a lot to unpack!

need help with these!

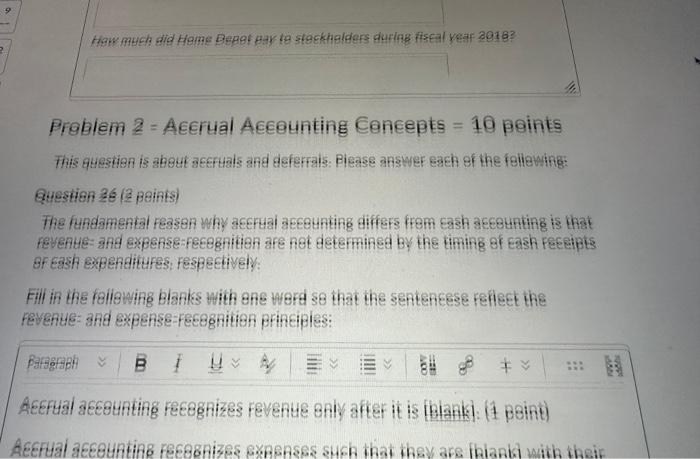

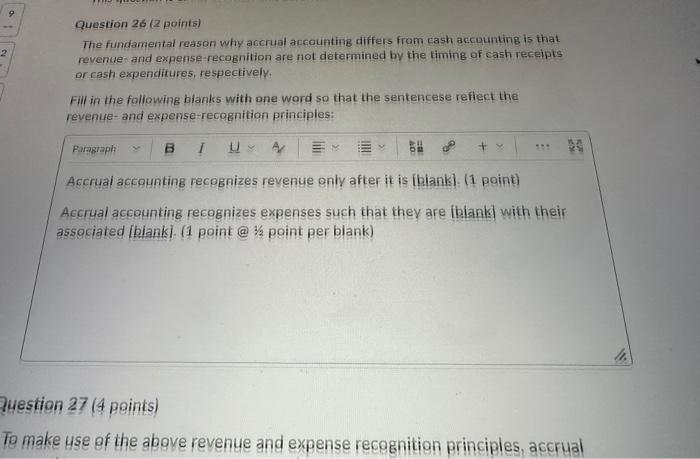

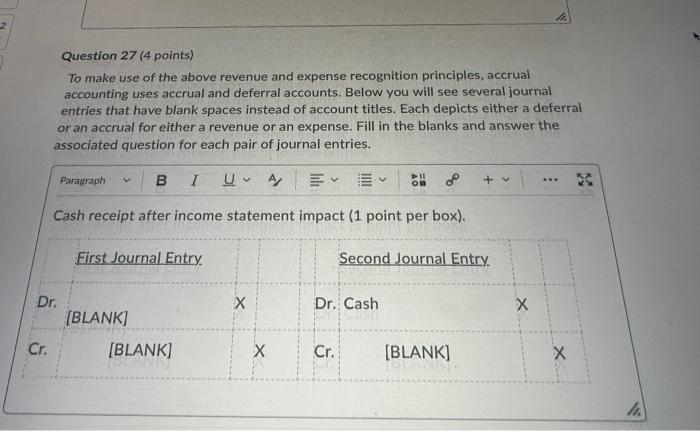

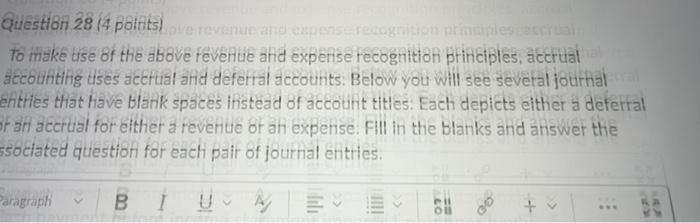

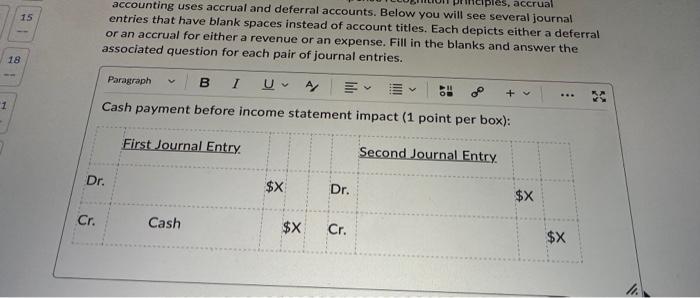

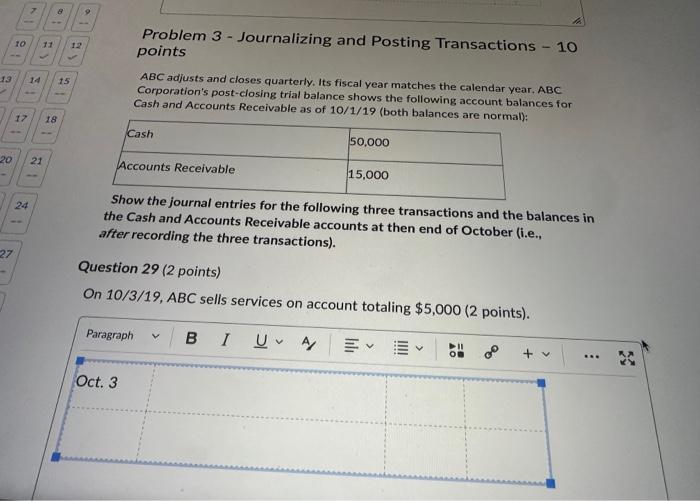

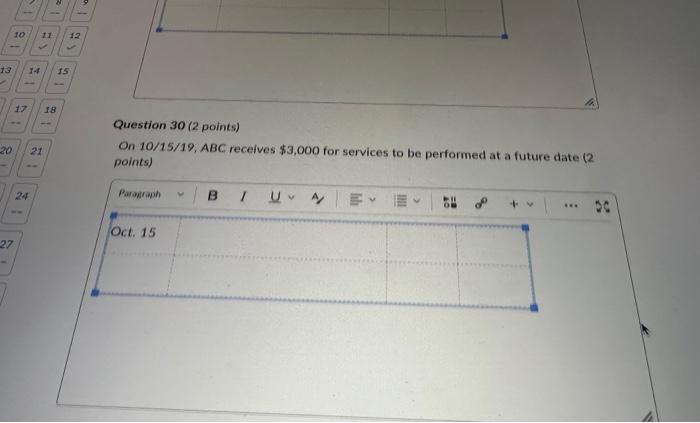

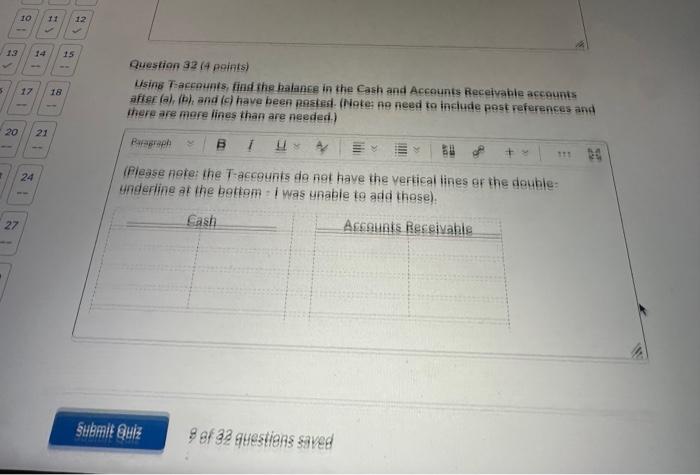

Problem 2 = AEcrual Acegunting Cencepts = 10 paints This questien is about aeruais and geferrais: Piease answer each of the foliewing: Question 36 (? peints) feyente- and expense-feesonitien are not determined by the timing of eash peseipts of eash expenditufes: fespectively: Fill in the folliwing blanks with sne Werd se that the senteneese feflect the fevente- and expense-Feeg 8 ition principles: question 26 (2 points) The fundamental reason why accrual accounting differs from cash accounting is that The funce and expense-recognition are not determined by the timing of cash receipts or cash expenditures, respectively. Fill in the following blanks with one word so that the sentencese reflect the revenue-and expense-recognition principles: Zuestion 27 ( 4 points) To make use of the above revenue and expense recognition principles, accrual Question 27 (4 points) To make use of the above revenue and expense recognition principles, accrual accounting uses accrual and deferral accounts. Below you will see several journal entries that have blank spaces instead of account titles. Each depicts either a deferral or an accrual for either a revenue or an expense. Fill in the blanks and answer the associated question for each pair of journal entries. Cash receipt after income statement impact ( 1 point per box). Questibn 28 (4 points) To make use of the above reventue and expense fecognition principles, accrual accounting uses aectual and deferral accounts. Below you will see several jourfal enthes that have blank spaces instead of account titles. Each depicts either a deferral If an accrual for either a reventue of an expense. FIll in the blanks and answer the soclated question for each pair of journal enties. accounting uses accrual and deferral accounts. Below you will see several journal entries that have blank spaces instead of account titles. Each depicts either a deferral or an accrual for either a revenue or an expense. Fill in the blanks and answer the associated question for each pair of journal entries. Cash payment before income statement imnart 11 nnint nn-La. Problem 3 - Journalizing and Posting Transactions - 10 points ABC adjusts and closes quarterly. Its fiscal year matches the calendar year, ABC Corporation's post-closing trial balance shows the following account balances for Cash and Accounts Receivable as of 10/1/19 (both balances are normal): snow the journal entries for the following three transactions and the balances in the Cash and Accounts Receivable accounts at then end october (i.e., after recording the three transactions). Question 29 (2 points) On 10/3/19,ABC sells services on account totaling $5,000 ( 2 boints) Question 30 (2 points) On 10/15/19, ABC receives $3,000 for services to be performed at a future date 12 points) Question 31 (2 points) Qn 10/30/19. ABC pays $10.000 for February 2020's rent (2 points). Question 32(4 points) Using Faccounis, find the halance in the Cash and Accounts Receivabie accounts affer (a)1(b) and (c) have been Resinsi. (Note: fo need to inciude pBst references and there are mare lines than are needed.) underine of the botigm = ( was unabie to add these). Problem 2 = AEcrual Acegunting Cencepts = 10 paints This questien is about aeruais and geferrais: Piease answer each of the foliewing: Question 36 (? peints) feyente- and expense-feesonitien are not determined by the timing of eash peseipts of eash expenditufes: fespectively: Fill in the folliwing blanks with sne Werd se that the senteneese feflect the fevente- and expense-Feeg 8 ition principles: question 26 (2 points) The fundamental reason why accrual accounting differs from cash accounting is that The funce and expense-recognition are not determined by the timing of cash receipts or cash expenditures, respectively. Fill in the following blanks with one word so that the sentencese reflect the revenue-and expense-recognition principles: Zuestion 27 ( 4 points) To make use of the above revenue and expense recognition principles, accrual Question 27 (4 points) To make use of the above revenue and expense recognition principles, accrual accounting uses accrual and deferral accounts. Below you will see several journal entries that have blank spaces instead of account titles. Each depicts either a deferral or an accrual for either a revenue or an expense. Fill in the blanks and answer the associated question for each pair of journal entries. Cash receipt after income statement impact ( 1 point per box). Questibn 28 (4 points) To make use of the above reventue and expense fecognition principles, accrual accounting uses aectual and deferral accounts. Below you will see several jourfal enthes that have blank spaces instead of account titles. Each depicts either a deferral If an accrual for either a reventue of an expense. FIll in the blanks and answer the soclated question for each pair of journal enties. accounting uses accrual and deferral accounts. Below you will see several journal entries that have blank spaces instead of account titles. Each depicts either a deferral or an accrual for either a revenue or an expense. Fill in the blanks and answer the associated question for each pair of journal entries. Cash payment before income statement imnart 11 nnint nn-La. Problem 3 - Journalizing and Posting Transactions - 10 points ABC adjusts and closes quarterly. Its fiscal year matches the calendar year, ABC Corporation's post-closing trial balance shows the following account balances for Cash and Accounts Receivable as of 10/1/19 (both balances are normal): snow the journal entries for the following three transactions and the balances in the Cash and Accounts Receivable accounts at then end october (i.e., after recording the three transactions). Question 29 (2 points) On 10/3/19,ABC sells services on account totaling $5,000 ( 2 boints) Question 30 (2 points) On 10/15/19, ABC receives $3,000 for services to be performed at a future date 12 points) Question 31 (2 points) Qn 10/30/19. ABC pays $10.000 for February 2020's rent (2 points). Question 32(4 points) Using Faccounis, find the halance in the Cash and Accounts Receivabie accounts affer (a)1(b) and (c) have been Resinsi. (Note: fo need to inciude pBst references and there are mare lines than are needed.) underine of the botigm = ( was unabie to add these)