Answered step by step

Verified Expert Solution

Question

1 Approved Answer

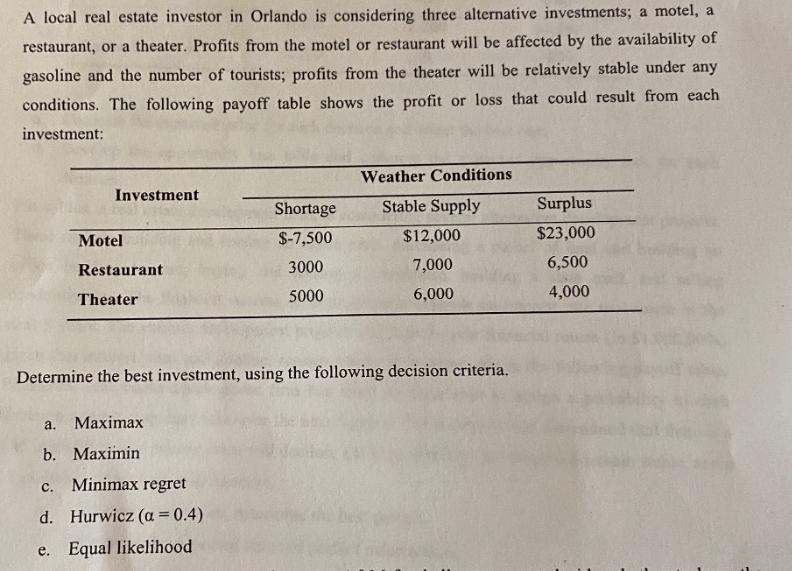

A local real estate investor in Orlando is considering three alternative investments; a motel, a restaurant, or a theater. Profits from the motel or

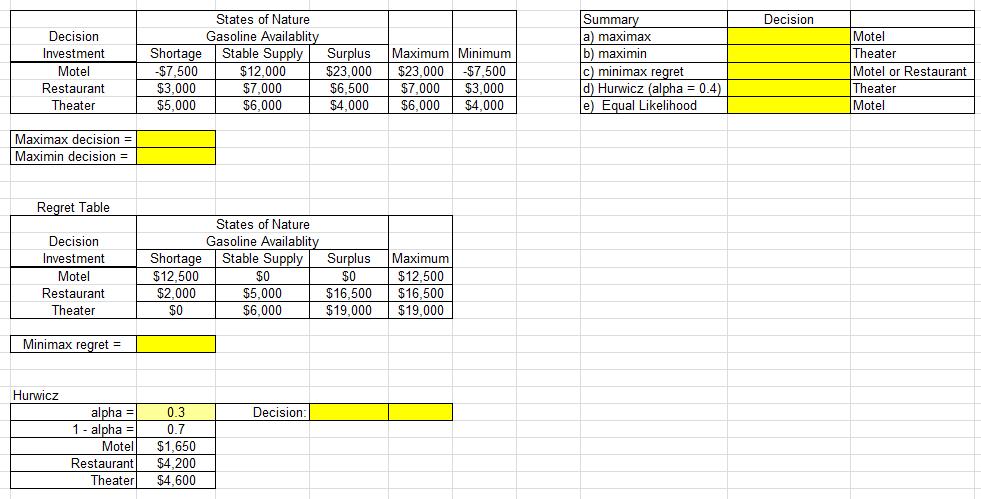

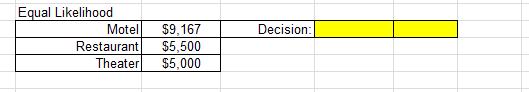

A local real estate investor in Orlando is considering three alternative investments; a motel, a restaurant, or a theater. Profits from the motel or restaurant will be affected by the availability of gasoline and the number of tourists; profits from the theater will be relatively stable under any conditions. The following payoff table shows the profit or loss that could result from each investment: Weather Conditions Investment Shortage Stable Supply Surplus Motel $-7,500 $12,000 $23,000 Restaurant 3000 7,000 6,500 5000 6,000 4,000 Theater Determine the best investment, using the following decision criteria. a. Maximax b. Maximin c. Minimax regret d. Hurwicz (a = 0.4) e. Equal likelihood States of Nature Summary Decision Gasoline Availablity Stable Supply $12,000 Decision a) maximax b) maximin c) minimax regret d) Hurwicz (alpha = 0.4) e) Equal Likelihood Motel Maximum Minimum -$7,500 $3.000 $4,000 Theater Motel or Restaurant Theater Investment Shortage -$7,500 $3,000 $5,000 Surplus Motel $23.000 $23.000 $6,500 $4,000 Restaurant $7,000 $6,000 $7,000 Theater $6,000 Motel Maximax decision Maximin decision = Regret Table States of Nature Gasoline Availablity Stable Supply Decision Investment Maximum Shortage $12,500 Surplus Motel $12.500 $0 $5,000 $6,000 $0 Restaurant $2,000 $16,500 $19.000 $16.500 Theater $19,000 Minimax regret = Hurwicz alpha 1- alpha 0.3 Decision: 0.7 Motel Restaurant $1,650 $4,200 Theater $4,600 Equal Likelihood Motel $9,167 Decision: Restaurant $5,500 $5,000 Theater

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

States of Nature Decision Gasoline Availablity Investment Shortage Stable Supply Sur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

60ae404866026_70775.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started