Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A loan officer wishes to compare the interest rates being charged for a 48-month fixed- rate auto loans and 48-month variable-rate auto loans. Two

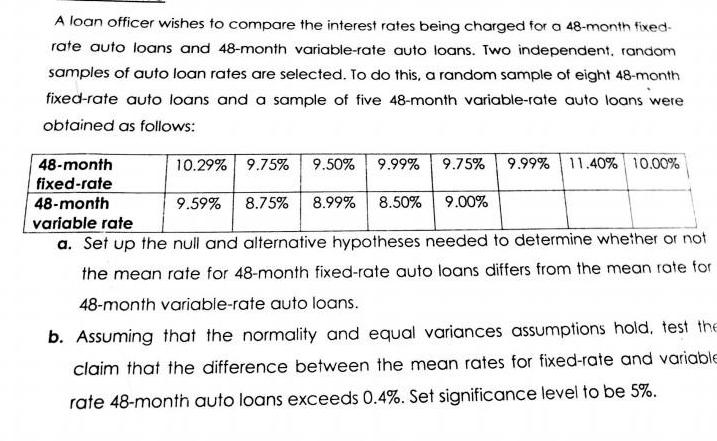

A loan officer wishes to compare the interest rates being charged for a 48-month fixed- rate auto loans and 48-month variable-rate auto loans. Two independent, random samples of auto loan rates are selected. To do this, a random sample of eight 48-month fixed-rate auto loans and a sample of five 48-month variable-rate auto loans were obtained as follows: 48-month fixed-rate 48-month variable rate 10.29% 9.75% 9.50% 9.99% 9.75% 9.99% 11.40% 10.00% 9.59% 8.75% 8.99% 8.50% 9.00% a. Set up the null and alternative hypotheses needed to determine whether or not the mean rate for 48-month fixed-rate auto loans differs from the mean rate for 48-month variable-rate auto loans. b. Assuming that the normality and equal variances assumptions hold, test the claim that the difference between the mean rates for fixed-rate and variable rate 48-month auto loans exceeds 0.4%. Set significance level to be 5%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a The null hypothesis H0 is that the mean interest rate for 48month fixedrate auto loans is e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started