Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A logit regression model and a Linear Probability Model (LPM) are used to explain the mortgage denial rates amongst a random sample of 1234

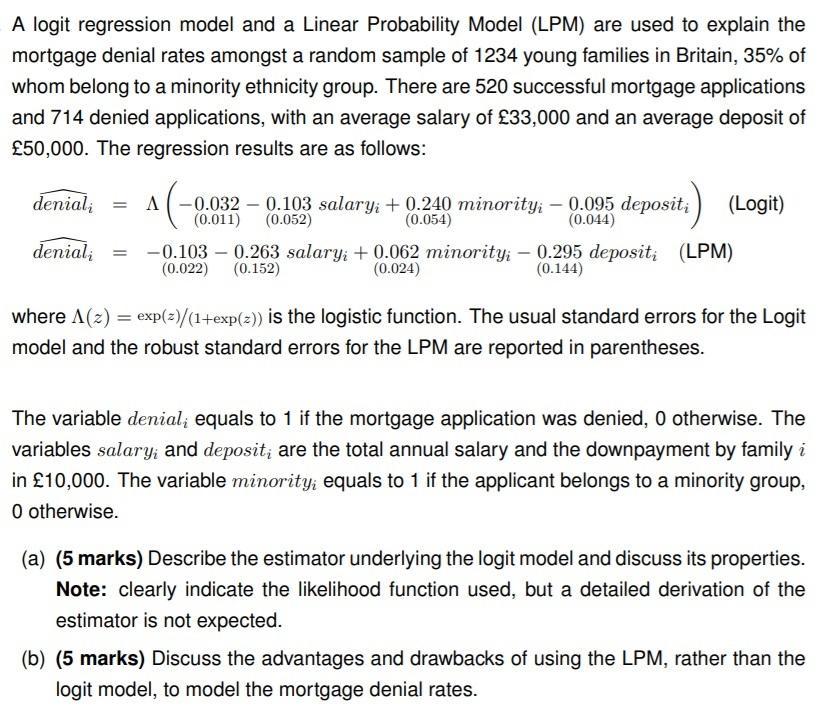

A logit regression model and a Linear Probability Model (LPM) are used to explain the mortgage denial rates amongst a random sample of 1234 young families in Britain, 35% of whom belong to a minority ethnicity group. There are 520 successful mortgage applications and 714 denied applications, with an average salary of 33,000 and an average deposit of 50,000. The regression results are as follows: denial; -0.032- 0.103 salary: + 0.240 minority; 0.095 deposit; (0.011) (0.052) (Logit) (0.054) denial; -0.103 0.263 salary; + 0.062 minority; 0.295 deposit; (LPM) (0.022) = (0.152) (0.024) (0.144) where A(z) = exp(z)/(1+exp(2)) is the logistic function. The usual standard errors for the Logit model and the robust standard errors for the LPM are reported in parentheses. The variable denial; equals to 1 if the mortgage application was denied, 0 otherwise. The variables salary; and deposit; are the total annual salary and the downpayment by family i in 10,000. The variable minority; equals to 1 if the applicant belongs to a minority group, O otherwise. (a) (5 marks) Describe the estimator underlying the logit model and discuss its properties. Note: clearly indicate the likelihood function used, but a detailed derivation of the estimator is not expected. (b) (5 marks) Discuss the advantages and drawbacks of using the LPM, rather than the logit model, to model the mortgage denial rates.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

nswer Fixed desit re sfe investment tin tht gurntees nsistent interest rtes seil interest rtes fr se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started