Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) LOCALA Inc. is considering whether to undertake a new project to mine for bauxite. To pursue the mining, LOCALA Inc. will need to

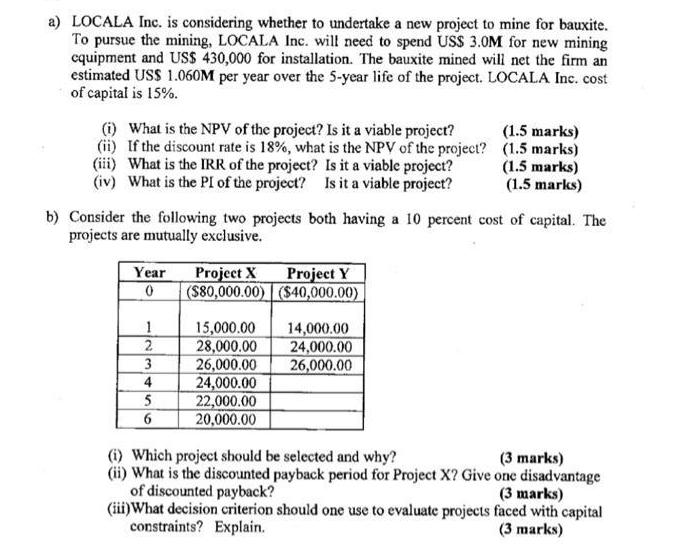

a) LOCALA Inc. is considering whether to undertake a new project to mine for bauxite. To pursue the mining, LOCALA Inc. will need to spend US$ 3.0M for new mining equipment and US$ 430,000 for installation. The bauxite mined will net the firm an estimated US$ 1.060M per year over the 5-year life of the project. LOCALA Inc. cost of capital is 15%. (i) What is the NPV of the project? Is it a viable project? (ii) If the discount rate is 18%, what is the NPV of the project? (iii) What is the IRR of the project? Is it a viable project? (iv) What is the PI of the project? Is it a viable project? b) Consider the following two projects both having a 10 percent cost of capital. The projects are mutually exclusive. Year 0 1 2 3 4 5 6 Project X ($80,000.00) 15,000.00 28,000.00 26,000.00 24,000.00 22,000.00 20,000.00 Project Y ($40,000.00) (1.5 marks) (1.5 marks) (1.5 marks) (1.5 marks) 14,000.00 24,000.00 26,000.00 (i) Which project should be selected and why? (3 marks) (ii) What is the discounted payback period for Project X? Give one disadvantage of discounted payback? (3 marks) (iii) What decision criterion should one use to evaluate projects faced with capital constraints? Explain. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION a i NPV of the project The NPV of the project can be calculated using the following formula NPV 3000000 1060000 1 015 1060000 1 0152 1060000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started