Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Ltd, a pharmaceutical company, is considering the manufacture of a new covid vaccine, for which the following information has been gathered. The Vaccine is

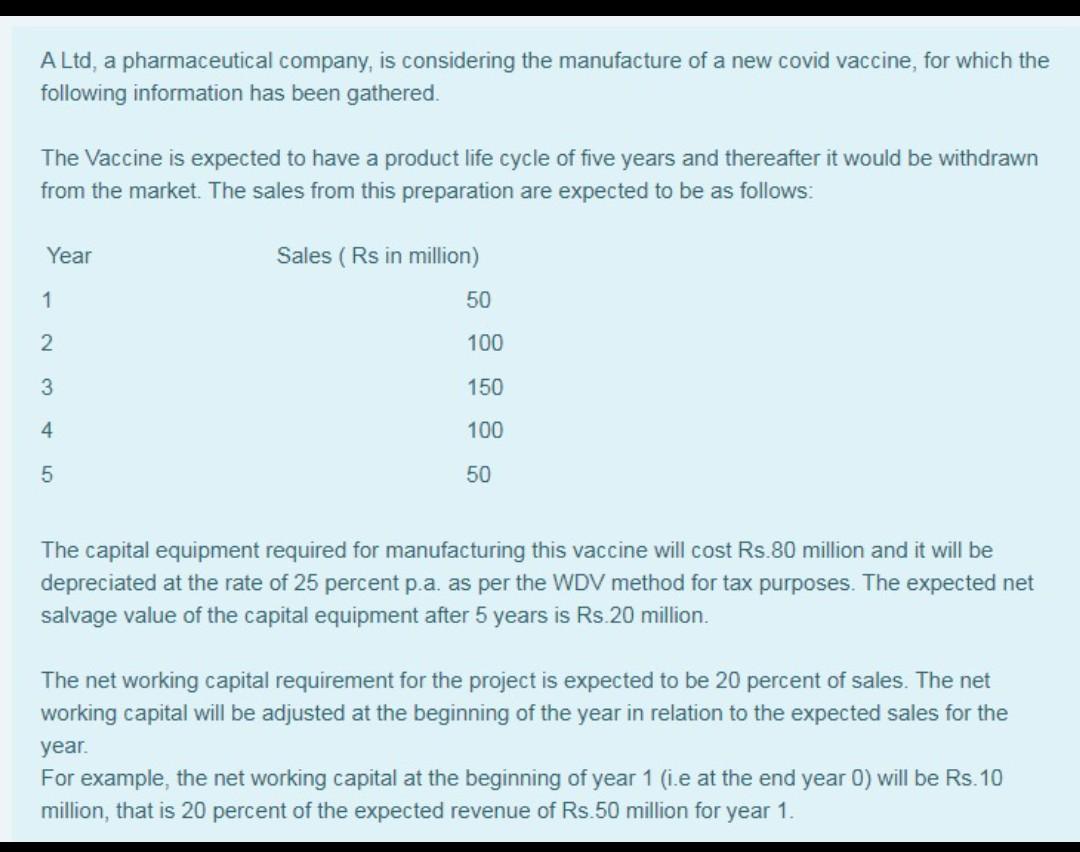

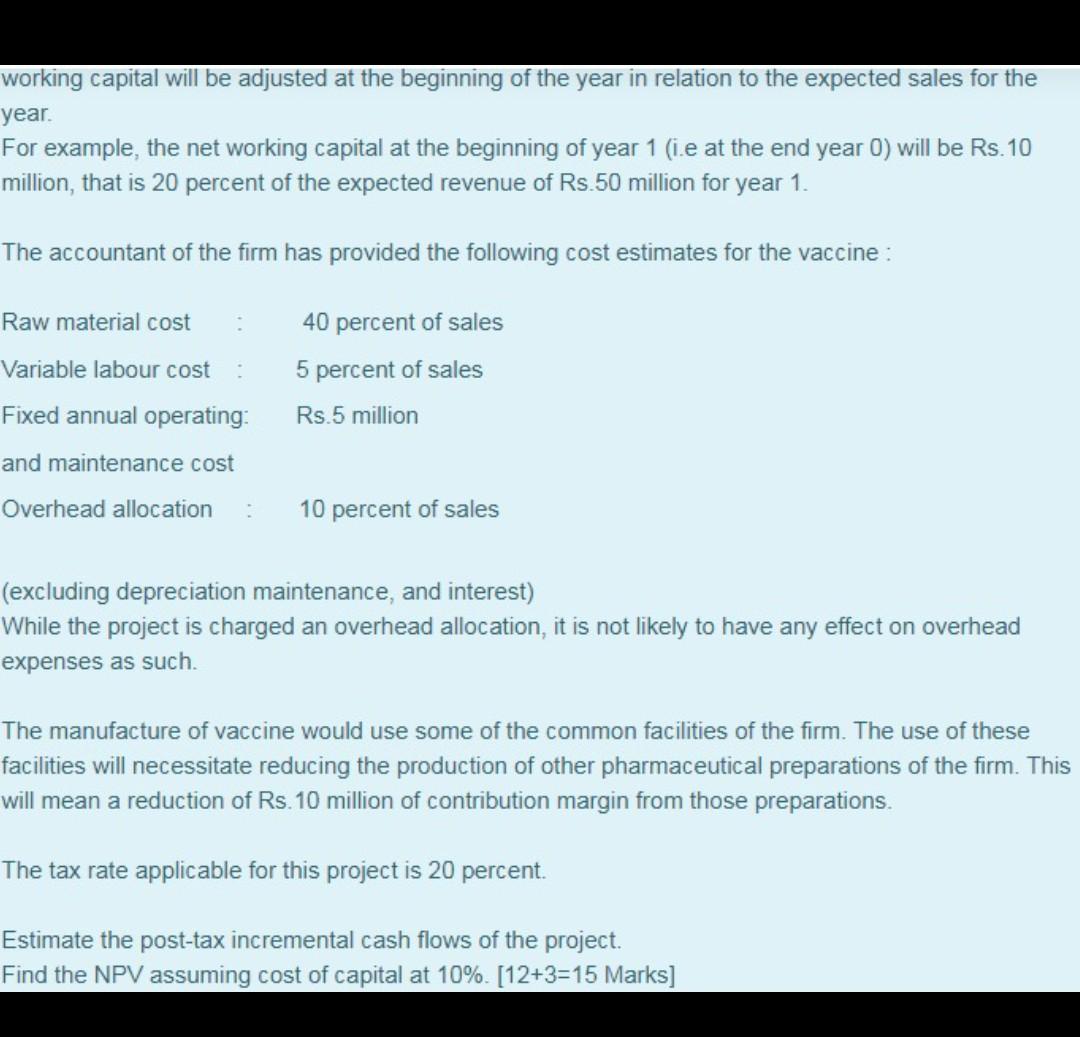

A Ltd, a pharmaceutical company, is considering the manufacture of a new covid vaccine, for which the following information has been gathered. The Vaccine is expected to have a product life cycle of five years and thereafter it would be withdrawn from the market. The sales from this preparation are expected to be as follows: Year Sales (Rs in million) 1 50 2 100 3 150 4 100 5 50 The capital equipment required for manufacturing this vaccine will cost Rs.80 million and it will be depreciated at the rate of 25 percent p.a. as per the WDV method for tax purposes. The expected net salvage value of the capital equipment after 5 years is Rs 20 million. The net working capital requirement for the project is expected to be 20 percent of sales. The net working capital will be adjusted at the beginning of the year in relation to the expected sales for the year. For example, the net working capital at the beginning of year 1 (i.e at the end year 0) will be Rs. 10 million, that is 20 percent of the expected revenue of Rs.50 million for year 1. working capital will be adjusted at the beginning of the year in relation to the expected sales for the year. For example, the net working capital at the beginning of year 1 (i.e at the end year 0) will be Rs. 10 million, that is 20 percent of the expected revenue of Rs. 50 million for year 1. The accountant of the firm has provided the following cost estimates for the vaccine : Raw material cost Variable labour cost 40 percent of sales 5 percent of sales Rs.5 million Fixed annual operating: and maintenance cost Overhead allocation 10 percent of sales (excluding depreciation maintenance, and interest) While the project is charged an overhead allocation, it is not likely to have any effect on overhead expenses as such The manufacture of vaccine would use some of the common facilities of the firm. The use of these facilities will necessitate reducing the production of other pharmaceutical preparations of the firm. This will mean a reduction of Rs. 10 million of contribution margin from those preparations. The tax rate applicable for this project is 20 percent. Estimate the post-tax incremental cash flows of the project. Find the NPV assuming cost of capital at 10% [12+3=15 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started