Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A local municipality is considering investing $250,000 to upgrade a park. Based on similar investments made by similar cities, it is anticipated the investment will

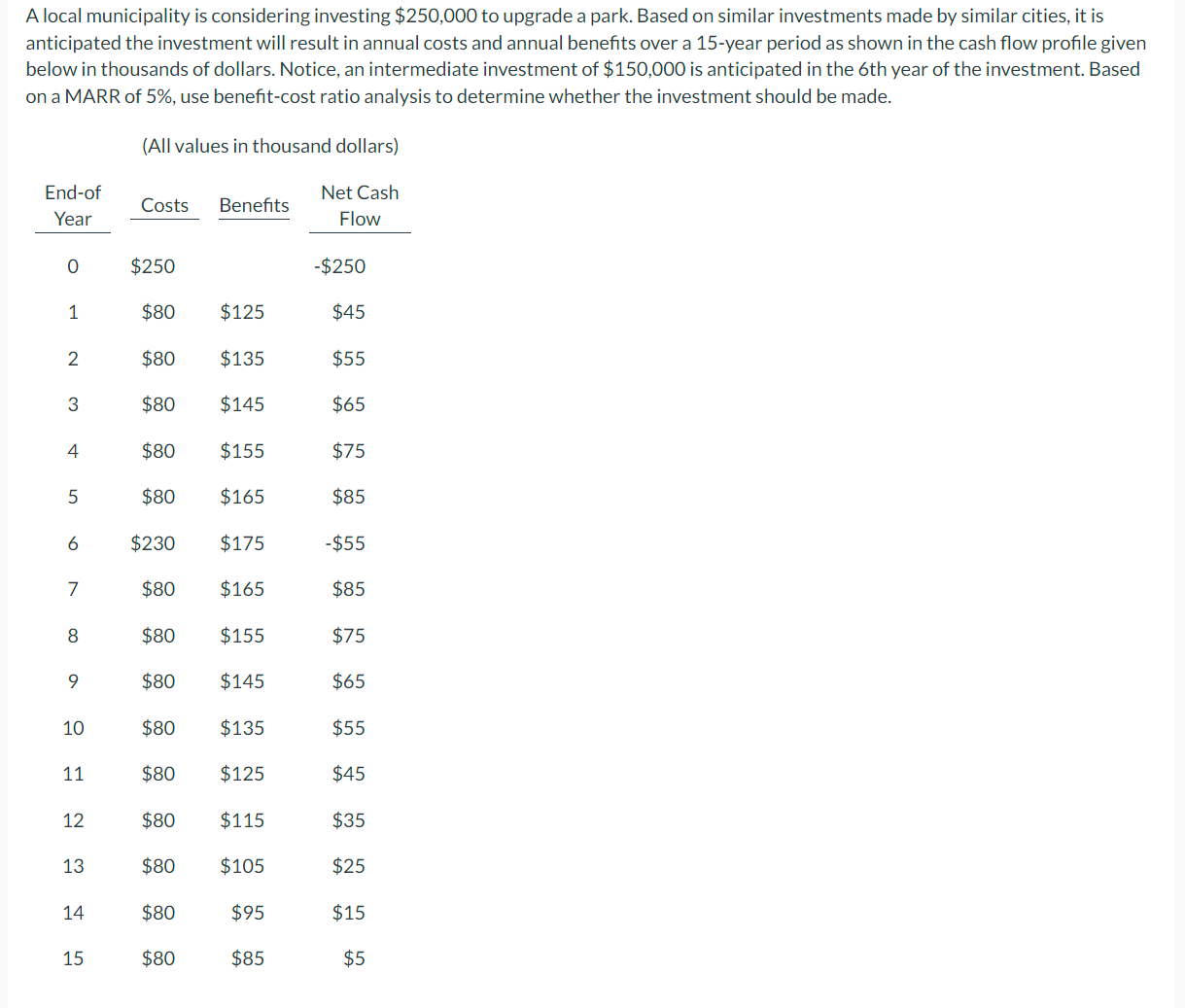

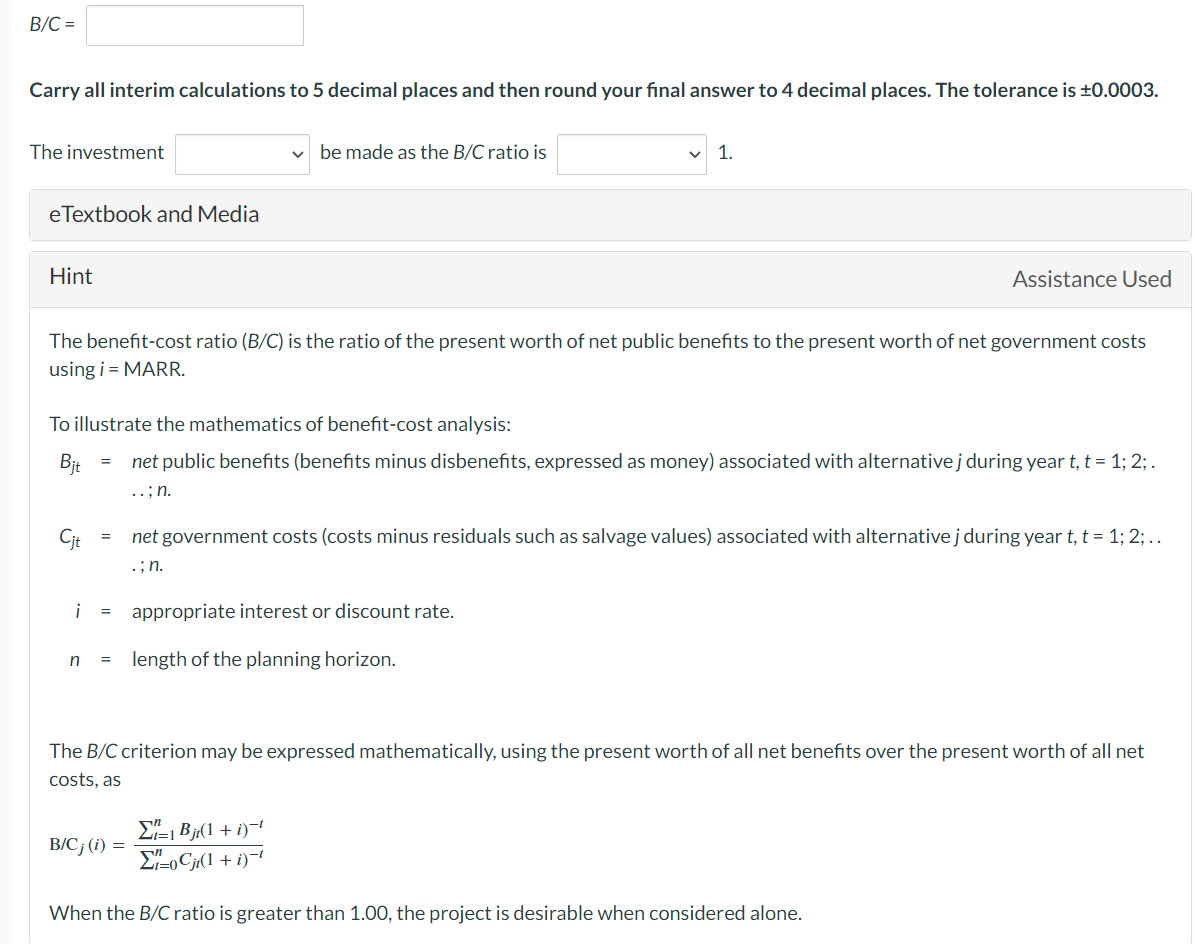

A local municipality is considering investing $250,000 to upgrade a park. Based on similar investments made by similar cities, it is anticipated the investment will result in annual costs and annual benefits over a 15-year period as shown in the cash flow profile given below in thousands of dollars. Notice, an intermediate investment of $150,000 is anticipated in the 6 th year of the investment. Based on a MARR of 5%, use benefit-cost ratio analysis to determine whether the investment should be made. (All values in thousand dollars) Carry all interim calculations to 5 decimal places and then round your final answer to 4 decimal places. The tolerance is \pm 0.0003 . The investment be made as the B/C ratio is 1. eTextbook and Media Hint Assistance Used The benefit-cost ratio (B/C) is the ratio of the present worth of net public benefits to the present worth of net government costs using i= MARR. To illustrate the mathematics of benefit-cost analysis: Bjt=Cjt=i=n=netpublicbenefits(benefitsminusdisbenefits,expressedasmoney)associatedwithalternativejduringyeart,t=1;2;...;n.netgovernmentcosts(costsminusresidualssuchassalvagevalues)associatedwithalternativejduringyeart,t=1;2;...;n.appropriateinterestordiscountrate.lengthoftheplanninghorizon. The B/C criterion may be expressed mathematically, using the present worth of all net benefits over the present worth of all net costs, as B/Cj(i)=t=0nCjt(1+i)tt=1nBjt(1+i)t When the B/C ratio is greater than 1.00 , the project is desirable when considered alone

A local municipality is considering investing $250,000 to upgrade a park. Based on similar investments made by similar cities, it is anticipated the investment will result in annual costs and annual benefits over a 15-year period as shown in the cash flow profile given below in thousands of dollars. Notice, an intermediate investment of $150,000 is anticipated in the 6 th year of the investment. Based on a MARR of 5%, use benefit-cost ratio analysis to determine whether the investment should be made. (All values in thousand dollars) Carry all interim calculations to 5 decimal places and then round your final answer to 4 decimal places. The tolerance is \pm 0.0003 . The investment be made as the B/C ratio is 1. eTextbook and Media Hint Assistance Used The benefit-cost ratio (B/C) is the ratio of the present worth of net public benefits to the present worth of net government costs using i= MARR. To illustrate the mathematics of benefit-cost analysis: Bjt=Cjt=i=n=netpublicbenefits(benefitsminusdisbenefits,expressedasmoney)associatedwithalternativejduringyeart,t=1;2;...;n.netgovernmentcosts(costsminusresidualssuchassalvagevalues)associatedwithalternativejduringyeart,t=1;2;...;n.appropriateinterestordiscountrate.lengthoftheplanninghorizon. The B/C criterion may be expressed mathematically, using the present worth of all net benefits over the present worth of all net costs, as B/Cj(i)=t=0nCjt(1+i)tt=1nBjt(1+i)t When the B/C ratio is greater than 1.00 , the project is desirable when considered alone Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started