annual interest rate of 15% was made on June 16 and was due on August 16. The loan was made to avoid a $200 price increase that will take place on June 21. The equipment is needed now but the money to pay for the equipment will not be available until the middle of August. Using exact interest, is it advisable to borrow the money to get the equipment now? Select the correct choice below and fill in the answer box to complete your choice. OA. No, because a modest loss of $ will be gained. B. Yes, because a modest savings of only $ will be realized.

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether it is advisable to borrow the money to get the equipment before the price incre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics For Managers Using Microsoft Excel

Authors: David M. Levine, David F. Stephan, Kathryn A. Szabat

7th Edition

978-0133061819, 133061817, 978-0133130805

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App