Question

A long straddle is an investment strategy whereby at time t an investor would buy a call option C(St,t; K,T) and buy a put

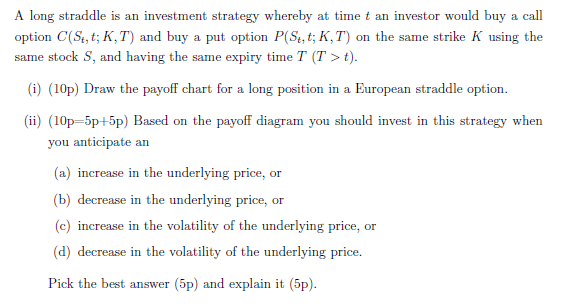

A long straddle is an investment strategy whereby at time t an investor would buy a call option C(St,t; K,T) and buy a put option P(St, t; K,T) on the same strike K using the same stock S, and having the same expiry time T (T>t). (i) (10p) Draw the payoff chart for a long position in a European straddle option. (ii) (10p-5p+5p) Based on the payoff diagram you should invest in this strategy when you anticipate an (a) increase in the underlying price, or (b) decrease in the underlying price, or (c) increase in the volatility of the underlying price, or (d) decrease in the volatility of the underlying price. Pick the best answer (5p) and explain it (5p).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Market Practice In Financial Modelling

Authors: Tan Chia Chiang

1st Edition

9814366544, 978-9814366540

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App