Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A loan officer intends to compare the interest rate for 48-month fixed-rate auto loans and 48-month variable-rate auto loans. She selects two independent random

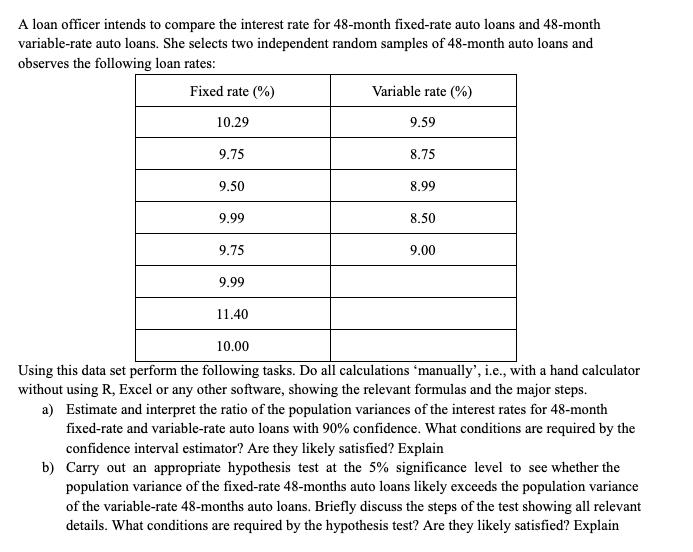

A loan officer intends to compare the interest rate for 48-month fixed-rate auto loans and 48-month variable-rate auto loans. She selects two independent random samples of 48-month auto loans and observes the following loan rates: Fixed rate (%) 10.29 Variable rate (%) 9.59 9.75 8.75 9.50 8.99 9.99 8.50 9.75 9.00 9.99 11.40 10.00 Using this data set perform the following tasks. Do all calculations 'manually', i.e., with a hand calculator without using R, Excel or any other software, showing the relevant formulas and the major steps. a) Estimate and interpret the ratio of the population variances of the interest rates for 48-month fixed-rate and variable-rate auto loans with 90% confidence. What conditions are required by the confidence interval estimator? Are they likely satisfied? Explain b) Carry out an appropriate hypothesis test at the 5% significance level to see whether the population variance of the fixed-rate 48-months auto loans likely exceeds the population variance of the variable-rate 48-months auto loans. Briefly discuss the steps of the test showing all relevant details. What conditions are required by the hypothesis test? Are they likely satisfied? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To estimate and interpret the ratio of the population vari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started